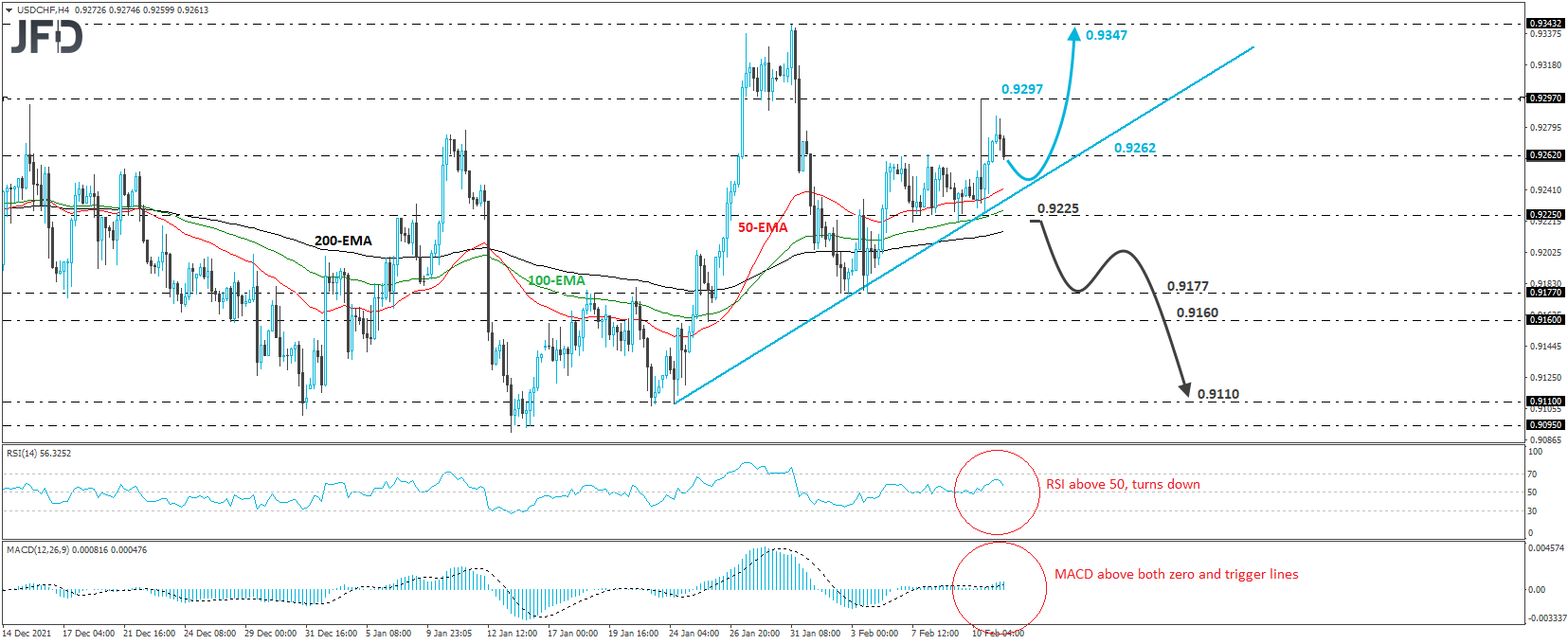

USD/CHF traded higher yesterday after it hit support at 0.9225 and the upside support line drawn from the low of Jan. 24. However, the advance was halted before the pair even reached yesterday’s peak of 0.9297, and then, it pulled back below the 0.9262 zone, marked by resistance by the highs of February 7th and 8th. That said, as long as the rate remains above the aforementioned upside line, we will consider the short-term outlook to be positive.

The current retreat may continue for a while more, but the bulls could retake charge from near the upside line taken from the low of Jan. 24. If so, a potential rebound could aim for yesterday’s peak, at 0.9297, the break of which could carry extensions towards the high of Jan. 31, at 0.9343.

Taking a look at our short-term oscillators, we see that the RSI, although above 50, has turned down, while the MACD, even though above both its zero and trigger lines, shows signs of topping as well. Both indicators detect slowing upside speed and support the notion for some further retreat before the next leg north.

Now, to start examining whether the bears have gained complete control, we would like to see an apparent dip below 0.9225, a barrier that provided strong support between February 7th and 10th. This will confirm the break below the pre-discussed upside line and a forthcoming lower low.

The bears could then get encouraged to dive towards the 0.9177 zone, marked by the lows of Feb. 2 and 3, or the low of Jan. 25, at 0.9160. If neither territory can stop the fall, then a break below 0.9160 could set the stage for declines towards the 0.9110 zone, marked by the lows of Jan. 21 and 24.