Dollar not impressed

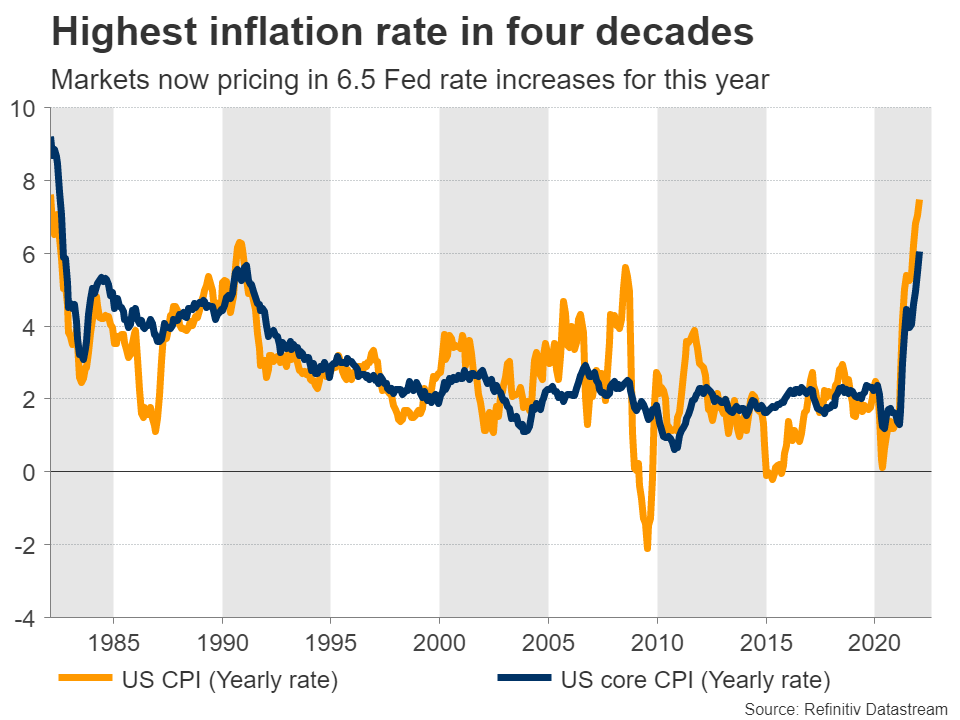

Will the Fed pull the handbrake? That’s what the market is betting on after the latest acceleration in inflation. Six and a half rate increases are now priced in for the year, the probability of a ‘double’ hike in March has gone through the roof, and there is all kinds of speculation about an emergency Fed meeting being called this month already.

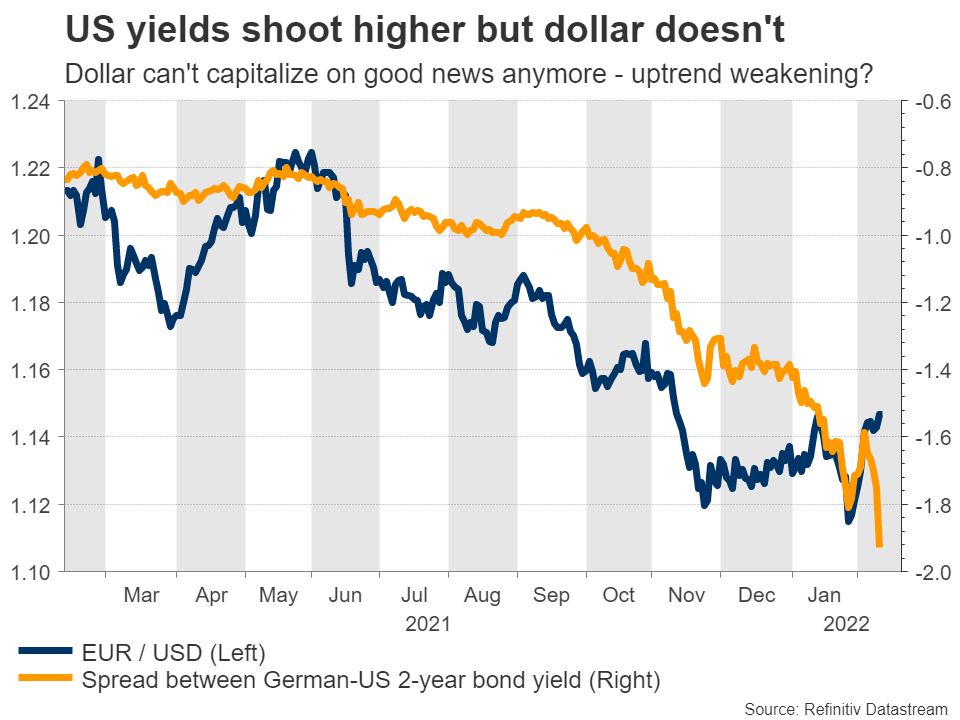

Bond markets are essentially saying the Fed has lost control and needs to take a sledgehammer to inflation. Yet despite the fireworks in yields, the FX market didn’t really play along. The dollar moved higher eventually, but it was a very delayed reaction and not particularly impressive considering that the market priced in one extra rate hike in a few hours.

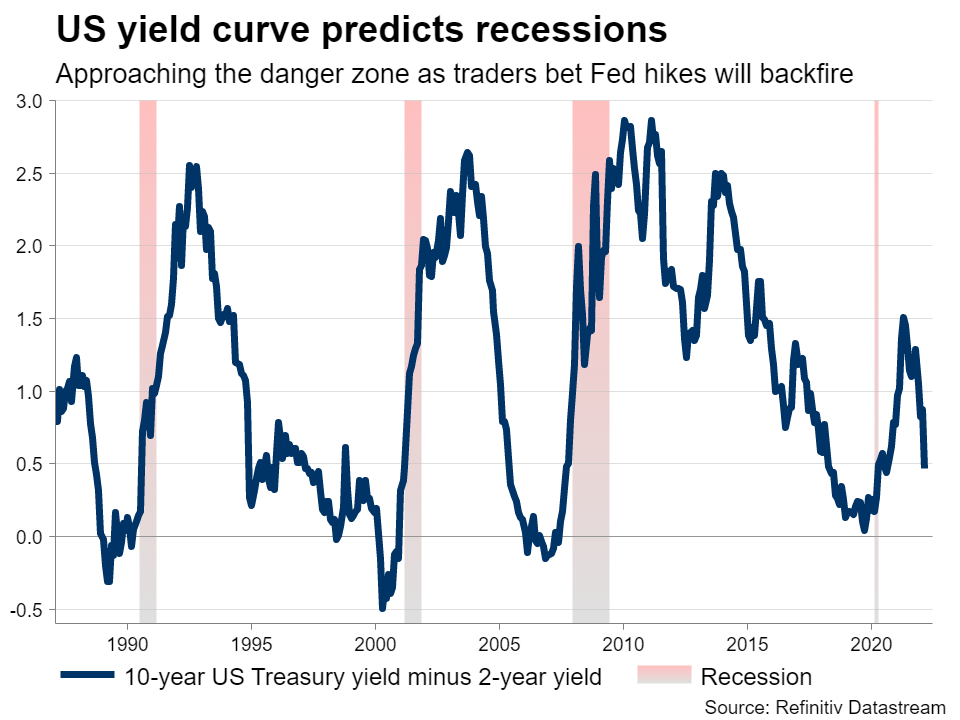

There are several ways to interpret this lethargic move. For instance, many big players may have been positioned for a hot print or sensed that the resulting shock-and-awe rate increases to stomp out inflation could ultimately backfire and trigger a recession.

The reason is not so important. What matters is the price action. There has been a consistent pattern in recent weeks where the dollar cannot capitalize on ‘good’ news even as Fed bets mount. This suggests the uptrend that’s been in force for more than a year is losing steam.

Let’s break it down. The Fed is almost ‘fully priced’ by now. In fact, markets may have gone too far already. There’s a serious argument that the yearly inflation rate could peak soon as government spending fades, supply chains finally normalize, consumers shift back to services with restrictions being lifted, and year-over-year comparisons become much tougher from March onwards.

When investors see concrete signs of ‘peak inflation, these hyper-aggressive Fed bets could be dialed back. Politics are not favorable either. The Democrats will probably lose Congress in November’s midterm elections, which means the days of extravagant government spending are over. This also implies that ‘peak growth’ may be behind us.

Last but not least, the Fed is not playing solo anymore. Foreign central banks including the ECB have started to turn hawkish, so the dollar’s interest rate advantage is unlikely to get any bigger.

All told, the dollar may have ‘one last hurrah’ left as markets speculate about a double rate hike in March, but the overall rally seems to be on its last legs. It’s just difficult to see much upside left with the Fed already priced so aggressively.

The minutes of the latest Fed meeting and retail sales for January will both be released on Wednesday. The minutes are likely outdated already given recent developments, so the spotlight will fall on retail sales. If the report is solid but the dollar cannot capitalize again, it would be another sign the picture is turning.

Barrage of UK releases

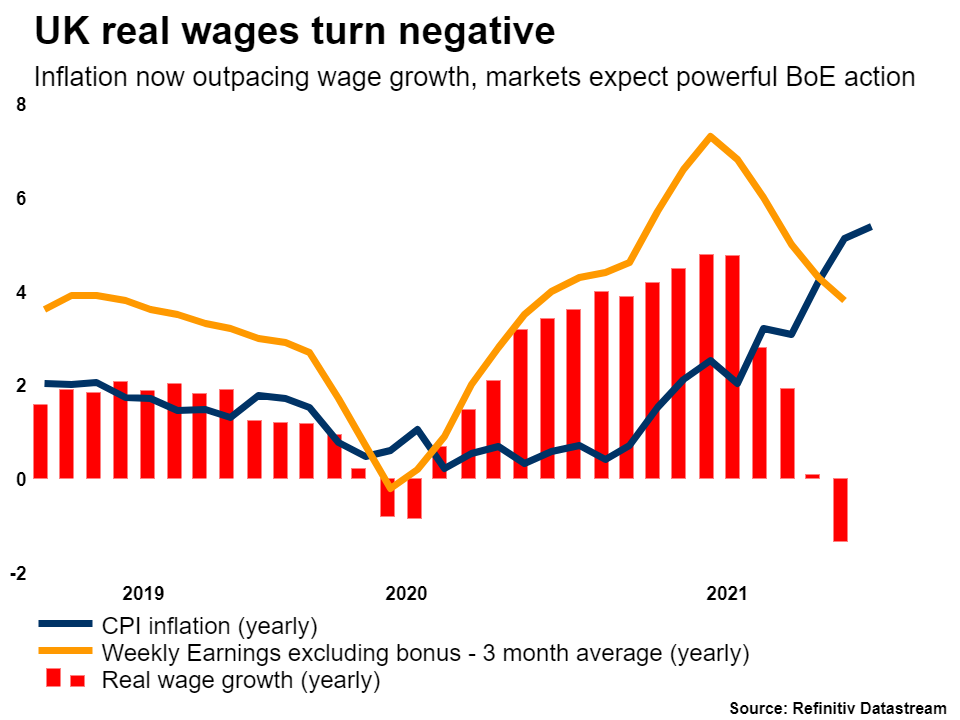

There’s a volley of British data releases coming up, starting with the latest jobs report on Tuesday. Inflation stats for January will hit the markets on Wednesday, ahead of retail sales on Friday.

The Bank of England raised rates last week and started to shrink its balance sheet, yet the pound could not rally and instead lost significant ground against the euro as the ECB also flipped the hawkish switch. Money markets are now pricing in another six rate increases by the BoE for this year.

In the euro area, the second estimate of GDP for Q4 is out on Tuesday, although the euro generally doesn’t react much to that.

Canadian and Australian data

In Canada, the latest inflation report will be released on Wednesday ahead of retail sales on Friday. The nation’s economy is absolutely booming, although the retail sales numbers may be rather soft amid the covid restrictions in December.

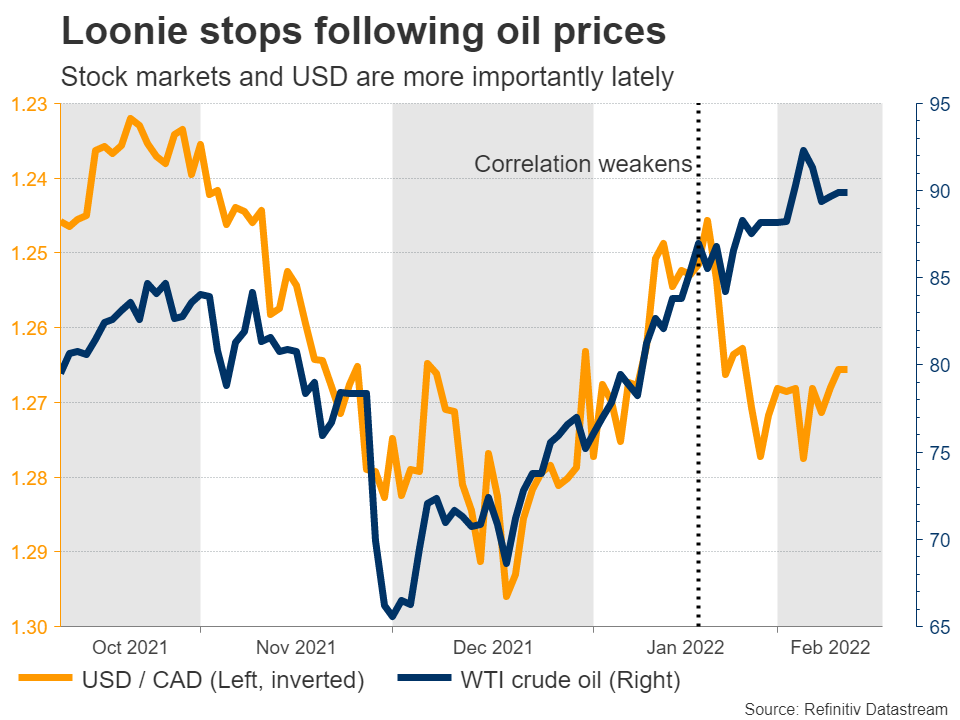

The Canadian dollar has been a real puzzle lately as it has decoupled from economic data and soaring oil prices, instead trading in lockstep with stock markets and risk appetite. That said, the outlook remains favorable as correlations could ultimately return and the broader inflationary environment bodes well for commodity-exporting economies like Canada.

In Australia, the minutes of the latest Reserve Bank meeting are out on Tuesday, before employment data on Thursday. Both could be crucial for the aussie as markets are pricing more than six rate increases for this year, despite the RBA’s reluctance to signal any.

Japanese and Chinese inflation

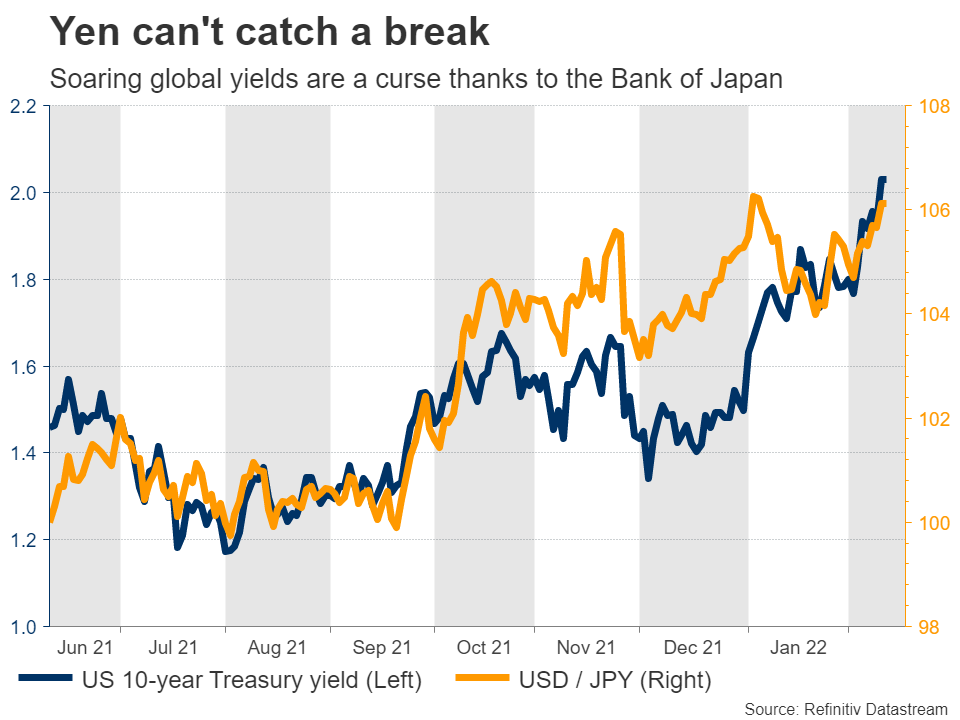

The yen has come under heavy fire recently, losing ground across the board as yields and commodity prices shot higher. Soaring global yields are bad news for the yen because the Bank of Japan remains committed to its yield curve control strategy, which keeps a ceiling on the nation’s yields.

Hence, Japanese yields cannot keep up with foreign ones and rate differentials automatically widen against the yen. For the currency to stage a comeback, markets need to see signs the BoJ might raise this ceiling. This puts more emphasis on the upcoming GDP and inflation numbers on Tuesday and Friday, respectively.

Finally in China, inflation stats for January will be released on Wednesday.