USDCHF gets rejected near familiar resistance

Short-term bias remains positive but probably too weak

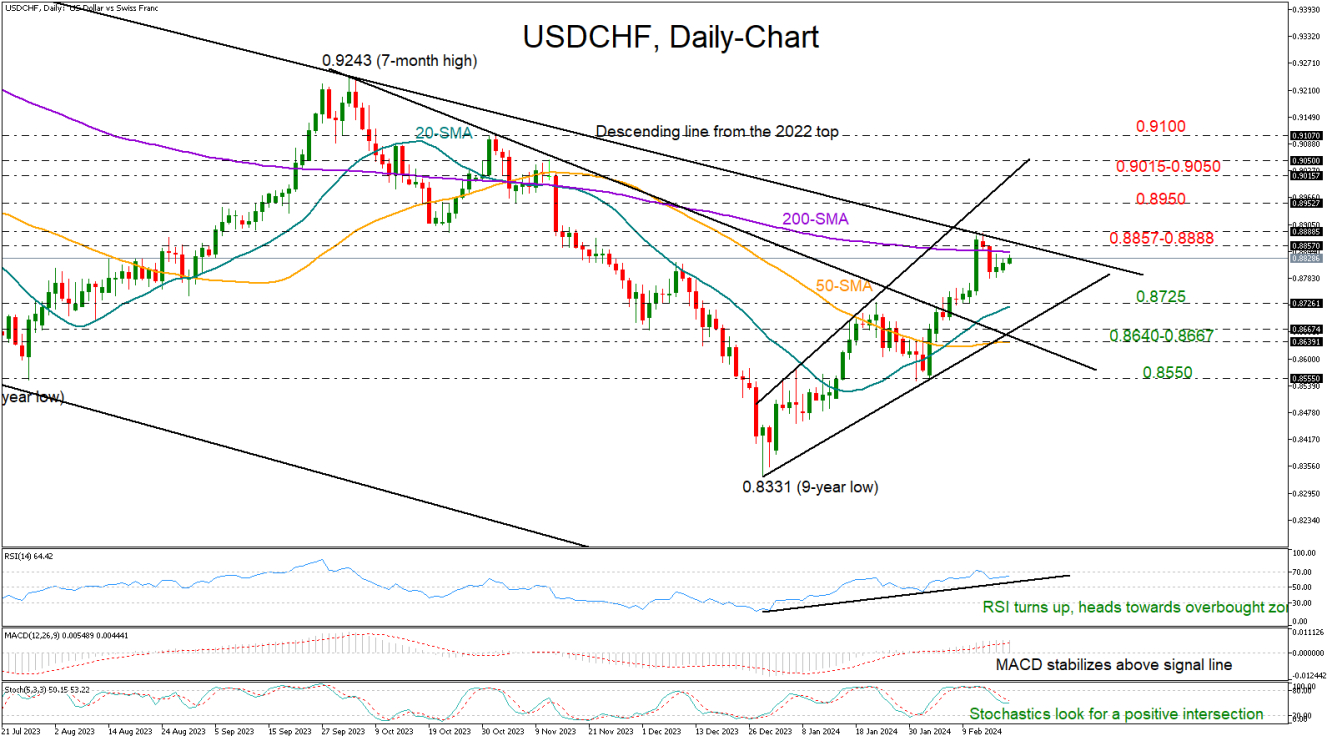

USDCHF has been in the green almost every week since the plunge to a nine-year low of 0.8331 at the end of December, but the bullish wave was not strong enough to overcome the descending trendline from the 2022 top last week.

The bulls, however, have not totally abandoned the battle. They are currently trying to recoup their latest pullback to stage another fight within the 0.8857-0.8888 area.

From a technical perspective, the short-term bias is still skewed to the upside as the RSI is comfortably above its 50 neutral mark, though the indicator is also a short distance below its 70 overbought level, suggesting that upside pressures might fade soon.

A solid move above the 0.8888 bar could encourage a rally towards the 0.8950 constraining zone. Running higher, the pair may attempt to pierce through the resistance line at 0.9015 and climb the 0.9050 barrier with scope to reach October’s obstacle near the 0.9100 psychological level.

In the event the pair faces another failure near its 200-day simple moving average (SMA) and the 0.8860 region, sellers could enter the market with force, sinking the price towards its 20-day SMA at 0.8725 and January’s high. Slightly lower, the trendline zone of 0.8640-0.8667 may protect the market from a potential slump to 0.8550.

All in all, USDCHF has been on an uptrend so far this year, but its short-term outlook remains fragile as a long-term barrier is still a threat at 0.8888.