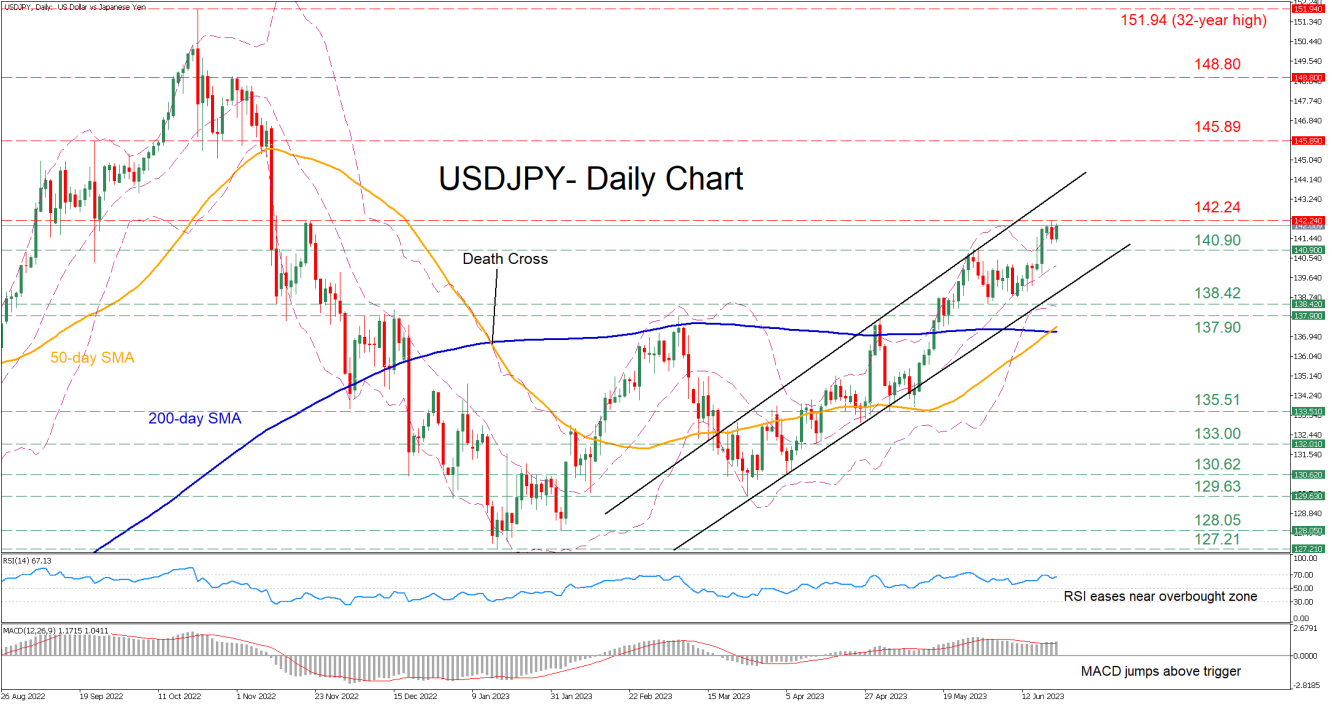

USDJPY has been trading within an upward sloping channel since mid-March, crossing above crucial technical levels and posting consecutive higher highs. However, the pair seems to be consolidating in the near term after failing to breach the November 2022 high of 142.24.

The momentum indicators currently suggest that the bullish forces are in control. Specifically, the RSI has flatlined just shy of the 70-overbought mark, while the MACD is holding above its red signal line in the positive territory.

If bullish pressures persist, the price needs to initially claim the recent rejection region of 142.24. Piercing through that wall, the pair could ascend towards the September high of 145.89 before the 148.80 hurdle gets tested. A break above the latter might pave the way for the 32-year high of 151.94.

Alternatively, should the uptrend lose steam and the price reverse lower, the recent resistance of 140.90 could serve as initial support. If that floor collapses, the bears might aim for the June low of 138.42 before the spotlight turns to 137.90. Further declines could then come to a halt at the 135.51 territory.

Overall, USDJPY has been stuck in a steep uptrend, but the price is approaching overbought conditions as it has been trading above its upper Bollinger band for the past few sessions. However, the recent completion of a golden cross between the 50-day simple moving average (SMA) and the 200-day SMA could enable the pair to extend its advance.