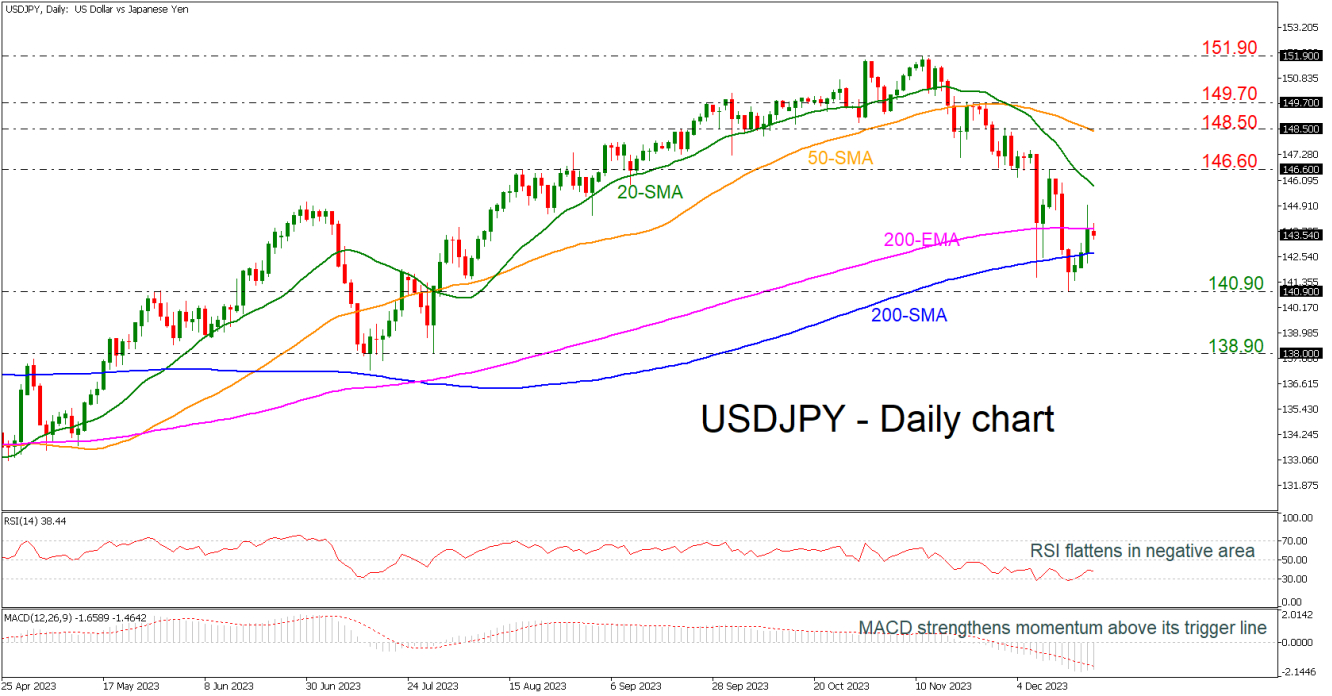

· USDJPY rebounds off 140.90

· Momentum indicators suggest more gains in the near term

USDJPY stormed higher after penetrating the 200-day simple moving average (SMA) but found strong resistance at the 200-day exponential moving average (EMA), recouping some of last week’s losses. The RSI indicator bounced off the 30 level but is flattening, while the MACD is moving higher after the slip beneath its trigger line.

If the bullish pressures persist, the price could revisit the 20-day SMA at 146.15 and the 146.60 barricade. Breaking above this area, the pair may face the 148.50 resistance, which overlaps with the 50-day SMA. A jump above that region could pave the way for 149.70.

Alternatively, should the bears attempt to push the price lower, initial declines could cease at the recent support lines of 200-day EMA at 143.80 ahead of the 200-day SMA at 142.60. Diving below these levels, the price may descend towards the 140.90 bottom.

In brief, USDJPY is in negative mode in the near-term after the pullback from 151.90 but in the very short-term timeframe is gaining some momentum. However, the odds are in favour of a bullish breakout as the MACD is strengthening in their negative territories.