Euro squeeze?

There has been a striking change in tone from the European Central Bank lately. Several officials have stressed the need to raise interest rates forcefully, igniting speculation about a series of shock-and-awe moves, even though business surveys suggest the Eurozone economy is on the verge of recession.

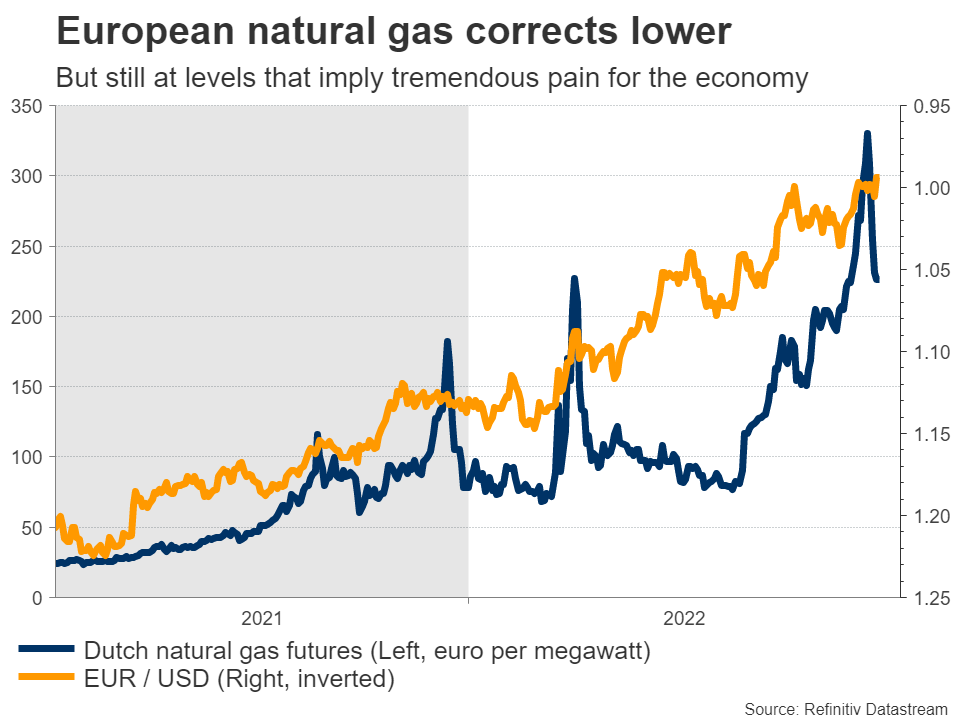

Electricity prices across Europe have spiraled out of control, threatening to kneecap economic growth as consumers and heavy industry get crushed. The catch is that surging prices will also fuel inflationary pressures. It’s a tough spot for the ECB, which has to choose whether the priority is to protect growth or slay inflation.

Their solution is to kill two birds with one stone. Since the Eurozone is a net-importer of energy, a falling euro makes power more expensive, exacerbating the problem. By signaling that they will raise rates with brute force, policymakers are trying to stop the bleeding in the euro, which would help cool inflation and prop up growth.

It’s not a perfect solution but it’s something. Allowing the euro to depreciate any further would be catastrophic, so the ECB has to act boldly and defend the currency. Accordingly, markets have priced in around a 80% chance for a three-quarter-point rate increase on Thursday.

Since it is not fully priced in, such a move coupled with some hawkish commentary could boost the euro, triggering a short squeeze rally now that European natural gas prices have also started to cool down. That said, even if euro/dollar rallies all the way up to 1.0370, the downtrend would still be in force.

Bank of Canada and OPEC

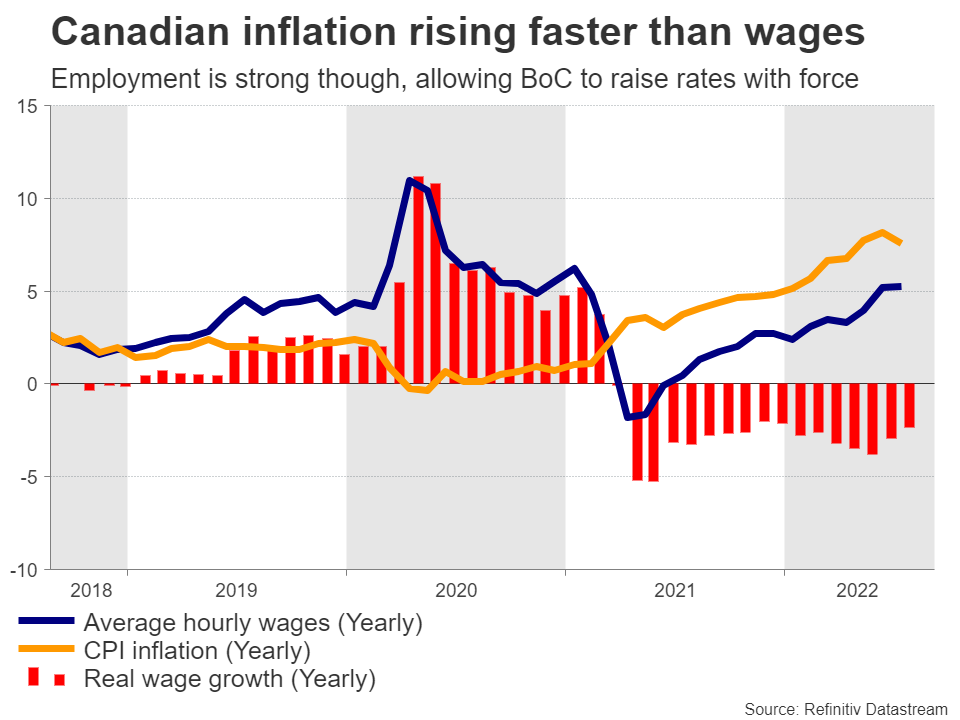

Over in Canada, the central bank is widely expected to raise rates by another three-quarters of a percent on Wednesday, something that markets currently assign an 85% probability to.

Faced with a labor market that is essentially at full employment, rampant inflation, and solid growth thanks to oil prices being so elevated, the BoC has been tightening policy at the speed of light. This hike would bring rates to 3.25%, entering restrictive territory.

Consequently, the loonie is the second-best performing major currency this year, lagging behind only the almighty US dollar, even despite its sensitivity to volatile stock markets. That said, the risks surrounding the loonie from this meeting seem tilted to the downside.

Having lifted rates into restrictive territory, the BoC could follow in the footsteps of other major central banks and signal that its future moves will depend entirely on incoming data, refusing to pre-commit to any further action. Similar to the Fed, markets might view that as a soft pivot.

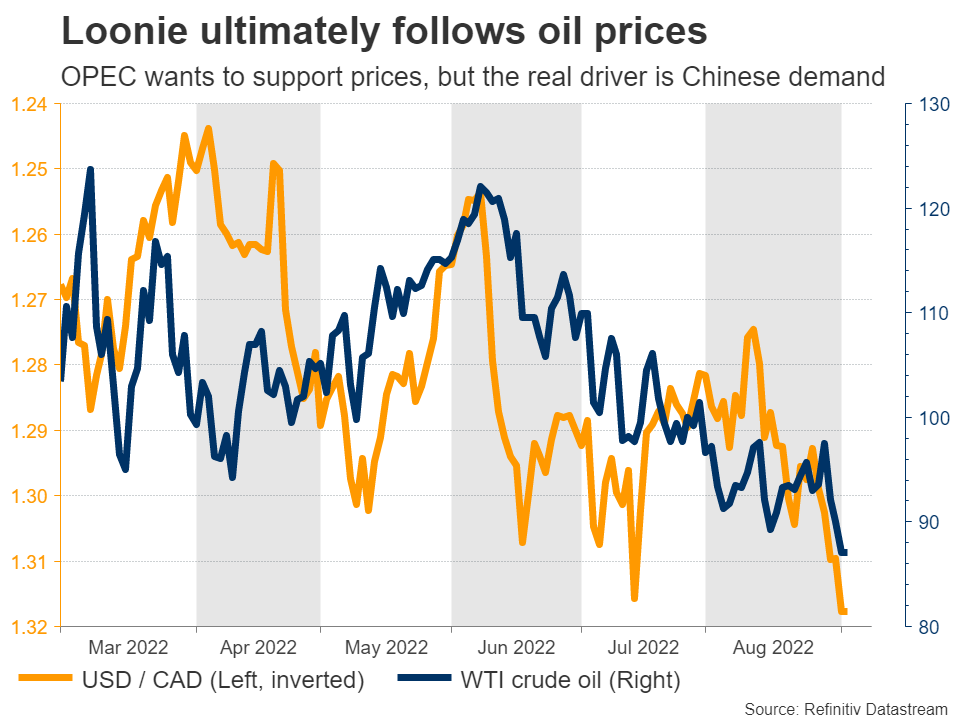

Heading into this decision, the loonie will also pay close attention to the OPEC meeting on Monday. The cartel has floated the idea of production cuts to offset the impact of any new barrels from Iran, in case a nuclear deal is reached. However, the market quickly shrugged that off and oil prices reversed lower.

OPEC is already producing far below its quota, so reducing that target might mean little in reality. Instead, the real driver of oil prices will be the demand side of the equation, with China tightening its covid restrictions again.

The week will wrap up with the latest employment report from Canada, out on Friday.

RBA set to lift aussie

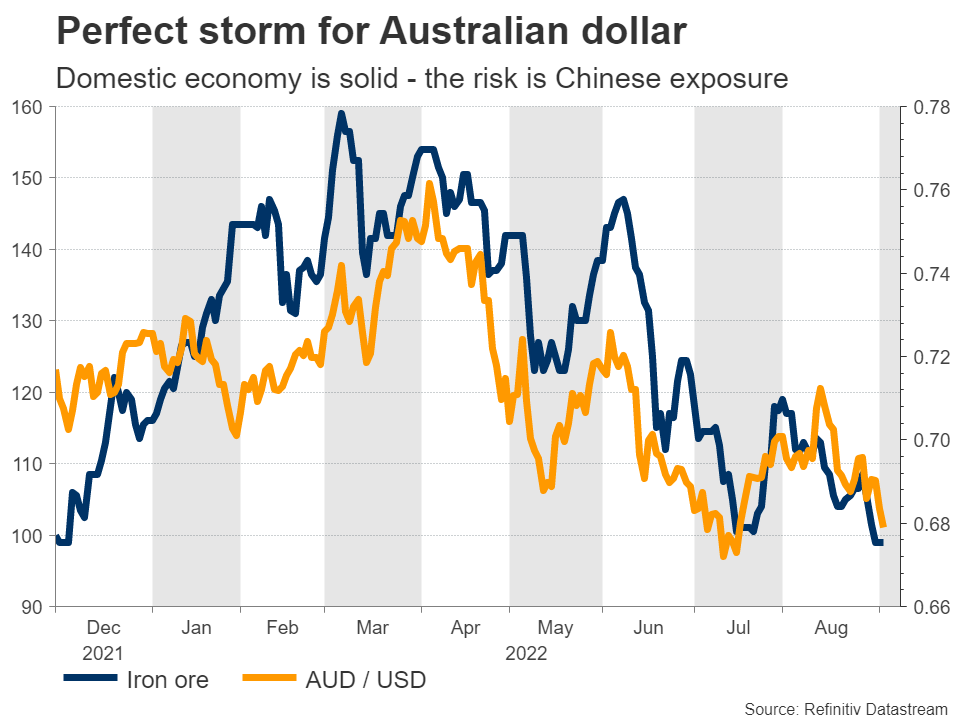

Crossing into Australia, the Reserve Bank will conclude its own meeting early on Tuesday. Market participants are leaning towards a half-point rate increase, pricing in almost a 60% probability for such action versus 40% for a smaller, quarter-point move.

From a domestic perspective, there’s no real reason for the RBA to play it cautious. The nation’s unemployment rate is at a record low, consumption is solid, and inflation is firing up. As such, a half-point move seems like the optimal choice, which in turn could boost the Australian dollar.

The elephant in the room is China. Australia’s entire economic model relies on China to absorb its commodity exports. With the Chinese property sector in freefall, demand for raw materials is rolling over, which will inevitably impact Australian growth. This risk is hanging over the aussie like a sword, so the overall outlook for the currency seems negative, even if it pops higher after the RBA decision.

On the data front, Australia’s GDP stats for Q2 will be released on Wednesday alongside China’s latest trade numbers. Then on Friday, China’s inflation prints for August will hit the markets.

UK leadership contest

In the United Kingdom, the new leader of the Conservative party and by extension the new prime minister will be announced on Monday. Betting sites suggest foreign secretary Liz Truss is a 10-1 favorite over former chancellor Rishi Sunak, so it seems like a foregone conclusion.

She has vowed to eliminate a planned increase in corporate taxes that would have taken effect next year and reverse a recent increase in national insurance, both of which would add fuel to inflation, putting more pressure on the Bank of England to raise rates.

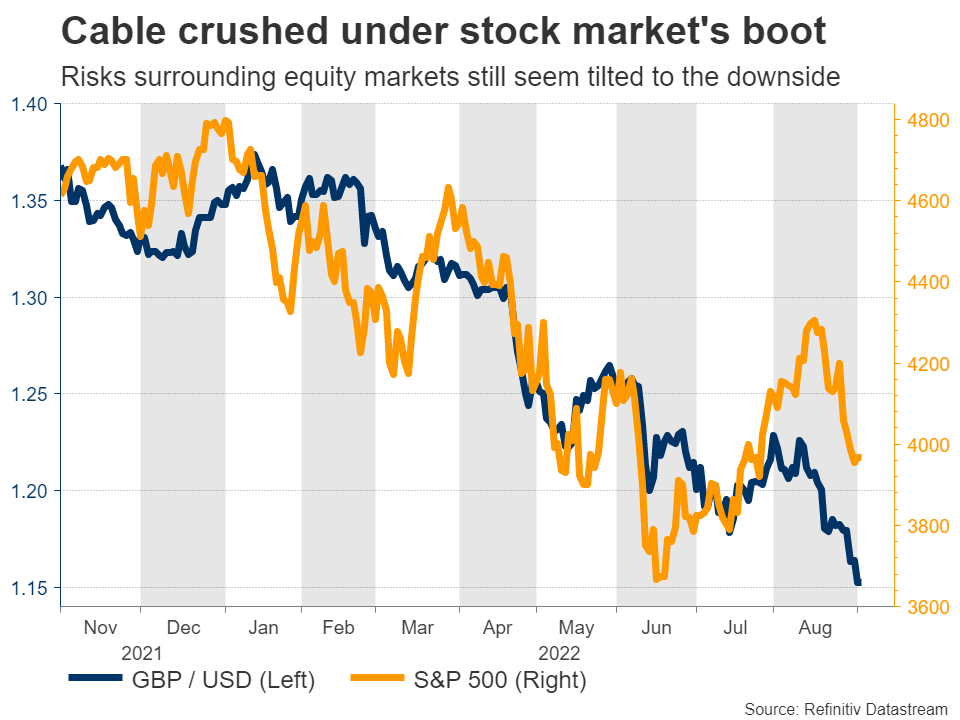

But that might not be enough to rescue the pound, which has been crushed under the boot of a falling stock market. With the Fed committed to keeping rates high until inflation is squashed, the quantitative tightening process doubling in speed this week, and earnings growth already struggling to outpace inflation, there might be more pain on the menu for equities.

Finally in America, Monday is a public holiday, which means US markets will remain closed. The ISM services index for August will follow on Tuesday.