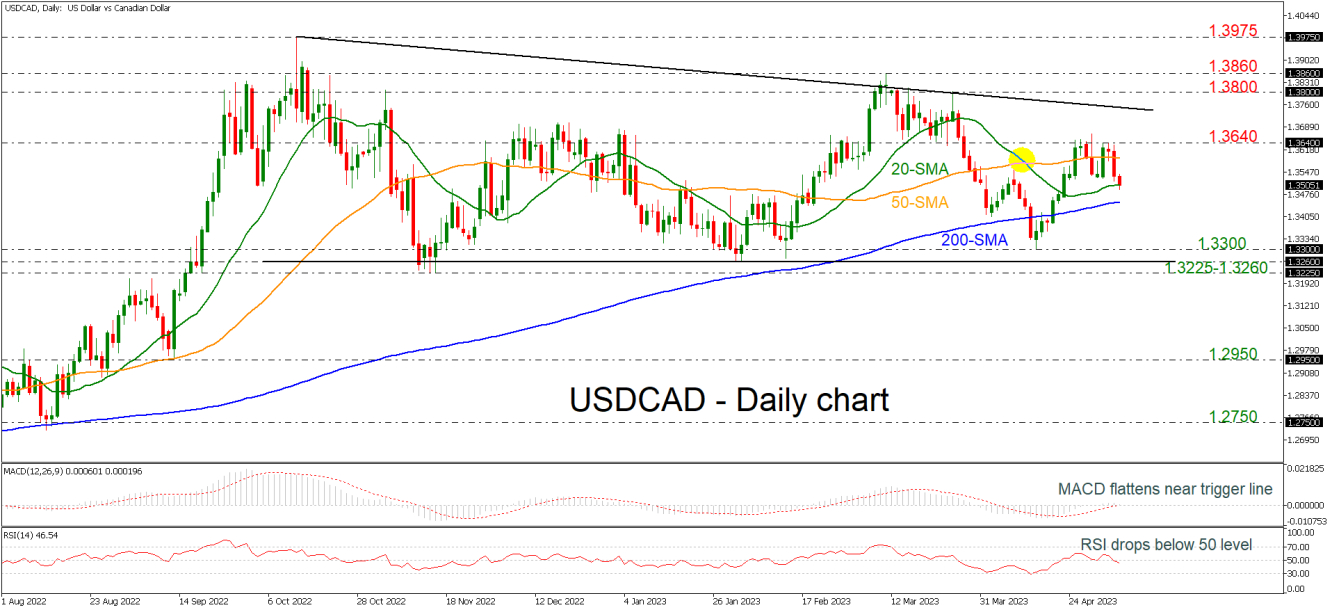

USDCAD is diving beneath the 1.3500 psychological mark and the 20-day simple moving average (SMA) after failing to jump above the 1.3640 resistance.

The MACD is moving sideways near its trigger and zero lines, while the RSI is falling beneath the neutral threshold of 50. In the long-term view, the market has been still holding within a descending triangle since October 2022.

Any more losses could meet an immediate key level near the 200-day SMA at 1.3450, ahead of the 1.3300 pscyhological mark. Beneath this, the price may hit the lower boundary of the triangle at 1.3260 and the 1.3225 support. Steeper downside pressures may shift the outlook to bearish.

On the flip side, a successful rise above 1.3640 could surge towards the downtrend line at 1.3750 before the bulls take the pair until the 1.3800 handle and the 1.3860 barrier, changing the current bearish situation to neutral.

To sum up, USDCAD is easing in the short-term and the broader outlook remains bearish as the price is trading within the bearish pattern.