- Central bank decisions in Eurozone and Canada coming up

- But FX traders will likely focus more on the US GDP report

- Is the dollar set to realign with its superior fundamentals?

Dollar turns to GDP stats for fuel

The US economic machine continues to fire on all cylinders. Shielded by the government’s enormous deficit spending and the slow transmission of high interest rates because of fixed-rate mortgages, the United States has defied expectations of an economic slowdown and instead enjoyed a stellar performance this year.

Beyond the Biden administration’s heavy spending, a historically tight labor market has also helped support household incomes, keeping consumption on a solid footing. Overall, it appears that the US economy reaccelerated over the summer, something the upcoming GDP numbers will probably confirm on Thursday.

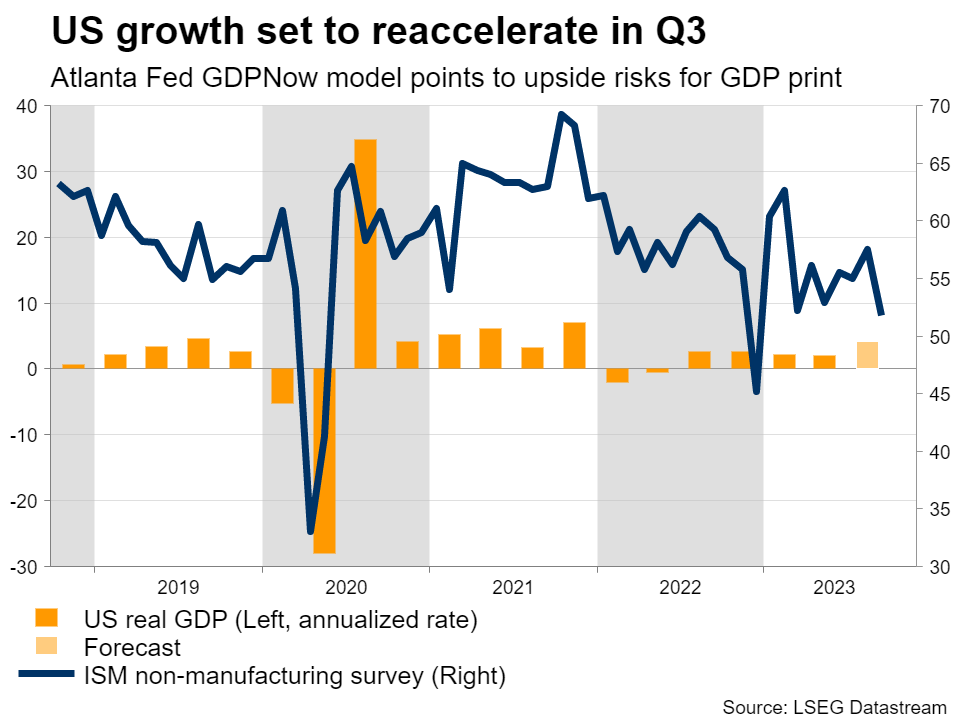

Economic growth is projected to have reached an annualized pace of 4.1% in the third quarter, almost double the 2.1% in the previous quarter. While this would be impressive in itself, there is even some scope for an upside surprise.

The Atlanta Fed has a model that estimates GDP in real time, and it currently points to growth of 5.4% during the quarter, much higher than official forecasts. This model has an accurate track record, so if anything, a positive GDP surprise seems more likely than a disappointment.

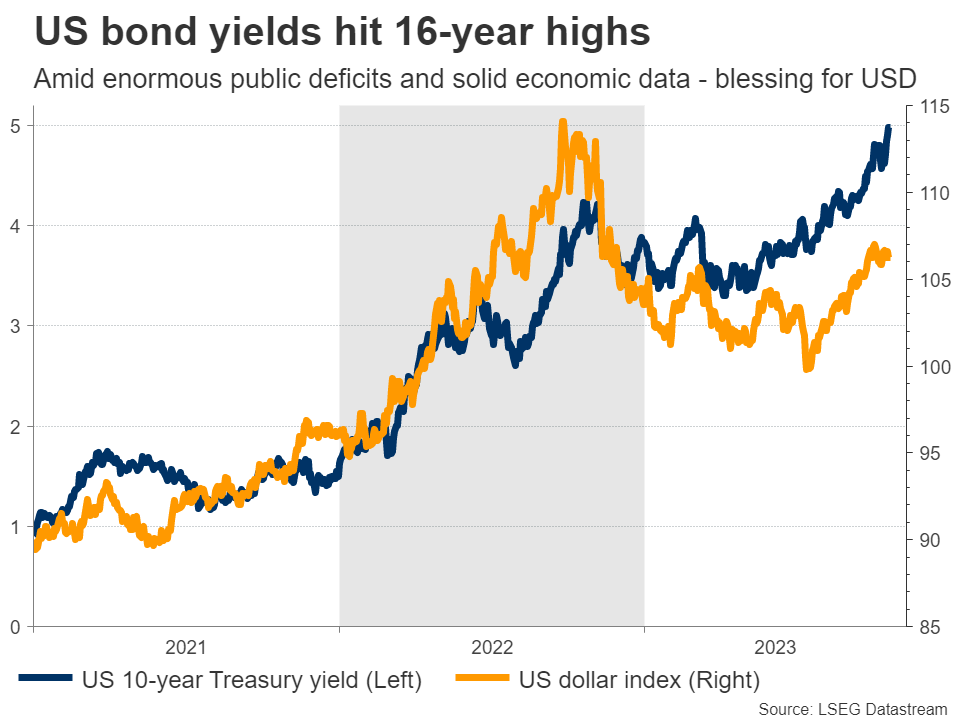

A stronger-than-expected GDP print could help the US dollar to resume its rally. The dollar’s uptrend has been fueled by a combination of solid economic fundamentals, the stunning rise in US yields, and the absence of any viable alternatives in the FX space. These factors are still in play, therefore, the outlook for the dollar remains bright.

Boasting the strongest economic growth among the G10 nations and the highest real interest rates, the dollar has turned into an attractive investment destination. In contrast, Europe and China are battling a severe economic slowdown, while the yen has been crushed by the Bank of Japan’s refusal to raise rates.

Of course, there are some risks on the horizon. Consumer savings from the pandemic have started to run out and US student debt repayments have resumed, which could dampen growth next year. But even accounting for these risks, the dollar still appears better positioned than its FX competitors, especially when adding its safe haven qualities into the calculation.

Aside from Thursday’s GDP report, there are several other US releases that could impact markets next week, including the S&P Global business surveys on Tuesday and the core PCE price index on Friday.

ECB meeting could be quiet

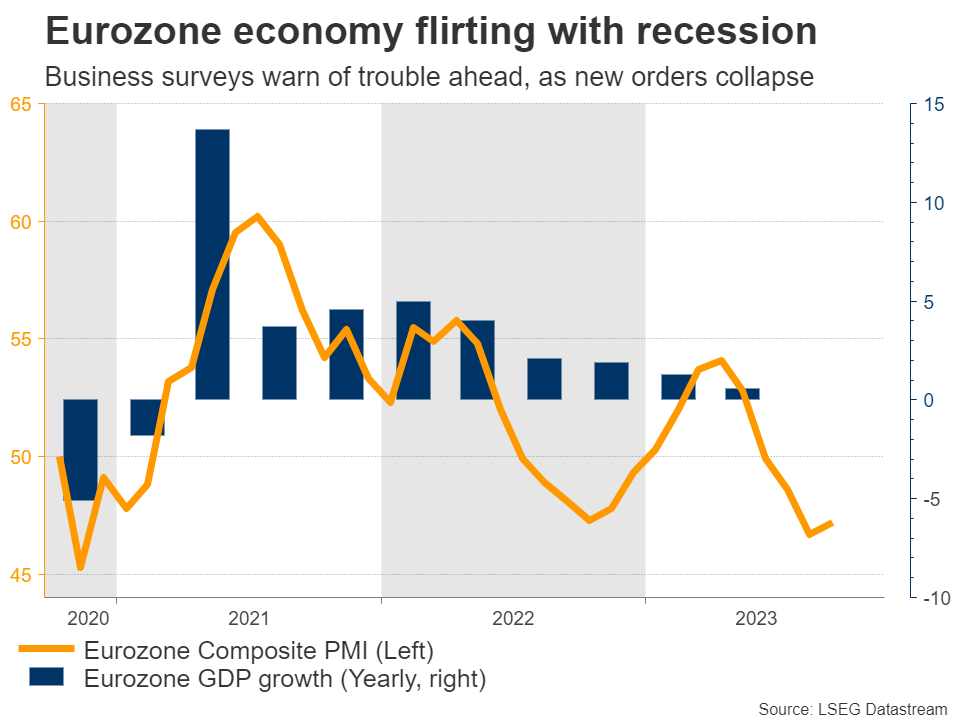

Crossing into the Eurozone, the central bank will announce its decision on Thursday. Markets are pricing in almost no chance of a rate increase, after the ECB signaled that rates have likely reached their peak for this cycle.

Incoming data releases point to an economy headed downhill, justifying this cautious approach. New business orders are falling at the fastest pace in three years, which is an ominous sign for economic activity. Meanwhile, consumers are being squeezed by rising mortgage costs and the resurgence in oil prices.

Hence, even though inflation is still elevated, the ECB is highly unlikely to raise rates again, as storm clouds of a recession are gathering. In fact, the key question now is how long it will take before the ECB begins to cut rates.

All told, this meeting might be a quiet event. With no scope for action, the focus will be on forward guidance. That said, policymakers probably won’t provide any concrete signals while the outlook is so uncertain. President Lagarde may strike a neutral tone, indicating that rates could remain at current levels for some time.

Instead, the latest business surveys on Tuesday might prove more important in shaping rate-cut bets and by extension for driving the euro. These PMI surveys are considered leading indicators, so if they continue to flash warning signs about a worsening economic slowdown, that could spell more trouble for the bruised euro.

Business surveys for October will also be released in the UK on Tuesday, alongside the latest batch of employment data. The British labor market lost jobs in the summer and a continuation of this trend could hammer the pound, as it would raise the risk of recession.

BoC to remain sidelined

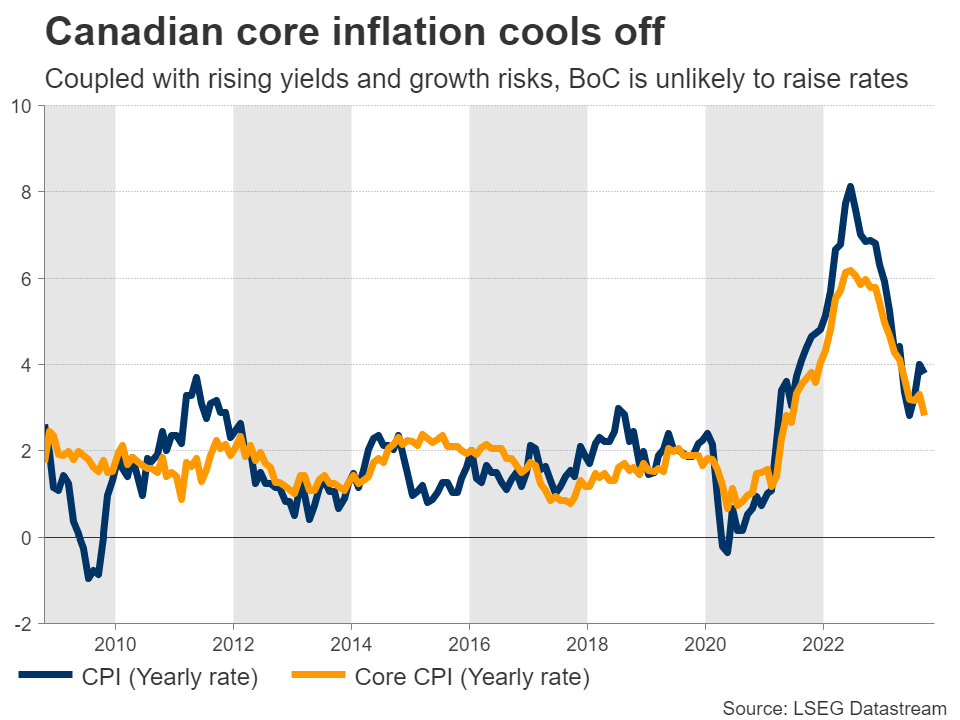

On Wednesday, the Bank of Canada will unveil its own decision and markets assign only a 15% probability to a rate increase. Inflation continues to cool, with the core CPI rate falling to 2.8% in September. Coupled with the steady rise in Canadian yields lately, which has similar effects to raising rates, this puts less pressure on the central bank to act again.

Reinforcing this notion are the gloomy signals from the BoC’s quarterly business survey. Canadian firms reported escalating concerns about weaker demand and noted fading pressure on wages, a combination that points to slower growth and colder inflation readings ahead.

Therefore, the BoC might disappoint those betting on an immediate rate increase next week, which argues for a negative reaction in the Canadian dollar. That said, the currency’s broader path will also depend on several other factors, such as the unfolding crisis in the Middle East and its implications for oil prices.

Finally on the data front, the quarterly inflation report from Australia will be released Wednesday, while in Japan, the latest Tokyo inflation prints are out on Friday.