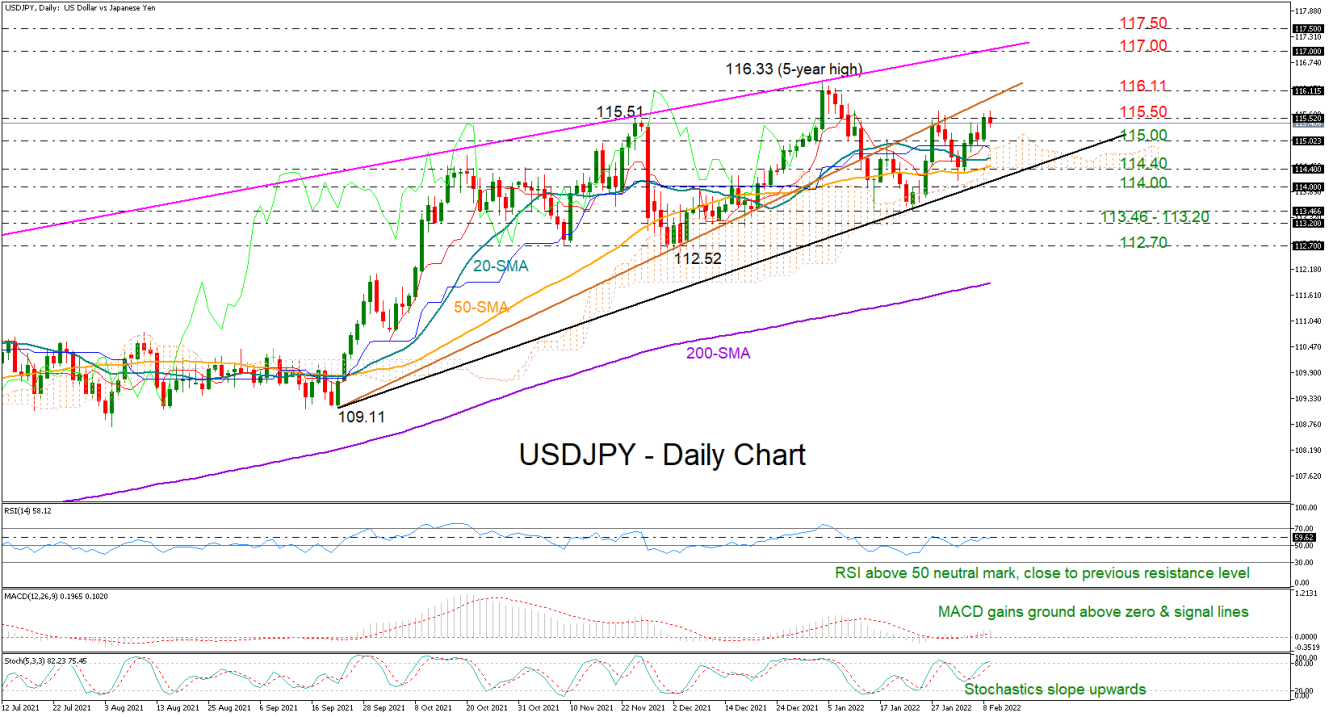

USDJPY revived its bullish momentum on Tuesday, but its efforts proved fruitless against the 115.50 border once again.

The bulls, however, may not give up the battle. With the MACD growing above its zero and signal lines and the RSI fluctuating comfortably above its 50 neutral mark, although close to its previous resistance territory, there is scope for further progress in the market. The Ichimoku lines endorse this view, as the red Tenkan-sen is set to cross above the blue Kijun-sen line.

As regards the market structure, the pair is still following a neutral trajectory in the short-term picture, though the new higher low at 114.14 registered earlier this month is an encouraging sign that buyers are gaining power.

A clear close above the 115.50 bar could see the price testing the key obstacle at 116.11, which the market was incapable of claiming in January despite touching a five-year high slightly above at 116.33. This is where the support-turned-resistance trendline from 109.11 is currently hovering. Hence, any step higher from here may add more fuel to the rally, likely bringing the 117.00 psychological mark and the 117.50 level last seen during the 2014 – 2016 period next in focus. The key resistance line, which joins all the highs from March 2021, could make this area more challenging.

On the downside, the 115.00 number could immediately come to the defense if sellers dominate. If it fails to hold, the decline could continue towards the 114.40 – 114.00 zone, where a tentative supportive trendline drawn from September’s lows is placed. Running lower, the pair may get congested within the 113.46 – 113.20 area before heading for the 112.70 handle.

In summary, USDJPY is preserving a bullish short-term bias despite facing a tough wall around the familiar 115.50 hurdle, making a move towards 116.11 possible.