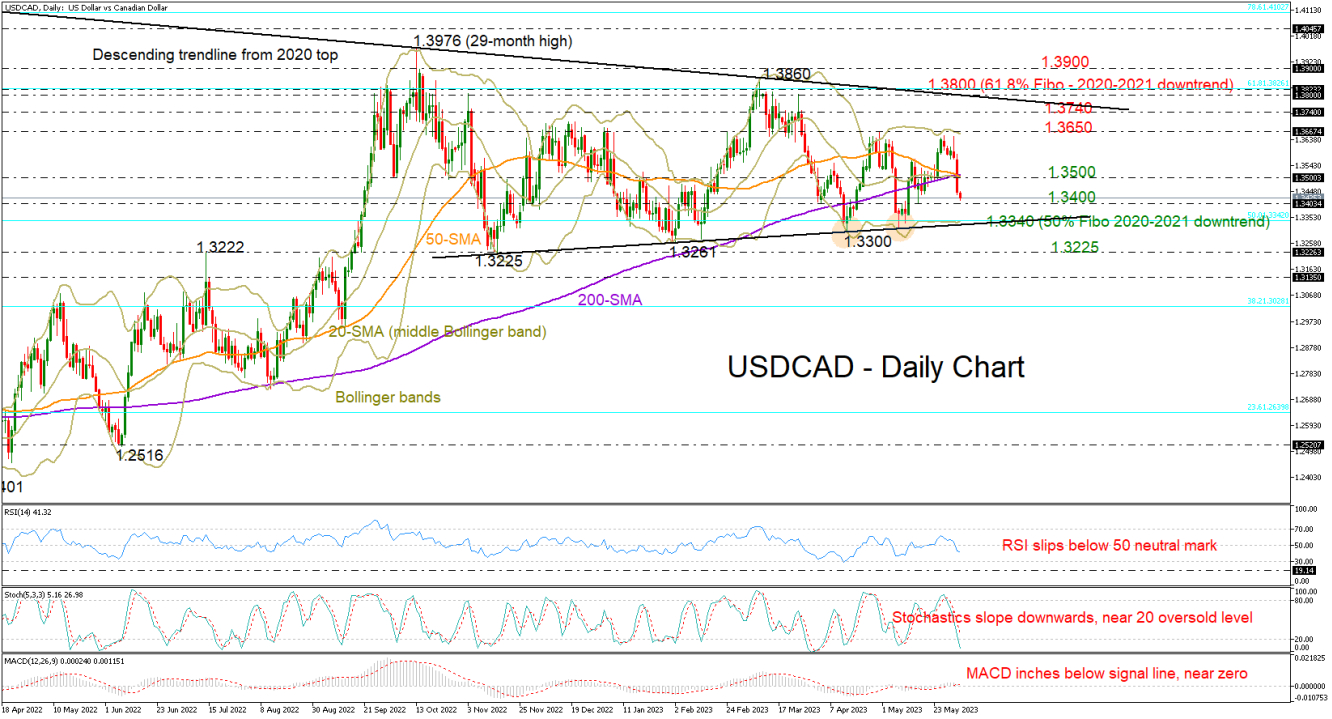

USDCAD plunged by 1.2% in the first trading day of June, sliding back below its simple moving averages (SMAs) to mark a new two-week low of 1.3417 on Friday.

The fast downside correction follows the double top creation around the tough resistance of 1.3650, which raised the risk of a bearish continuation. Overall, there are barely any bullish signs in the market, although a pause or a rebound near the 1.3400 level cannot be excluded as the stochastic oscillator is quickly approaching its 20 oversold level. The RSI has crossed back below its 50 neutral mark, while the MACD has inched below its red signal line. Moreover, the price is trading some distance above the lower Bollinger band, suggesting that the decline has still some room to run.

In trend signals, a bearish cross between shorter and longer SMAs is in progress. If successfully completed, traders may start to worry about a broad negative trend reversal, especially if the price breaks its six-month range below the 1.3340 floor. This is where the 38.2% Fibonacci retracement of the 1.4667-1.2007 downleg intersects the support line from November. Hence, a decisive close lower and below 1.3300 could see a depreciation towards the key 1.3225 handle. Another breakdown here may drive the pair towards the 1.3135 barrier.

Conversely, a bounce back above the SMAs at 1.3500 might lift the price up to the 1.3650 ceiling. A move higher could initially stall around the constraining zone of 1.3740 before targeting the tough 1.3800-1.3820 resistance territory. The bulls will need to climb that wall to clear the way towards the 2022 top of 1.3976.

In brief, USDCAD could stay under sellers’ control in the short term, with the confirmation expected to come below 1.3400.