- Japanese policymakers are stepping up their “verbal intervention” in an attempt to boost the Japanese yen.

- USD/JPY is nonetheless in a healthy uptrend and breaking out to fresh 2023 highs.

- On the other hand, EUR/JPY and especially GBP/JPY appear to have lost their previous bullish momentum.

Ever since USD/JPY broke (back) above 145.00 six weeks ago, traders have been on edge fearing potential intervention from the Bank of Japan.

Generally speaking, Japan’s export-oriented economy benefits from weakness in the yen because it makes Japanese-made goods appear “cheaper” to foreigners. Despite that economic truism, Japanese policymakers still get uncomfortable when their currency falls too sharply or consistently.

To that point, we saw some clear “verbal intervention” from high-level Japanese officials last night. Prime Minister Kishida noted that “excessive” currency moves are “undesirable” and that policymakers will continue to monitor FX moves “closely” and with “a high sense of urgency.”

In addition, BOJ Governor Ueda noted that it’s important for FX moves to “move stably, reflecting fundamentals”, though in this case, you could argue that the ongoing weakness in the yen reflects the fundamentals of a large yield spread between the two countries that is unlikely to narrow any time soon.

Separately, PM Kishida revealed the outlines of a budget involving a sharp increase in defense spending, as well as tax breaks for semiconductors, EV batteries, and biotechnology. The market impact of the proposed budget, at least on the yen, has been limited.

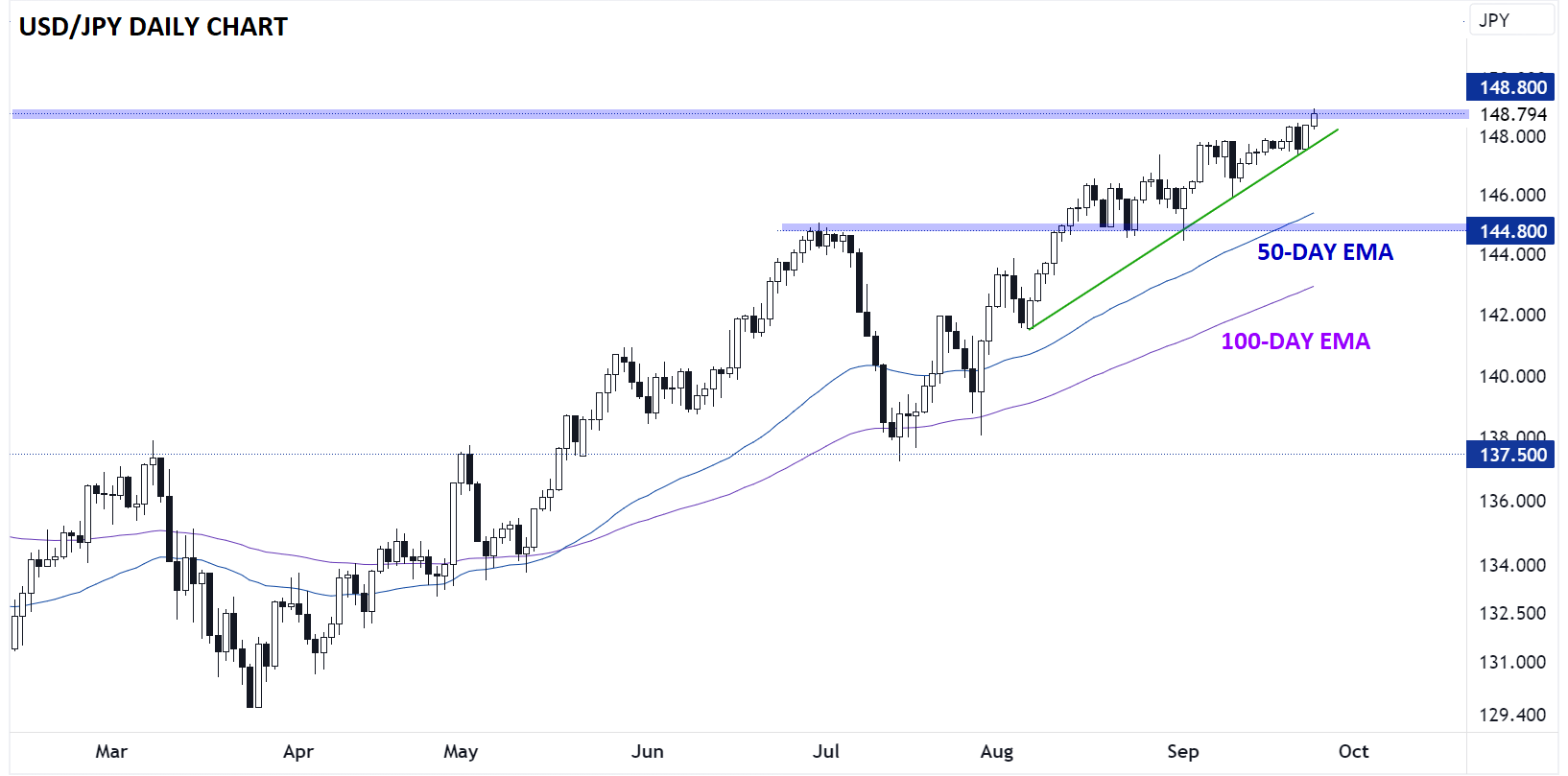

USD/JPY: Technical View

Source: TradingView, StoneX

Turning our attention to the charts, USD/JPY remains by far the most bullish of the major yen crosses. After testing its near-term bullish trend line in the middle of last week, USD/JPY has seen a strong bounce over the last two sessions and the pair is now testing the high from last November near 148.80. If this level is broken, there’s little in the way of technical resistance until closer to last October’s high near 152.00, though a clean breakout here may be enough to convince Japanese policymakers to stop threatening and start actually intervening in the market before USD/JPY reaches that level.

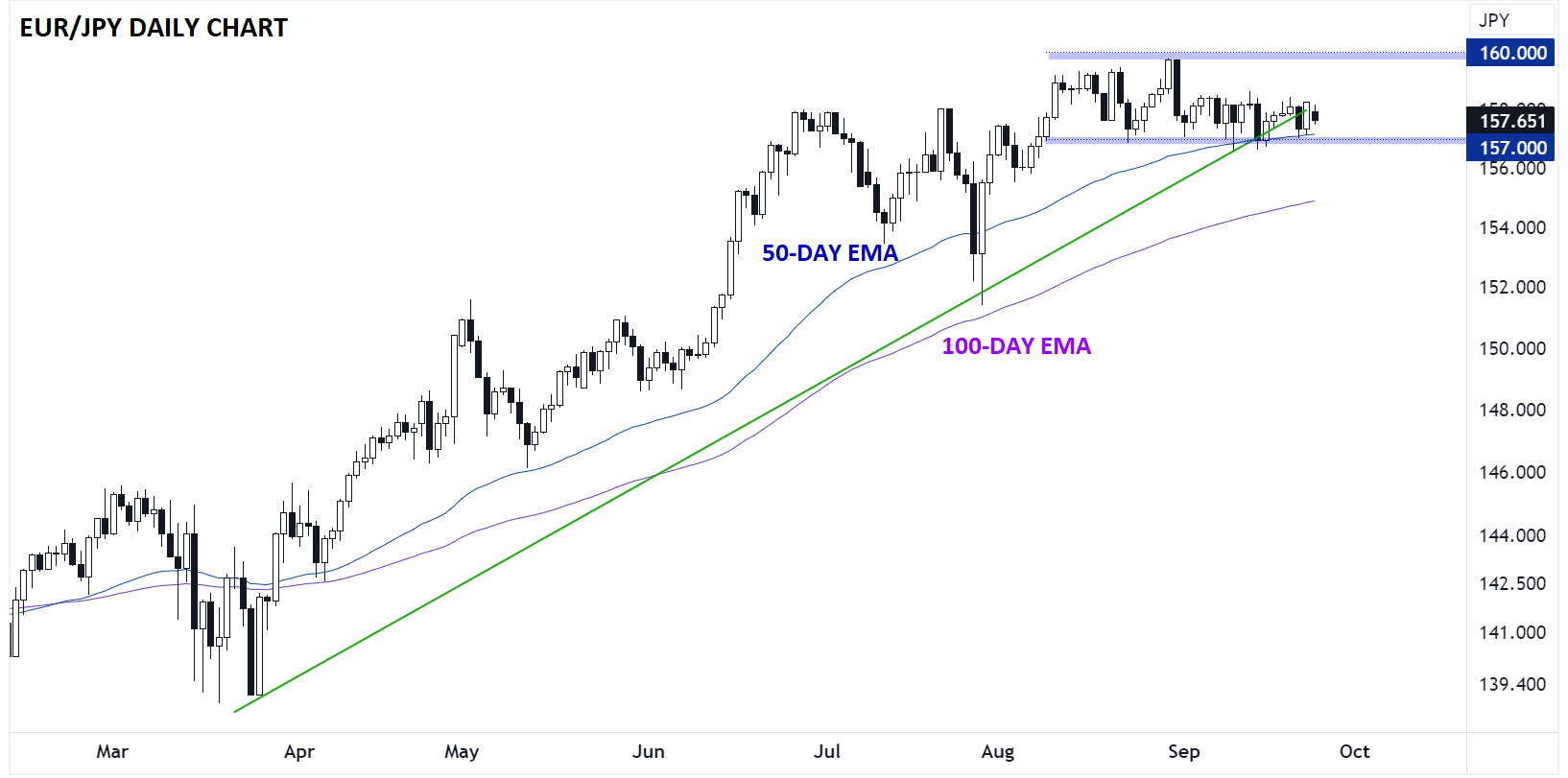

EUR/JPY: Technical View

Source: TradingView, StoneX

One reason to potentially hold off on outright intervention is the performance of some of the yen crosses. As the chart above shows, EUR/JPY has lost all of its upside momentum over the last seven weeks, merely moving sideways in the upper 150s over that period. For now, the near-term technical bias remains neutral, with a break below key support at 157.00 needed to tip the short-term scales in favor of the bears. Meanwhile, a clean move above 160.00 would signal that the technical uptrend has resumed and clear the way for another leg higher from here.

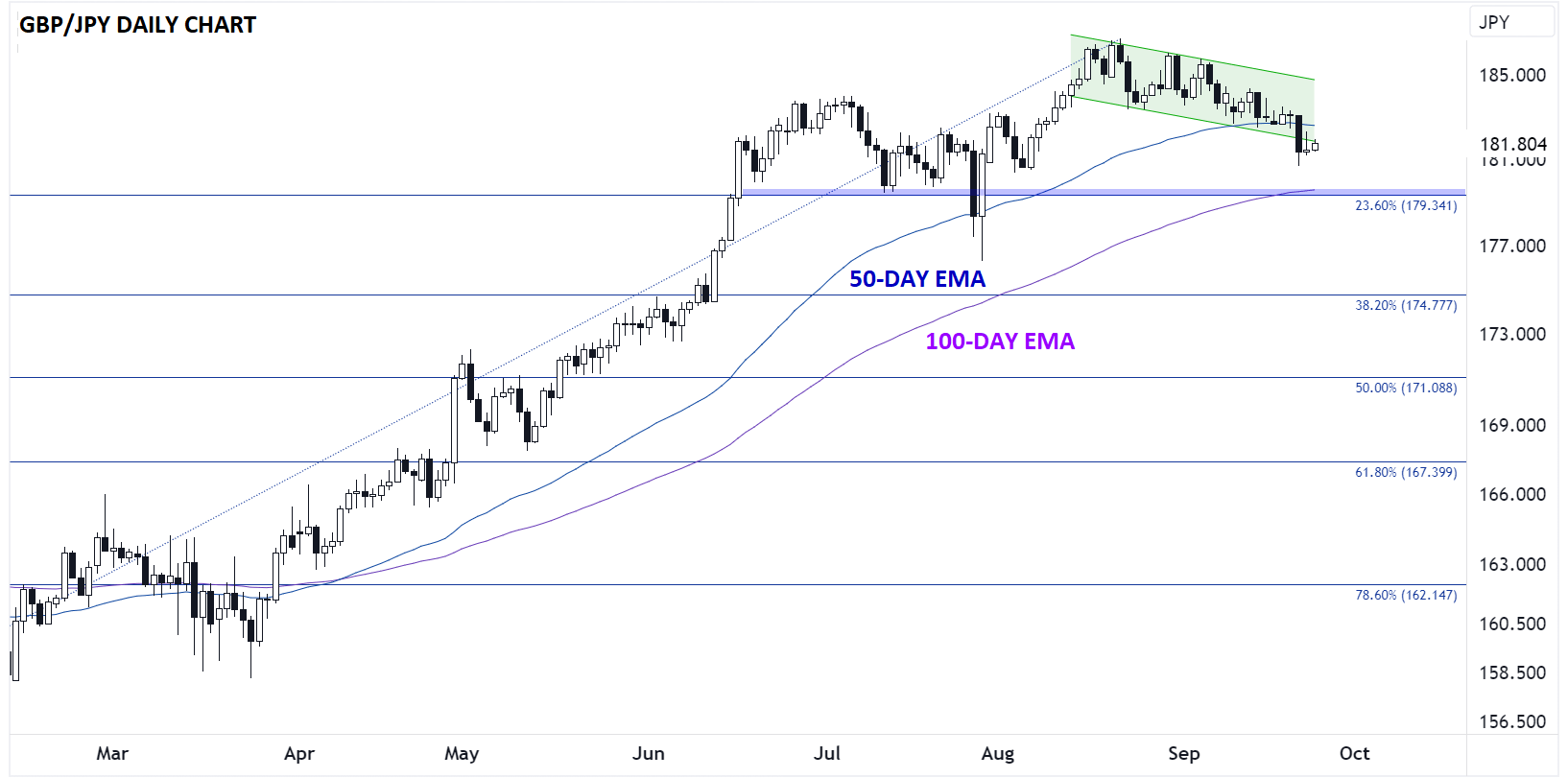

Japanese Yen Technical Analysis – GBP/JPY Daily Chart

Source: TradingView, StoneX

Compared to USD/JPY or EUR/JPY, GBP/JPY is weaker still, with prices actually forming a near-term bearish channel over the past six weeks. Last week’s sharp drop through the 50-day EMA points to elevated odds of another leg lower from here, with bears turning their eyes toward the 23.6% Fibonacci retracement of the entire 2023 rally below 180.00 as the next logical support level to target.