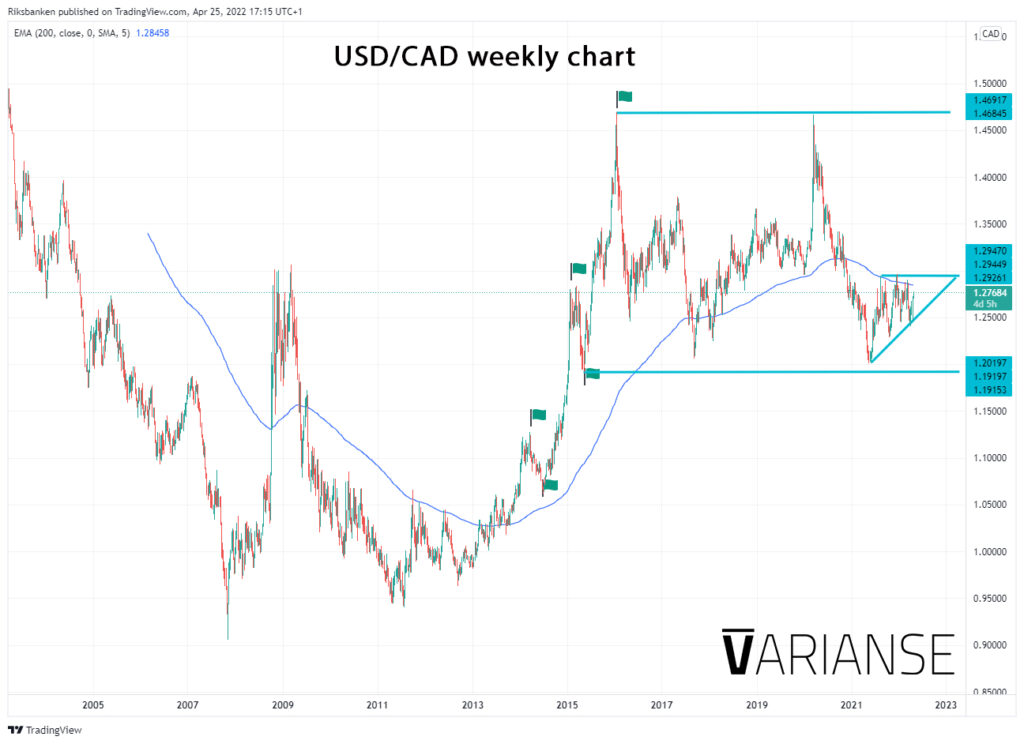

USD/CAD, has been stuck in a very big range between the May 11, 2015 swing low of 1.19202 and Jan. 18 swing high of 1.46903. However, since the summer of 2020, the price has consolidated into a right-angled ascending triangle pattern.

The pair could be ripe for a breakout as the price gets squeezed. It is worth pointing out that the price on the daily chart has broken above its 21, 50, and 200-day average. Still, given the current underlying certain prevailing in financial markets, traders should be considering a price break above and below the pattern.

Looking to the topside, a break above the 1.29261 to 1.29470 could open the opportunity for broader gains for the pair. From that level, the 1.34 region could represent the next major point of resistance before considering the possibility of a retest of the 18 January swing high of 1.46903, which resides just after a major sell zone starting at the 1.40 mark.

In other words, sellers are very likely to try and wrest control of the market between 1.40 and 1.46903. It’s also worth pointing out that the price has not been above those levels since 2003. For those with a more pessimistic outlook for USD/CAD, the 1.21 to 1.20 region is a major support area for the currency pair.

1.19197 would be the next major support level if that region is breached. In addition, a sustained break below the 1.9197 level would mark the start of a long-term downtrend and leave the currency pair exposed to a potentially more precipitous drop to the 1.1283 level, which is the next area of prominent area of resistance turned support. Hence buyers are more likely than not to step in and heavily defend the 1.21 to 1.20 region.