ECB meets as stagflation fears grow

There can be little doubt that the war in Ukraine has thrown a spanner in the works for central bankers’ plans to tighten monetary policy in their fight against decades-high inflation. But the ECB is possibly facing the biggest dilemma out of all central banks as the economic pain in the euro area will doubtlessly be the most acute given its proximity to sanction-hit Russia.

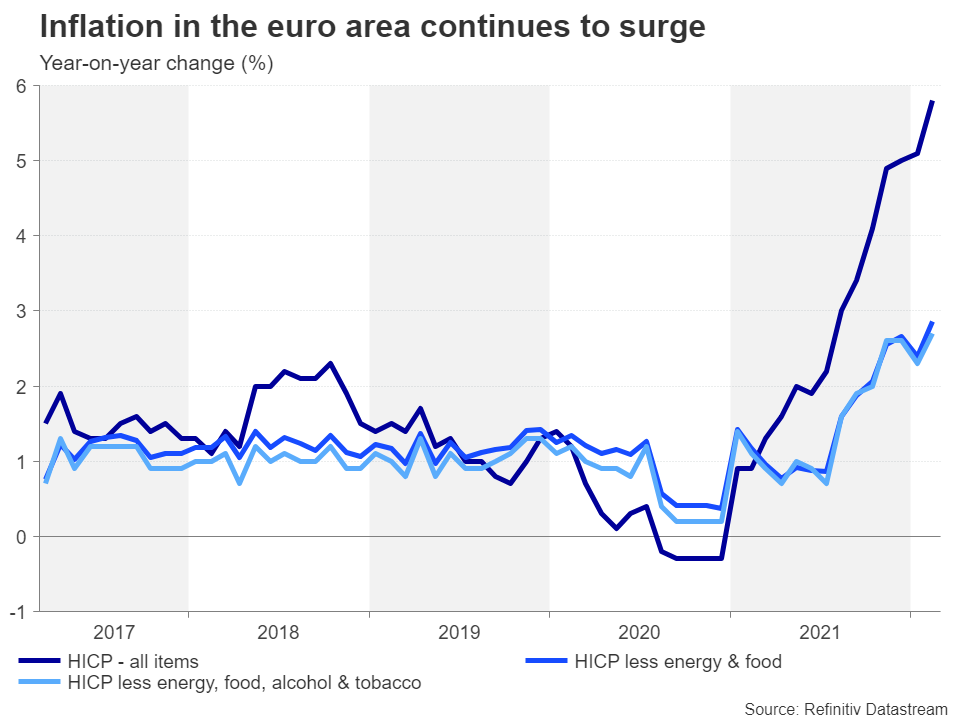

The crisis couldn’t have come at a worse time for policymakers as inflation is soaring in the Eurozone. The bloc’s harmonized CPI index jumped to a new all-time peak of 5.8% year-on-year in February and further increases are almost certain now that energy prices are scaling fresh highs. The ECB is anticipated to revise up its inflation forecasts when it meets on Thursday. At the same time, however, the latest growth projections will probably incorporate the potential hit from the Ukraine conflict so this should provide a strong enough case for the doves to argue for a patient response to the inflation shock.

Nevertheless, the ECB will need to be seen to be taking some steps to stem the surge in price pressures and will likely signal the end of asset purchases either in Q3 or Q4. The latter would be the dovish outcome and could worsen the euro’s woes as it would imply that rates won’t start to go up until early 2023.

On the data front, the revised estimate of Q4 GDP on Thursday and German industrial orders and production on Monday and Tuesday, respectively, will be the only notable releases.

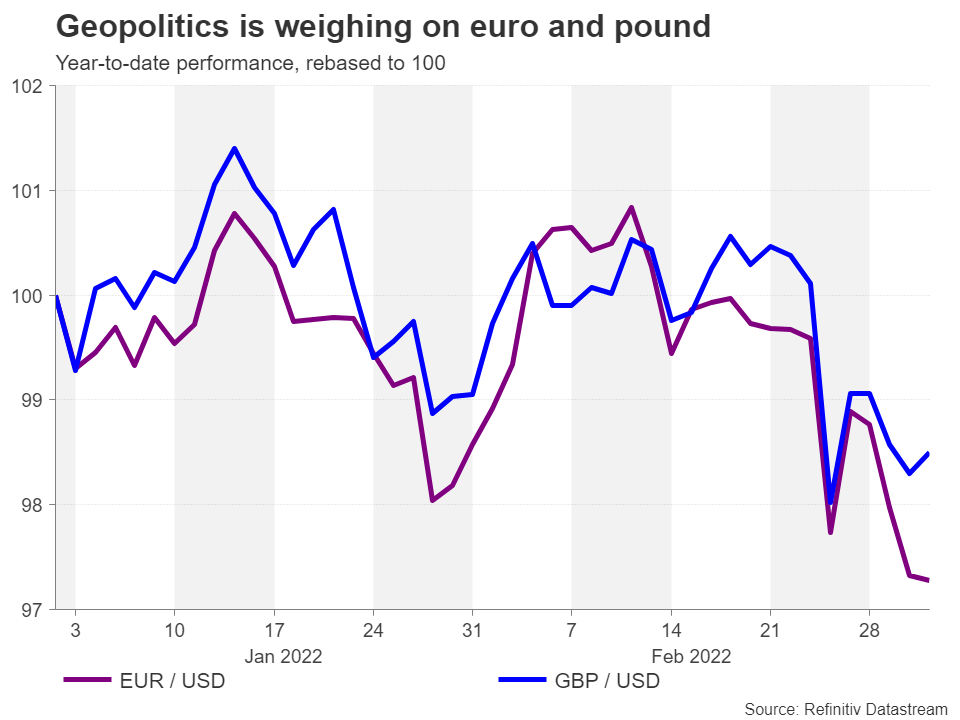

Bruised pound might shrug off UK data barrage

Another currency that’s taken a tumble from the geopolitical uncertainties is the British pound. Like the Eurozone, UK growth will be negatively affected from the war as Western sanctions on Russia are compounding the energy crisis. Although this magnifies the risk to higher inflation, some market participants are betting that the subsequent weaker growth from the squeeze on consumers will soon drain the excess demand out of the economy, reducing the upwards pressure on prices.

Accordingly, investors have priced out about one 25-bps rate hike for the Bank of England, pushing the pound lower.

Next week, the key monthly readings on GDP, industrial and manufacturing output, and the trade balance for January due Friday are unlikely to spur much reaction as the BoE has already indicated that a rate hike is on the cards at its next policy decision. In addition, there will be no updated economic forecasts at the March meeting so investors will have to wait a bit longer to get a clearer idea of how big an impact Russia’s invasion of Ukraine will have on growth, and ultimately, on the BoE policy path.

Spiralling US CPI to set sights on 8% mark

The inflation story will not be escaping the limelight at all next week as the US CPI report for February is due on Thursday. The headline CPI print is expected to inch higher to 7.8% y/y to yet another fresh 40-year high. Core CPI is also forecast to keep climbing, rising from 6.0% to 6.4% y/y.

While it’s quite possible that the trend of positive CPI shocks will not end with the February data, the speculation of whether there will be a 25 or 50 bps rate increase has already been resolved courtesy of Fed Chair Powell in remarks he made at his Congressional hearing. So the markets’ response to any surprises will likely be limited, unless it’s a negative one.

Thus, safe-haven flows look set to remain in the driving seat for the US dollar as the Ukraine fallout continues to weigh on riskier assets.

In other US data, the JOLTS job openings on Wednesday and the University of Michigan’s preliminary reading of consumer sentiment on Friday will also be watched.

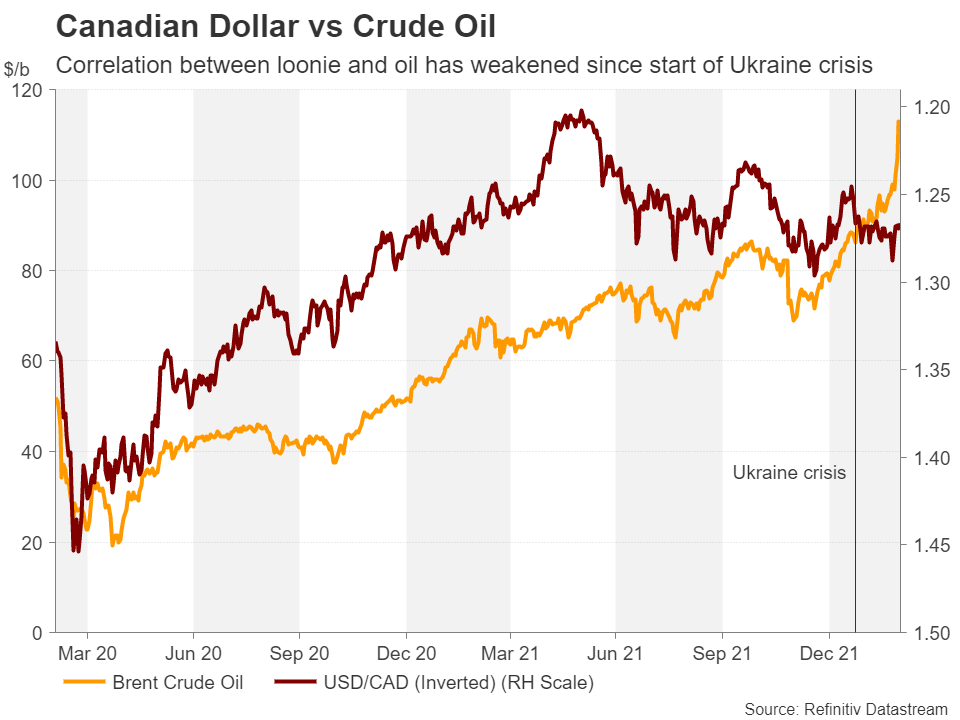

Loonie hoping for employment boost

North of the border, the Canadian dollar has been having somewhat of a tougher time since the onset of the troubles in Ukraine despite the massive rally in oil prices. Investors had been worried that the Bank of Canada would turn more cautious but that changed after policymakers proceeded with the first post-pandemic rate hike on Wednesday and signalled that more are on the way.

The loonie has since risen to one-month highs against its US counterpart, restoring its positive correlation with oil prices.

There could be a further boost in store next Friday from the February employment report. Canada’s economy shed 200k jobs in January amid fresh virus curbs brought on by the Omicron wave. A strong bounce back in February could aid the loonie to extend the past week’s gains.