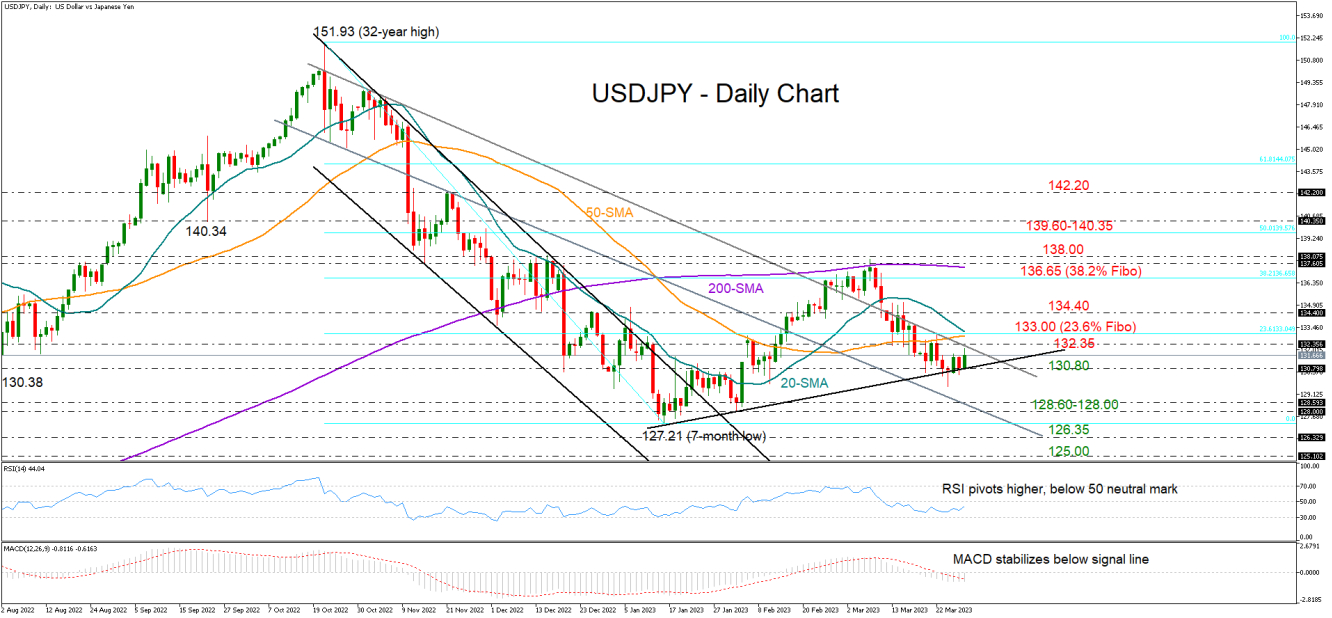

USDJPY resumed its bullish momentum early on Thursday, sustaining a strong foothold within the 130.00 area and around the short-term ascending trendline that has been navigating the market since the start of the year.

The RSI is following the price higher at the moment, though it has not exited the bearish territory yet. Likewise, the MACD has not crawled above its red signal line, both suggesting that the latest rebound is unconvincing.

For the recovery to continue, buyers would need to pierce through the wall of 132.35-133.00. The 20- and 50-day simple moving averages, the 23.6% Fibonacci retracement of the 151.93-127.21 downtrend, and the extension of October’s resistance line are all placed here. Therefore, a clear close higher is required to ease negative risks and lift the price up to 134.40. Should the bulls breach the latter, the price could advance up to the 38.2% Fibonacci level of 136.65 and the flattening 200-day SMA at 137.60. Then, an extension above 138.00 could clear the way towards the 50% Fibonacci mark of 139.60.

In the event the floor around 130.80 collapses, the pair may dive to meet the lower support line within the 128.60-128.00 area. If the October-January downtrend comes back into play below 127.20, the 126.35 region could immediately pause additional declines to 125.00.

Summing up, USDJPY is not out of the woods yet, despite stabilizing its bearish wave around a key support area. A close above 134.40 could boost buying interest, though only a bounce above the 200-day SMA would strengthen the 2023 upleg.