- China reports Q4 GDP data on Wednesday; is a rebound in store?

- CPI numbers due in UK, Japan and Canada

- Retail sales to be the main focus in the US

Is China’s recovery getting back on track?

The Chinese economy suffered several wobbles in 2023, as the property crisis went from bad to worse. Markets held their breath for a major stimulus announcement, but with one eye on deleveraging, authorities’ response only went as far as offering targeted drip-feed measures, leaving investors flabbergasted and disappointed.

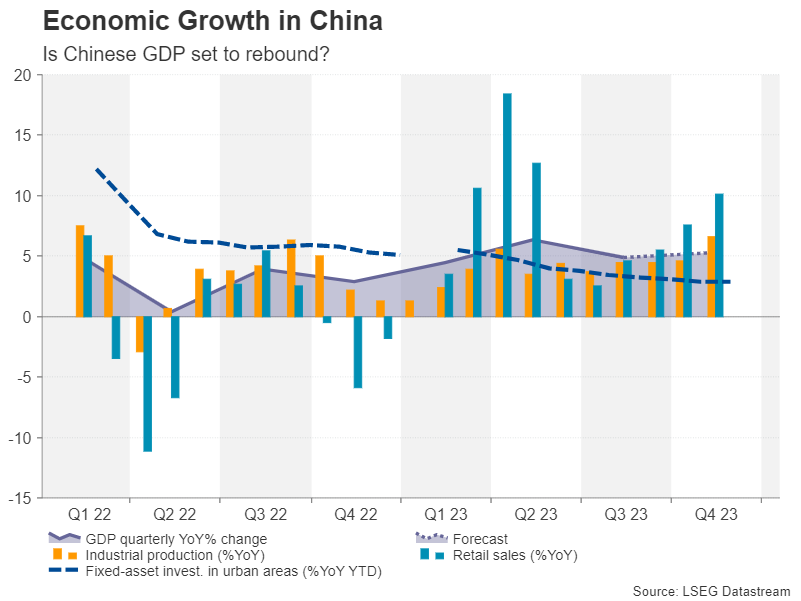

However, the government’s efforts may not have been totally in vain as Chinese consumers have been spending more since the summer and industrial production has also been rebounding. The property sector remains a significant risk but there are signs that the market is stabilizing. Hence, GDP growth likely quickened in the final quarter of 2023 to 5.3% y/y after slowing to 4.9% y/y in the third quarter. A Q4 reading of slightly above 5.0% y/y would ensure that the government meets its growth target of around 5.0% for the full year.

The GDP data will be released on Wednesday alongside the monthly prints on industrial output, retail sales and fixed asset investment.

Global equities as well as the Australian dollar, which is considered a liquid proxy for the China risks, could gain on the back of stronger-than-expected growth in the world’s second largest economy.

Australian jobs data will also be key for the aussie

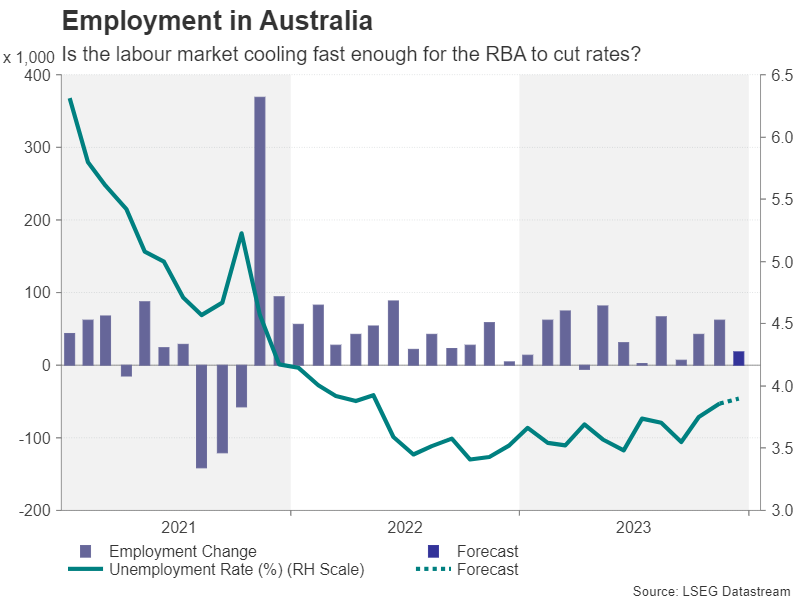

However, China’s economic performance will not be the only thing on the aussie traders’ minds as Australian employment numbers are due on Thursday. Australia’s labour market has cooled off slightly in recent months, with the unemployment rate inching up to 3.9%.

If the employment report points to further weakness in December, investors will likely up their bets of expected rate cuts by the Reserve Bank of Australia in 2024. At the moment, the RBA is seen to be the least dovish among the major central banks – something that contributed to the local dollar’s revival last autumn.But if those bets are scaled back, the aussie could struggle against its US counterpart, especially if optimism about China remains in short supply.

CPI to headline busy data week for the pound

Another currency that’s been supported by expectations of fewer rate cuts than other central banks is the British pound. Although the Bank of England is predicted to slash rates by at least 100 basis points, the ECB and Fed are expected to cut even more aggressively.

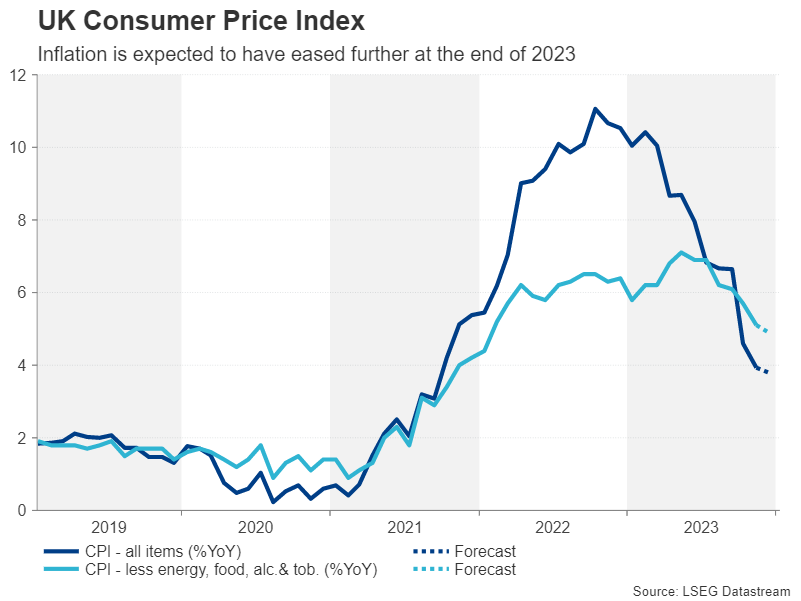

As in Australia, inflation in the UK has taken longer to come down from the 2022 highs, but there’s been a marked improvement in this trend in the last couple of reports. The headline rate of CPI in the UK fell to 3.9% y/y in November and is forecast to have cooled marginally to 3.8% y/y in December.

Core CPI will also be watched on Wednesday as it remains above 5.0%, while a day earlier, UK jobs and wage numbers are due for November.

Retail sales figures for December will round up the week for sterling on Friday. The pound has been consolidating after briefly flirting with the $1.28 level in December. If inflation continues to surprise to the downside, cable’s uptrend will likely come under question. However, the retail sales stats will be important too as an upbeat set of numbers would ease concerns of the UK economy entering a technical recession at the end of 2023.

Fed rate cut bets face more tests

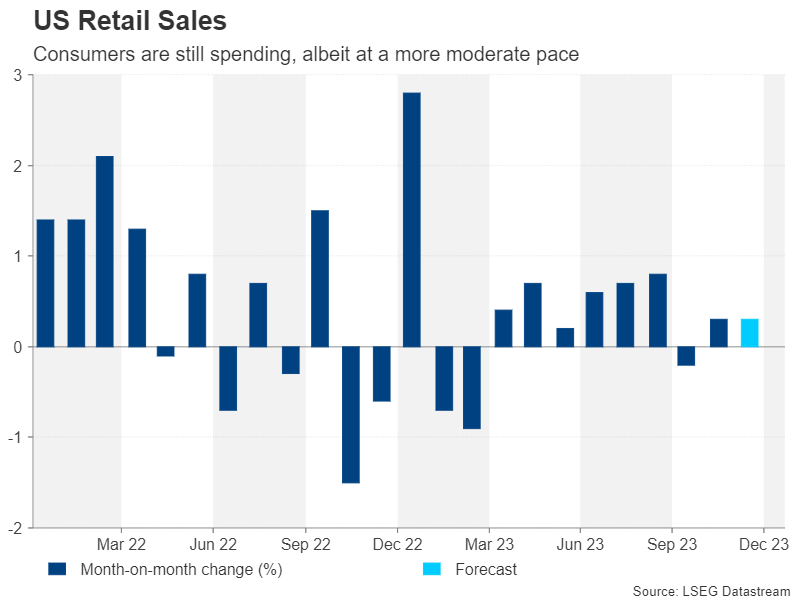

Retail sales will also be the highlight in the United States, with the remaining releases being mostly second-tier data. Whilst US consumer spending has slowed after the summer surge, it isn’t about to fall off a cliff either. Retail sales grew by 0.3% m/m in November and the December readings due on Wednesday are expected to show a similar pace for the month.

Industrial production figures are out on Wednesday too, while on Thursday, building permits and housing starts for December might attract some attention. Existing home sales will follow on Friday.

Regional Fed surveys will shed some light on the manufacturing sector on Monday (New York Fed) and Thursday (Philly Fed), and finally on Friday, investors will be monitoring the University of Michigan’s vital consumer sentiment survey.

With markets betting so heavily for around 150 basis points of rate cuts by December 2024, a broadly solid set of indicators could spark some repricing in Fed fund futures, potentially pushing up Treasury yields and in turn, the US dollar.

Loonie to take cues from Canadian CPI

The Canadian dollar staged an impressive rebound at the end of 2023, even though oil prices retreated during this period. Much of the loonie’s gains were driven by the broader pullback in the US dollar, as well as the improvement in risk appetite.

The focus in the coming week will switch back to the domestic economy as the latest consumer price index is due on Tuesday. Canada’s CPI rate stood unchanged at 3.1% y/y in November, which is a worsening from the 2.8% figure recorded back in June, signalling a stalling of the progress in getting inflation all the way down to the Bank of Canada’s 2% target midpoint.

On the bright side, underlying measures of inflation have continued to decline, so any further drop in the core figures could offset an unexpectedly hot headline number.

The loonie could recoup its slight year-to-date losses against the greenback if CPI heads in the wrong direction again. But for the currency to be able to resume its medium-term uptrend, this will depend more on how Fed expectations and oil prices evolve in the coming weeks.

Can Japanese CPI put the yen on the front foot?

The Japanese yen hasn’t had a very good start to 2024, as expectations of an imminent policy shift by the Bank of Japan dwindled after the earthquake that struck the country on New Year’s Day.

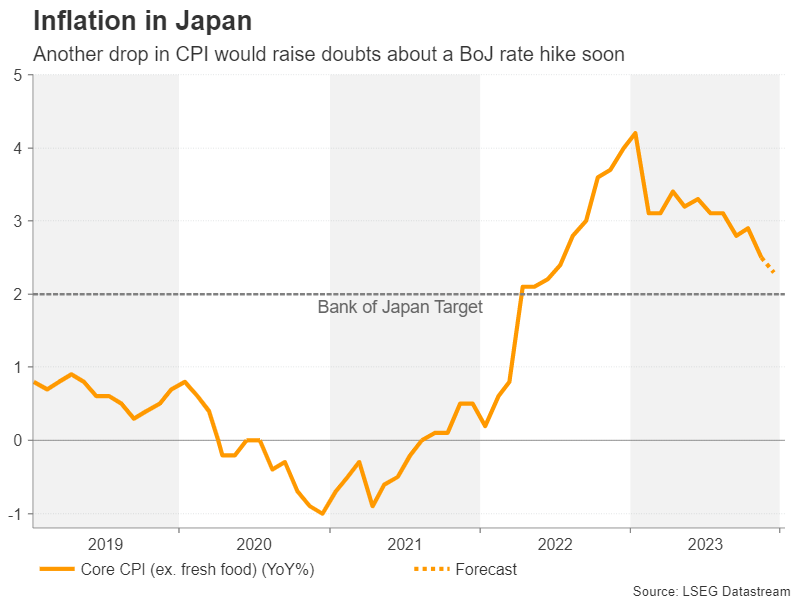

There could be a further setback for the yen on Friday as CPI is projected to have eased from 2.5% to 2.3% y/y in December. Although it’s unlikely that inflation in Japan will reaccelerate much over the next few months, as long as it holds above 2%, that would be enough for the BoJ to call time on negative interest rates. But for that to happen, policymakers will want to see stronger wage growth, which will only become evident after the spring wage negotiations.

For now, the yen will probably not react much to the December CPI data and at best, the incoming data can only provide some support. The other releases next week include corporate goods prices on Tuesday and machinery orders on Thursday.