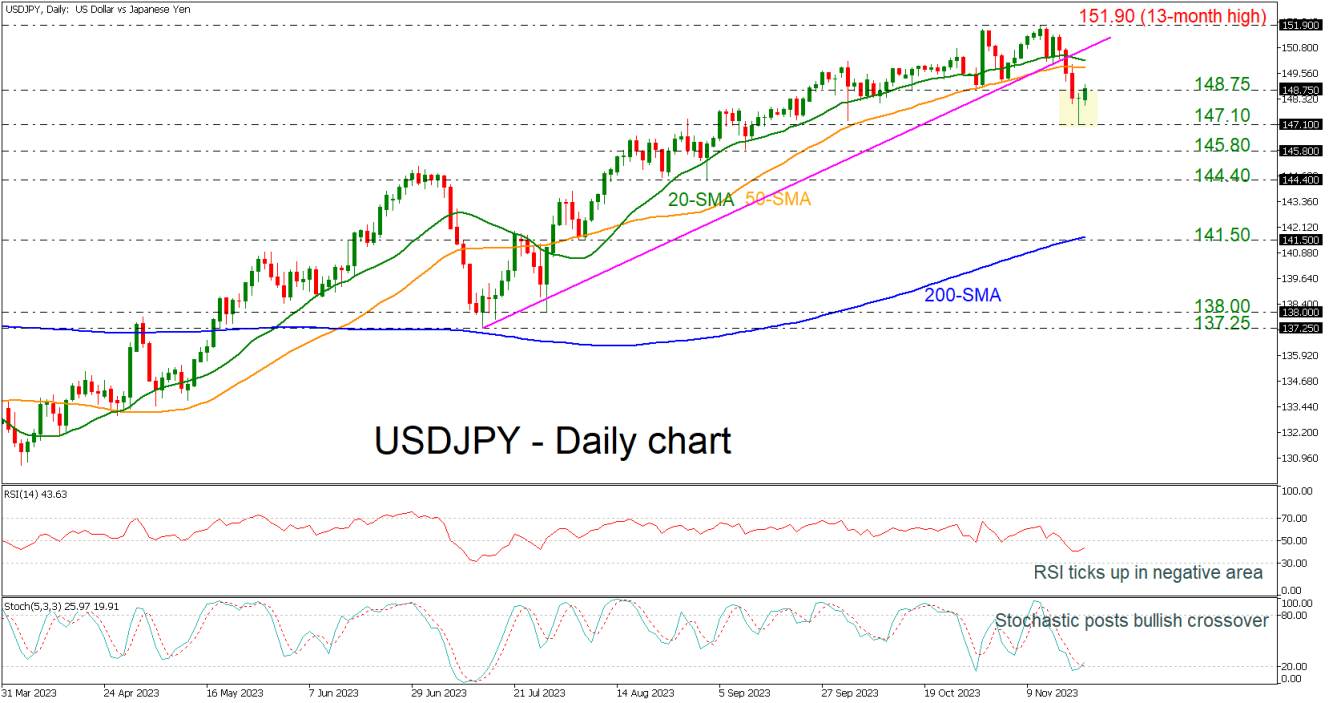

· USDJPY advances after it bottomed at 147.10

· Momentum indicators suggest more gains in the near term

· A jump above 20- and 50-day SMAs would shift the bias back to bullish

USDJPY stormed higher after posting a bullish doji candle that indicates an upside reverse on the current trend in the short-term.

The price is gaining some ground trying to recoup the previous days’ sell-off with the technical oscillators endorsing the positive move. The RSI is ticking up in the negative region, while the stochastics posted a bullish crossover between the %K and %D lines.

If the bullish pressures persist, the price could revisit its recent resistance lines of the 50- and then the 20-day simple moving averages (SMAs) at 149.85 and 150.20 respectively. A jump above these lines and a return above the penetrated rising trend line could pave the way for the 13-month peak of 151.90.

Alternatively, should the bears attempt to push the price lower, initial declines could cease at the recent support of 147.10. Diving below that floor, the price may descend towards the 145.80 barrier ahead of the 144.40 level, registered on September 1.

In brief, USDJPY is switching the bearish bias to bullish in the short-term timeframe and any jumps above the short-term SMAs would confirm the upside structure in the medium-term outlook as well.