- Japanese yen loses ground ahead of BoJ decision on Tuesday

- ECB meets on Thursday, will it push back against rate cut bets?

- Bank of Canada decides too, while the US releases GDP stats

BoJ unlikely to rescue battered yen

The Japanese yen started the new year on the wrong foot, losing 5% of its value against the US dollar in the space of three weeks as cooling inflation and a sharp slowdown in wage growth convinced investors that the Bank of Japan will delay its plans to exit negative interest rates.

For a long time, market pricing suggested the BoJ would end negative rates in April. However, traders have now pushed back the timing of this move to July, dealing a heavy blow to the yen.

BoJ officials are unlikely to rock the boat when they meet on Tuesday. Governor Ueda has already downplayed the prospect of raising rates, s

tressing that there is no rush. The economic data pulse has weakened further since he made those comments, so the BoJ will most likely maintain a cautious stance.

In fact, some media reports suggest the BoJ will cut its inflation forecasts for this year. That would signal even less urgency to normalize policy, which in turn could keep the yen under pressure.

On the data front, the inflation stats for Tokyo will hit the markets on Friday.

Will the ECB push back on rate cuts?

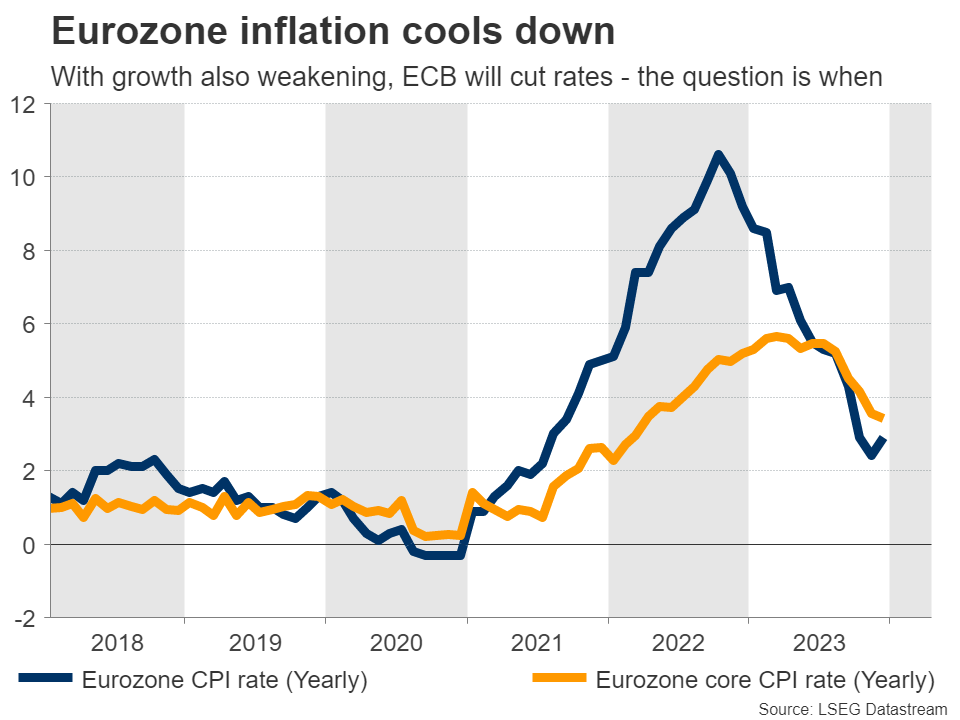

In the euro area, the European Central Bank decision will take center stage on Thursday. Market pricing suggests the central bank will do nothing, so the action will come mostly from the commentary by President Lagarde.

Several ECB officials have tried to dampen speculation about imminent rate cuts lately. Markets currently assign an 85% probability that the ECB will slash rates in April, but various policymakers including Lagarde have warned that’s too early, pointing to a summer rate cut instead.

If the ECB hammers this message home next week, the euro could briefly spike higher as some rate-cut bets are unwound. That said, it might be difficult for the single currency to sustain any advances, amid stagnant economic growth. With business surveys warning about a technical recession, the picture for the euro appears grim overall.

Speaking of business surveys, the next batch will be released on Wednesday, one day ahead of the ECB decision.

Bank of Canada decides, US publishes GDP data

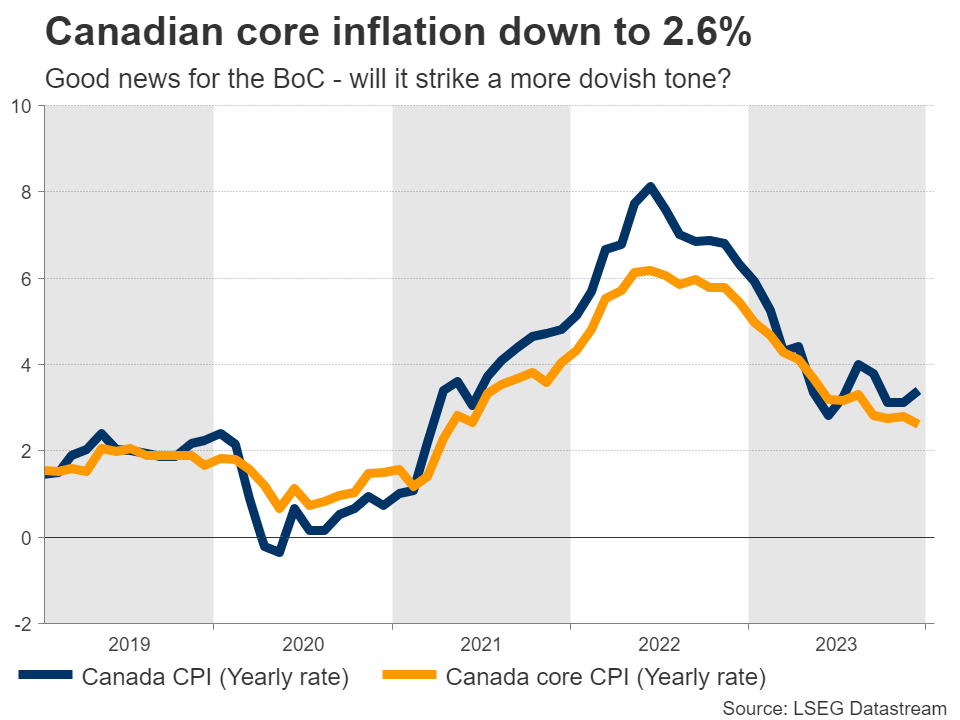

Over in Canada, the central bank will announce its own decision on Wednesday. Markets assign a 15% probability for an immediate rate cut, so it’s going to be an interesting event.

The Canadian economy has been flashing mixed signals lately. With wage growth firing up and record levels of immigration boosting housing prices, there is a concern that inflation could remain elevated for some time.

However, core inflation has declined dramatically, falling to 2.6% in annual terms in December. The BoC aims to keep inflation in a target range of 1% - 3%, so there is an argument that the job is almost done. Similarly, the latest business survey from the BoC warned about a weaker demand outlook, which could dampen inflation further.

Bearing everything in mind, the central bank will most likely hold interest rates steady at this meeting, but it might strike a more dovish tone, softly opening the door for an easing cycle later this year.

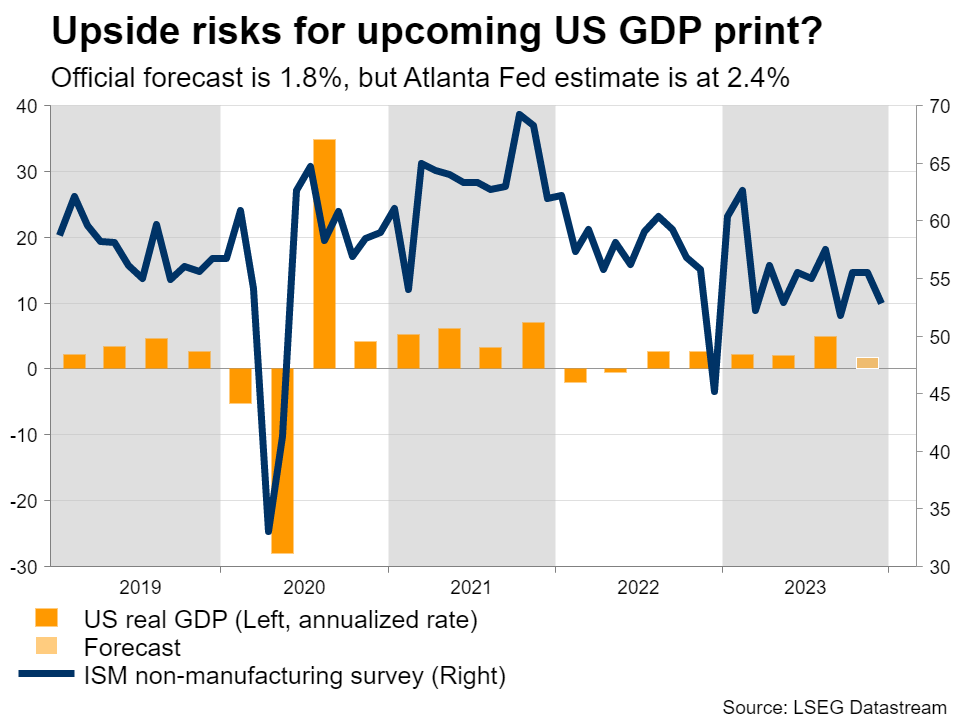

Across the border, the main event in the United States will be the release of preliminary GDP stats for Q4 on Thursday. The forecast is for the American economy to have grown by an annualized rate of 1.8% in the final quarter.

As for any surprises, a stronger-than-expected GDP print seems more likely than a disappointment. That’s mostly because of the Atlanta Fed GDPNow model, which estimates growth at 2.4% instead, much higher than the official forecast.

This model has a solid track record, and if it proves accurate this time as well, the dollar could benefit as traders scale back bets of rapid-fire Fed rate cuts this year. The core PCE price index for December will follow on Friday and could also be important in shaping Fed expectations.

Finally in New Zealand, inflation stats for Q4 will see the light on Tuesday.