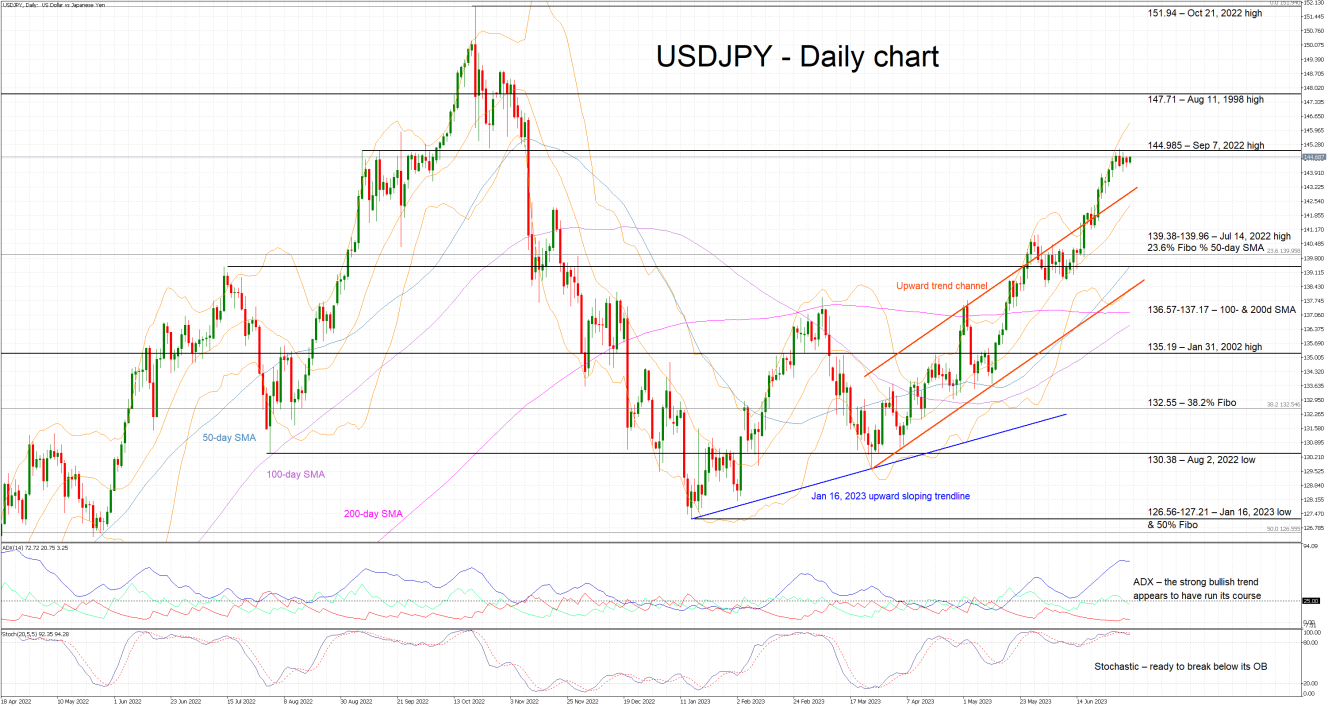

USDJPY has been trading sideways over the past five sessions as the aggressive rally that started on March 24, 2023 appears to have halted. There are a few reasons for the latest move, including the intervention talk, but the bears are still not satisfied. They are desperately looking for a small pullback to recover part of their recent losses and dent the bulls’ confidence.

It is fair to say that the momentum indicators are finally showing some rally exhaustion signs. The stochastic oscillator continues to trade in its overbought territory, but it appears to be making another effort to move below the 80-threshold and therefore confirm the increased bearish pressure. In the meantime, the Average Directional Movement Index (ADX) has topped, and it is currently trading sideways. A continuation of this move or even a drop by the ADX would be seen as a signal that the bullish trend has run its course.

Having said that, the bears are ready to defend the September 7, 2022 high at 144.985 and push USDJPY back inside the recent upward trend channel. Even lower, the key 139.38-139.96 range, populated by the July 14, 2022 high and the 23.6% Fibonacci retracement level of the March 9, 2022 - October 21, 2022 uptrend, awaits them. A successful break of this area would be a significant win for the bulls from a market sentiment perspective.

On the flip side, the bulls accept the need for a small correction, but they are still keen on registering a new 2023 high. They are keen on quickly clearing the 144.985 level and then targeting the August 11, 1998 high at 147.71. They can then set their eyes on the 32-year high at 151.94.

To conclude, the path of least resistance remains for higher USDJPY prints but, for the first time in a while, the bears could count on the momentum indicators' support to finally engineer a pullback towards the 139.96 area.