ECB about to do the unthinkable

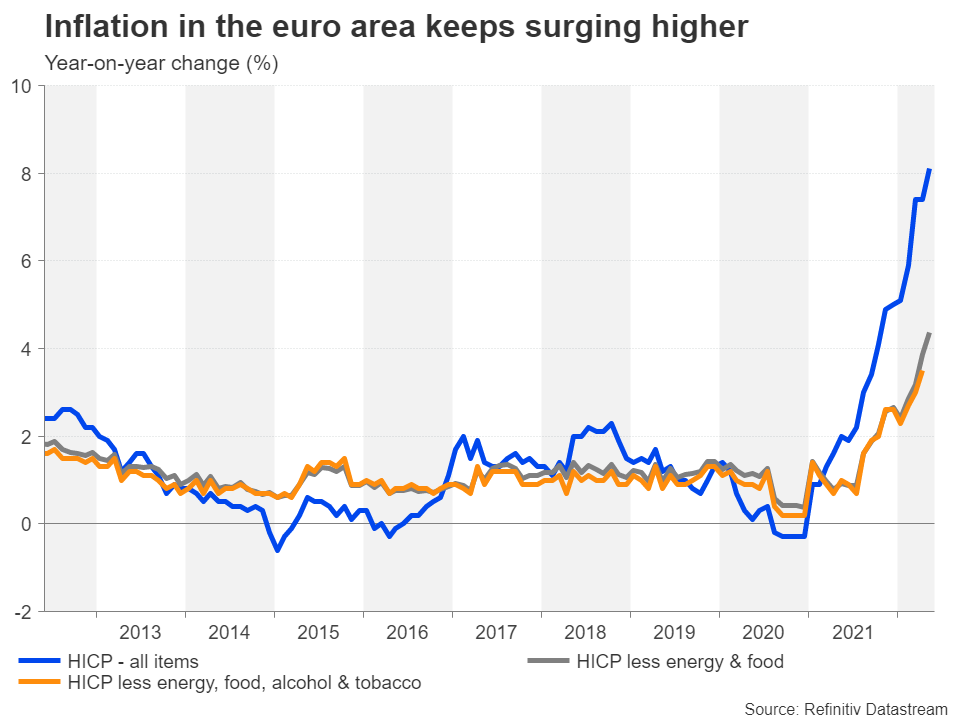

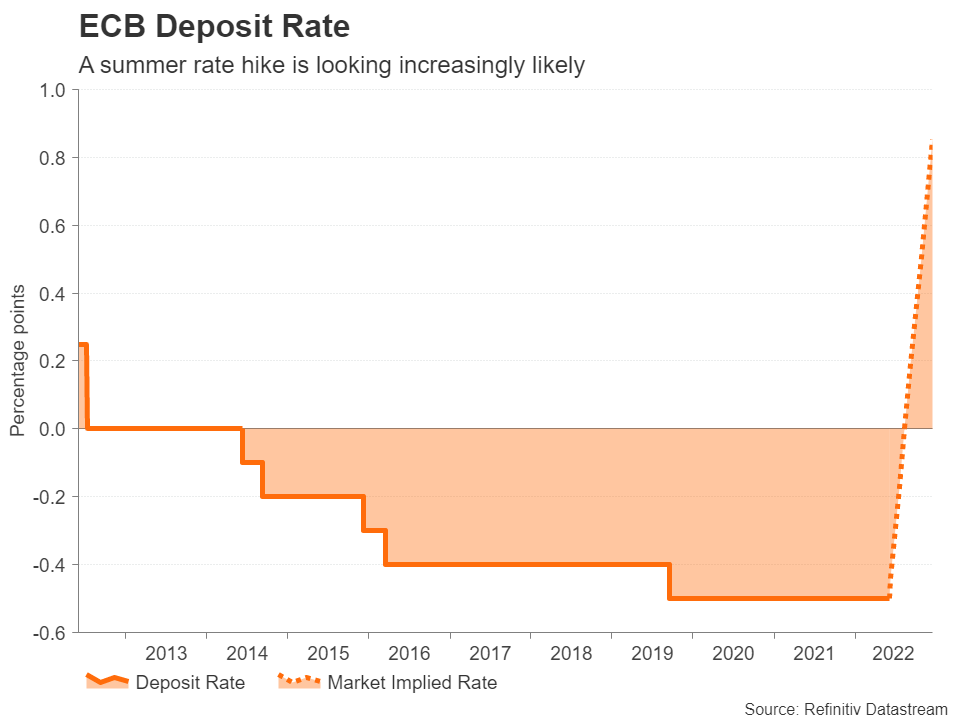

Inflation in the euro area surged to a new record high of 8.1% y/y in May, adding pressure on the ECB to end its long-running asset purchase programme as quickly as possible and lift the deposit rate out of negative territory, where it’s been since 2014. The policy decision on June 9 will therefore be a highly significant one even though the outcome has been well telegraphed by now.

Policymakers have signalled that they want to wrap up their bond purchases by early July and begin raising rates later that month when they meet on the 21st. There is some uncertainty as to the size of the initial rate increase and most likely, President Christine Lagarde will want to set the record straight on that in June rather than encourage speculation in the run up to the July meeting.

Having already made several policy U-turns this year, it’s difficult to imagine Lagarde will endorse a move bigger than 25 basis points. She will probably want to keep her options open for September but will prefer to provide investors with explicit guidance about the summer liftoff.

But even in this ‘least hawkish’ scenario, the turnaround in policy in such a short time has been dramatic, as only a few months ago, a 2022 rate rise was unthinkable for many at the ECB, including Lagarde herself.

All the talk of rate hikes has bolstered the euro, giving it a leg up against the US dollar and other majors. However, with at least a 25-bps increase at each of the July and September meetings already priced in, investors will be looking for hints that the ECB is willing to go faster. Otherwise, the euro will struggle to extend its recovery without further weakness in the dollar.

Will the RBA surprise again?

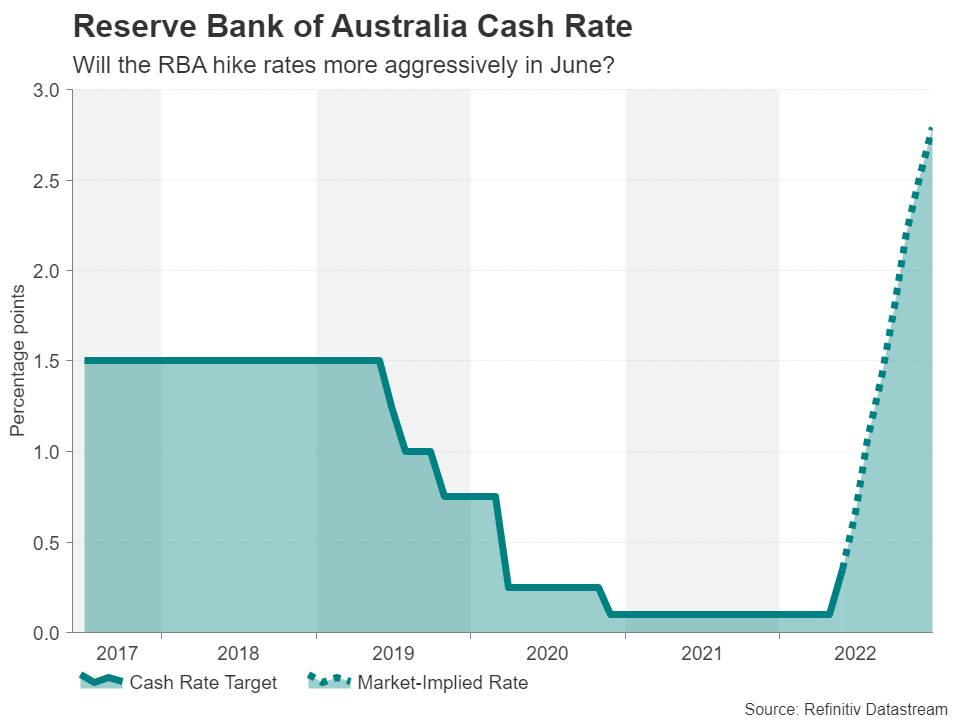

Ahead of the ECB’s decision, the RBA is expected to announce its second rate hike on Tuesday. The RBA raised rates by 25 bps in May, taking some investors by surprise not just with the timing, but also with the size of the increase. After China’s relaxation of lockdown restrictions in Shanghai and the robust GDP growth in the first quarter, the RBA has been given the green light to go full steam ahead with policy tightening.

Money markets are quite aggressively priced for the RBA. Investors are betting almost 10 rate hikes of 25 bps in the remaining seven meetings of 2022. This leaves the Australian dollar highly exposed to disappointments should the RBA not live up to the hawkish expectations. A 25-bps rate rise would almost certainly be seen as overly cautious by the markets and probably by policymakers too. Hence, there’s a good chance the RBA will opt for a 40-bps increase, which would take the cash rate to 0.75%, although another unexpectedly larger move cannot be ruled out given the central bank’s unpredictability in the past.

The aussie has just surpassed the $0.72 level as it continues to recover from May’s almost two-year trough. But the bulls might need to see some signs that more aggressive tightening is on the cards later in the year to maintain the positive momentum.

Keeping one eye on China’s slowdown

China has been a major concern for the markets lately as the timing of the recent lockdowns with the heightened geopolitical tensions couldn’t have been worse. Although some sense of normality is re-emerging in the worst hit region Shanghai, the fact that authorities are not letting up on their zero-Covid strategy means that the draconian measures could return at the first hint of a fresh outbreak.

This might explain why the subsequent relief rally in risk assets has been somewhat patchy. But the incoming data will likely show an improving economic picture, so there is scope for further boosts to risk appetite in the coming week.

Investors will be eager to see a solid rebound in both exports and imports when China reports May trade data on Thursday. The consumer and producer price indices released on Friday will be important too as any pickup in inflationary pressures would dampen expectations of more forceful policy easing in the future, and this could in turn weigh on equities and the aussie.

US inflation: obsessing about the peak

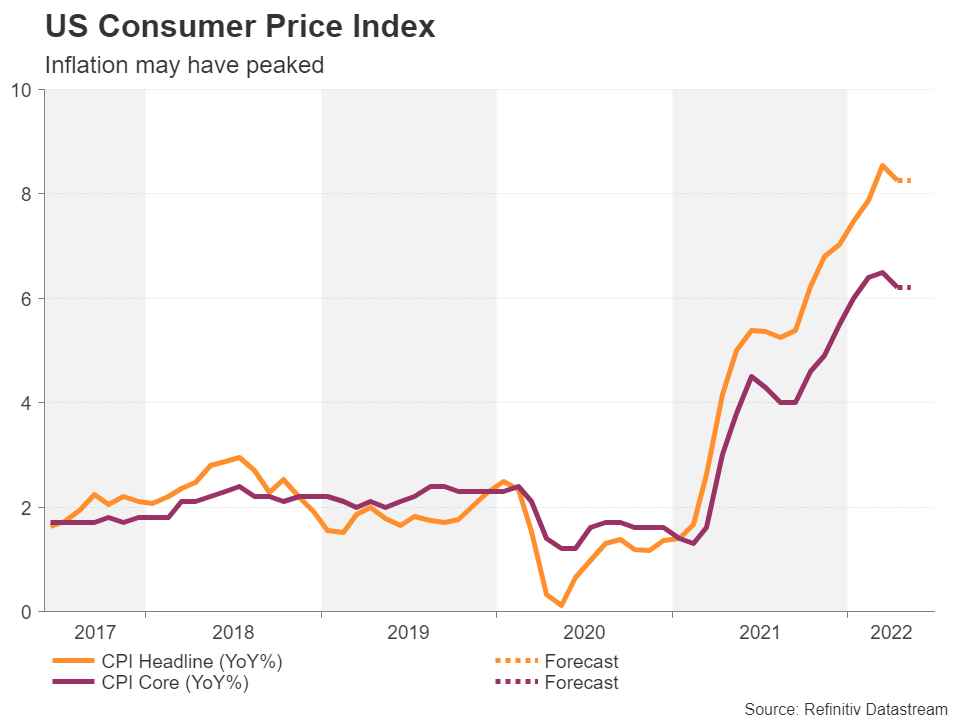

Excitement is building that inflation in America is peaking or has already peaked following some moderation in both the CPI and PCE measures recently. There could be further good news on this front on Friday when the consumer price index for May is due.

The headline rate is expected to have stayed unchanged at 8.3% y/y in May and the core rate is also projected to have held steady, at 6.2%.

f the numbers indeed provide more indication that price pressures are levelling off and inflation will only head downwards from hereon, Treasury yields might start pulling back again, having just managed to recoup some of the May losses. The US dollar could slip again too as it’s been struggling to back on the front foot despite halting a two-week slide.

The problem, however, is that peak inflation won’t solve all the Fed’s problems. Policymakers will want to be confident that inflation is on a sustained path towards the 2% target before calling time on rate hikes. Thus, it could be a while still before there is a clearer picture on the direction that inflation is travelling.

Nevertheless, any softness in the CPI prints next week would be greeted with cheer by the markets, potentially sparking a rally on Wall Street but bruising the dollar.

Canadian jobs data on the way

Canada’s employment report is due on Friday and most likely the labour market kept growing in May. The strong jobs market is one reason why the Bank of Canada turned more hawkish at the June meeting, warning that it may have to “act more forcefully” to fight inflation. Following the hawkish tilt, the latest employment numbers are unlikely to bring anything new to the table with regards to the policy outlook.

Nonetheless, a strong report would be supportive of the loonie in the face of lower oil prices. Though so far, OPEC’s decision to pump more crude to compensate for reduced Russian supply has only brought about a relatively modest downside reversal in oil futures.