The Japanese yen is in positive territory on Friday. In the European session, USD/JPY is trading at 135.92, down 0.57%.

USD/JPY has been rather muted this week, with the exception of Monday, when the pair jumped 1.8%. The gain was driven by the unexpectedly strong US employment report, which dampened hopes of a dovish pivot by the Federal Reserve. The economic calendar has been light this week in both the US and Japan, and investors are focused on next week, with a host of key releases. The highlights are the US inflation report on Tuesday and the Fed’s final meeting of the year on Wednesday. Japan releases the Tankan indices on Tuesday, which provides a snapshot of the strength of the manufacturing and services sectors.

The economy has finally caught up to pre-Covid levels, but the recovery has been slower than other major economies. Japan’s GDP declined 0.2% q/q in the third quarter, revised upward from -0.3% in Q2, which was also the consensus. The Bank of Japan is expected to hold course, maintaining its ultra-accommodative policy in order to support Japan’s fragile economy. Inflation has broken above the BoJ’s target of 2%, driven by surging energy costs. What may finally lead to a change in policy at the BoJ is the changing of the guard in April, when Governor Kuroda will vacate his position after being at the helm over the past 10 years.

It has been the polar opposite at the Federal Reserve, which is widely expected to increase rates by 50 basis points next week. This would bring the cash rate to 4.50%, the highest amongst the major central banks. The Fed has gone to great efforts to present a hawkish face to the markets and quash speculation that it is planning a dovish pivot. Still, after four consecutive hikes of 75 bp, a smaller move will fuel speculation that the Fed may be slowly winding down its current rate tightening cycle.

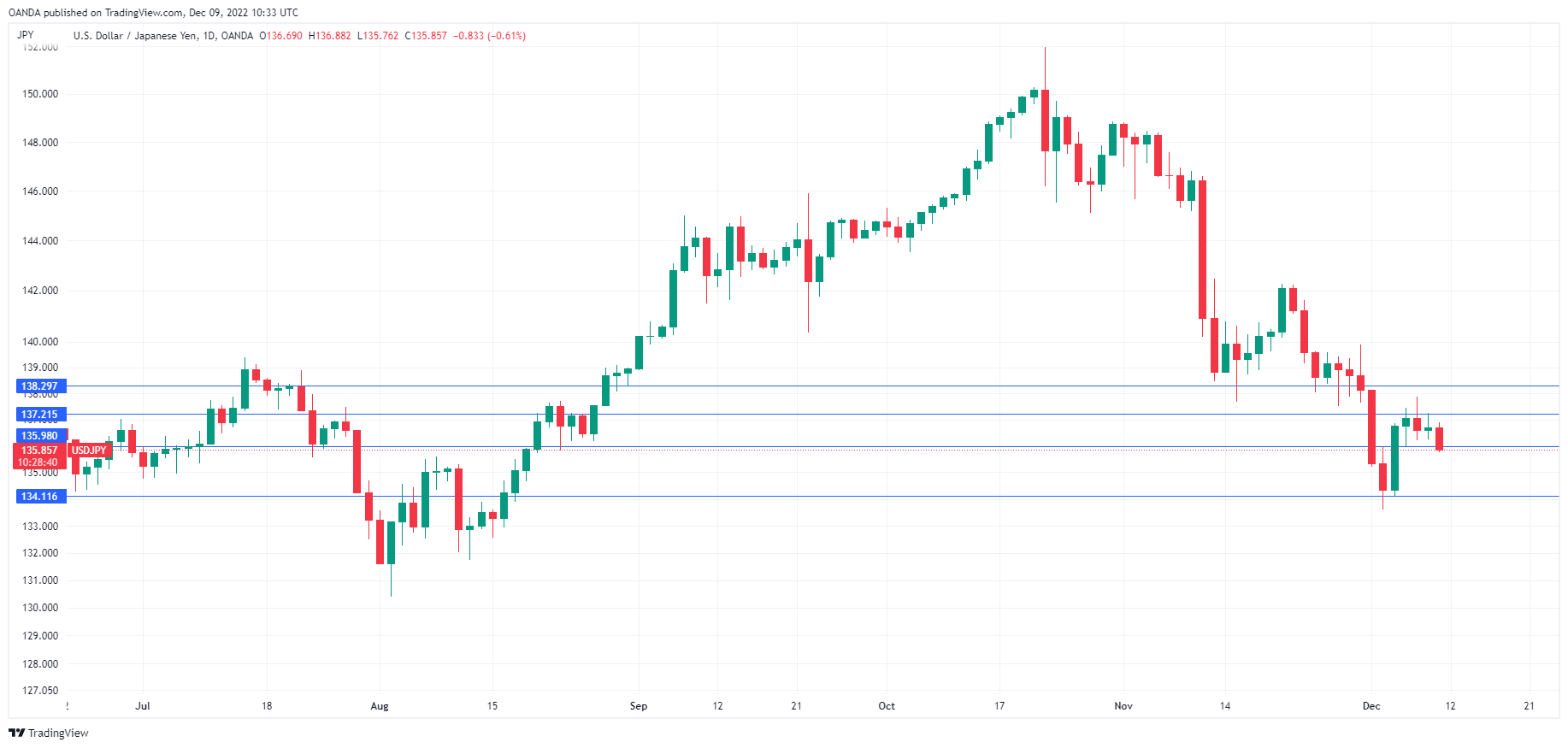

USD/JPY Technical

- USD/JPY faces resistance at 1.3681 and 1.3766

- There is support at 1.3596 and 1.3535