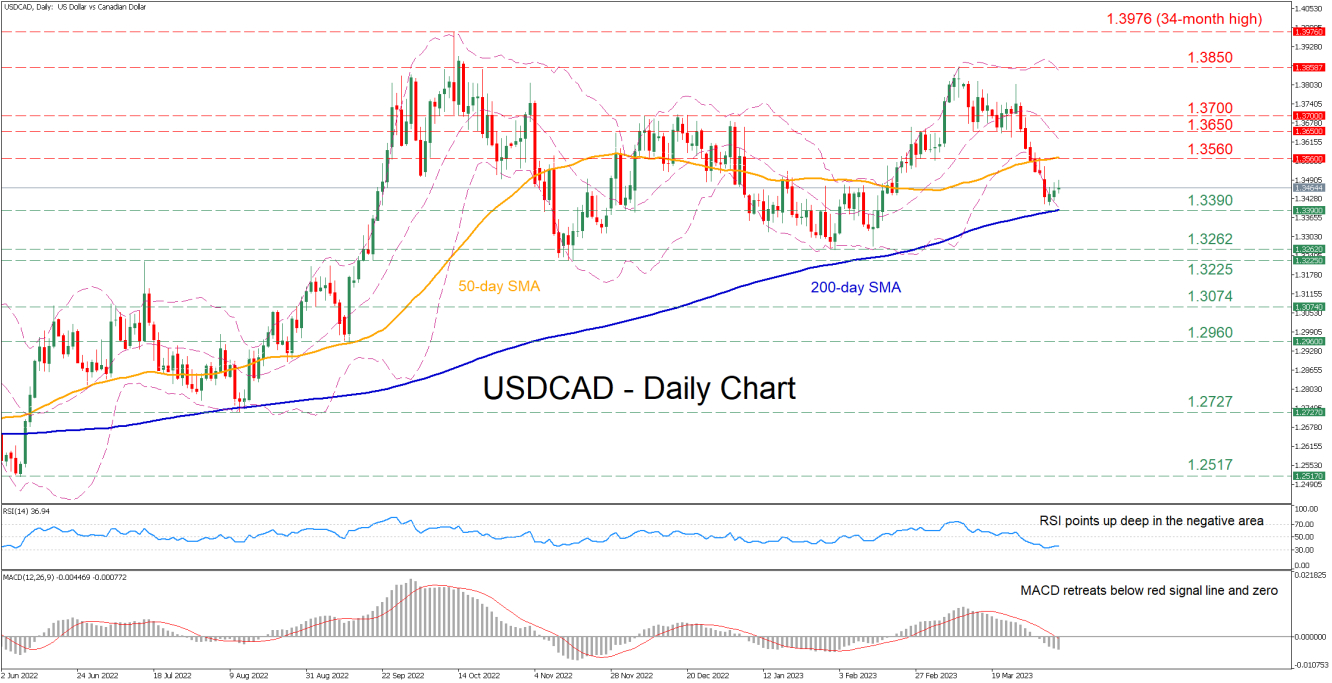

USDCAD has been in a steep downtrend after peaking at the 1.3850 region in mid-March. However, the pair managed to pause its retreat and pare some losses just shy of the 200-day simple moving average (SMA).

Despite the minor bounce, the short-term oscillators remain deep in their negative territories, suggesting that the bearish bias is intact. Specifically, the RSI is flatlining beneath its 50-neutral mark, while the MACD histogram is softening below both zero and its red signal line.

If the downtrend resumes, the price could encounter support at the 200-day SMA, currently at 1.3390. Sliding beneath that floor, the pair could descend towards the 2023 low of 1.3262. Further retreats could then cease at the November 2022 bottom of 1.3225.

On the flipside, should the price reverse higher, initial resistance might be found at the 1.3560 hurdle, which overlaps with the 50-day SMA. Conquering this barricade, the bulls could target 1.3650 before the November-December resistance zone of 1.3700 comes under examination. A break above the latter could set the stage for the 2023 peak of 1.3850.

In brief, USDCAD seems to have temporarily paused its selloff, but near-term risks remain tilted to the downside. Hence, for the downtrend to continue, the price must initially overcome the ascending 200-day SMA.