One big trade

Ever since the Russian invasion, financial markets have turned into one massive war trade. Most assets are being driven entirely by this theme, rising and falling with war headlines. Stock markets, the British pound, and the euro suffer whenever sanctions escalate, while the US dollar, the yen, and commodities tend to benefit.

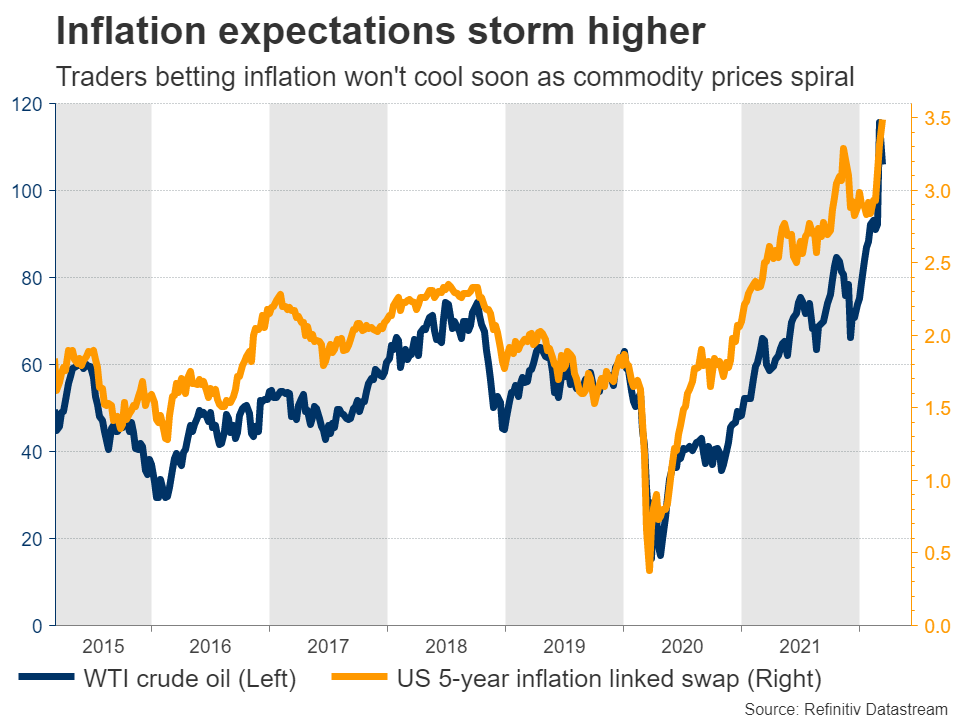

In the commodity sphere, the crippling sanctions on Moscow will limit the supply of various metals, food, and energy products. This translates into higher raw material prices, so traders are betting inflation won’t cool anytime soon. Market-based measures of inflation expectations have stormed higher, creating a headache for central bankers.

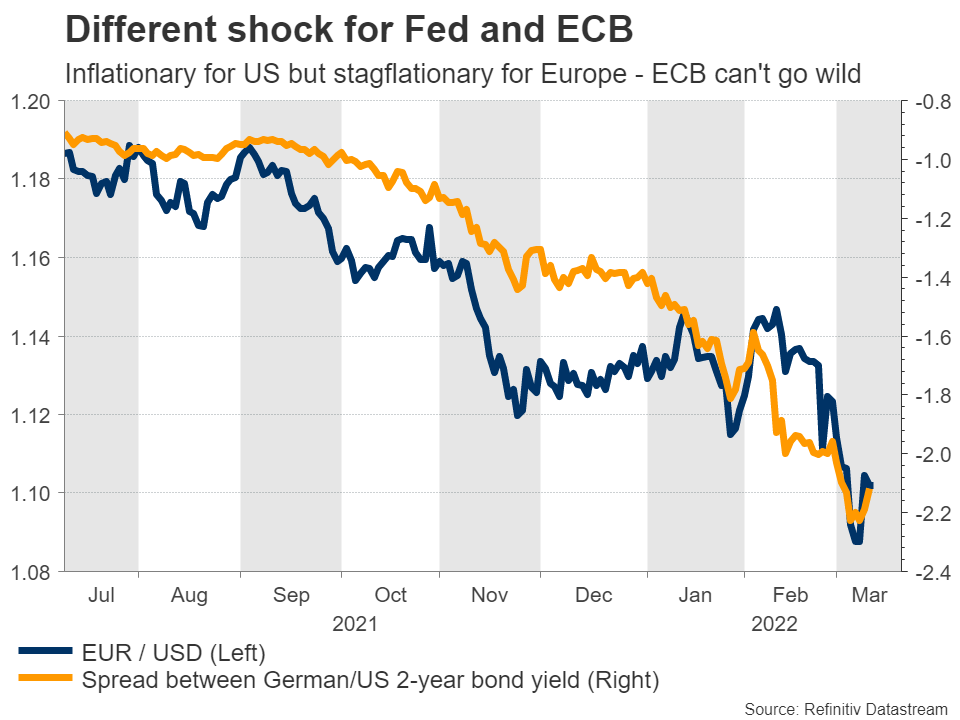

But it’s a very different headache for different central banks. For the Fed, this is only an inflationary shock. America is energy independent and its banks have almost no exposure to collapsing Russian assets, so this won’t derail the economy. But for Europe, it’s a stagflationary shock. Consumers will get squeezed by higher living costs and the banking sector will take a serious hit, which could be a nightmare for growth.

This means that while the Fed can respond with powerful rate increases to fight inflation, the ECB doesn’t really have that luxury as tightening into a slowing economy would raise the risk of a recession to uncomfortable levels. In other words, this war has changed the game for relative Fed/ECB policy, something also reflected by the demolition in euro/dollar.

Moving forward, how the war unfolds will be the most important element. Markets seem priced for a worst-case scenario at this point, which implies that a ceasefire could spark serious reversals in the ‘Ukraine trade’. This may be only a matter of time as President Zelensky seems willing to compromise, for instance by keeping Ukraine out of NATO.

Fed - all about the dots

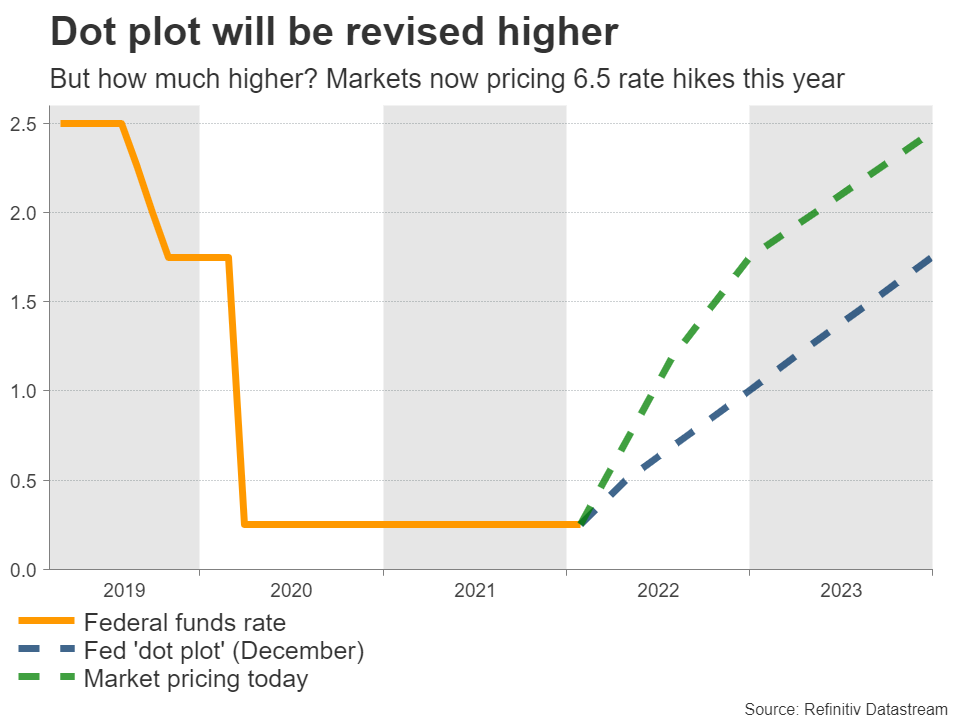

The main event will be the Fed meeting on Wednesday. A quarter-point rate increase is fully priced in, so the market reaction will depend mainly on what Chairman Powell says during his press conference and the interest rate projections in the updated ‘dot plot’.

The latest dots in December pointed to only three rate increases for this year but market pricing currently implies six and a half. Hence, it’s a safe bet the dots will be revised higher - the question is exactly how much higher. Will the officials signal four, five, or six hikes?

There’s a solid argument it might be six, which would probably be the most bullish outcome for the dollar. The labor market is tight, wages are firing up, consumption is solid, and inflation is scorching hot. The latest CPI print clocked in at 7.9% in yearly terms and considering the latest spike in energy prices, the next one could be even hotter.

Another argument is that the Fed wants a stronger dollar at this stage. A stronger currency can help cool inflationary forces faster, without the need to tighten too much. In this sense, talk is both cheap and advantageous. This also provides Chairman Powell with an incentive to strike a more hawkish tone.

On the data front, the latest edition of retail sales will be released a few hours ahead of the FOMC decision.

BoE - rolling out the big guns?

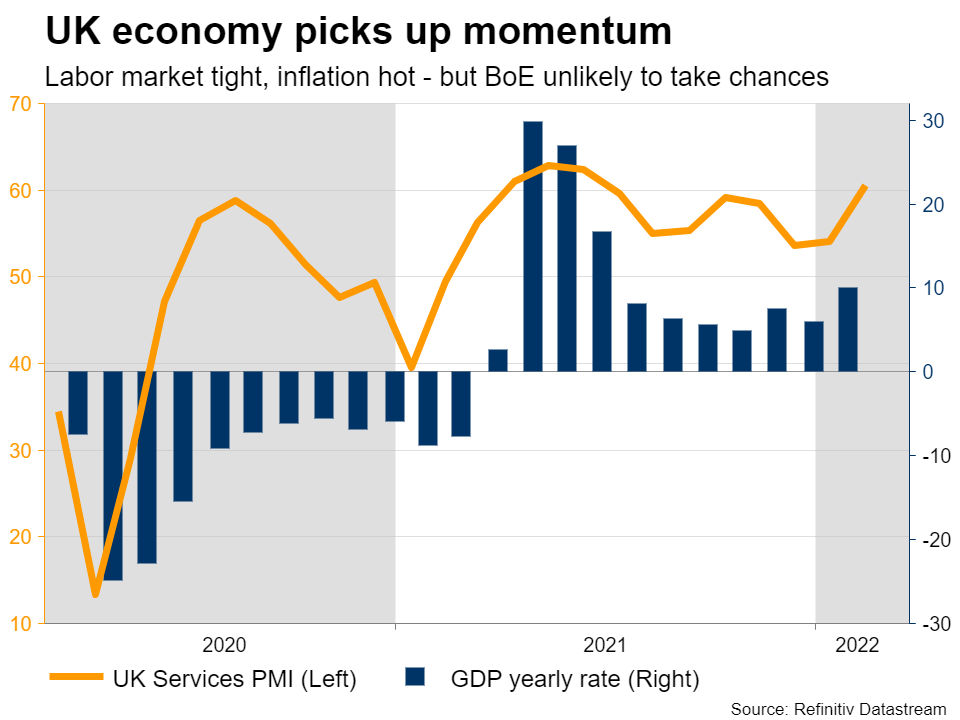

The Bank of England will conclude its own meeting on Thursday. With the labor market firing on all cylinders, inflationary pressures heating up, and the latest business surveys pointing to an acceleration in growth, investors are convinced another rate increase is on the menu.

A regular 25 basis points (bps) rate hike is already priced in and money markets imply a 15% probability for a 50 bps move. This begs the question - how aggressive does the BoE want to be?

The pound has been devastated by the Ukraine crisis and the BoE is unlikely to change this dynamic, unless it surprises markets with a ‘double’ rate hike. However, that’s highly unlikely. Raising rates with reckless abandon doesn’t make sense from a risk management perspective when the economy is already headed for a slowdown.

Overall, markets seem to have gotten too aggressive with BoE hikes. A total of 100bps is priced in by June. There are only 3 meetings until then, which means traders have already priced in a ‘double’ hike over the next few months. This leaves scope for disappointment if the BoE hesitates to roll out the big guns. For sterling to enjoy a relief rally, a truce in Ukraine is needed.

BoJ unlikely to join the party

The Bank of Japan will also meet on Friday, but don’t expect much. The world’s third-largest economy has barely escaped deflation, wages aren’t rising, and consumers will get squeezed considering the nation’s reliance on energy imports.

Hence, while the BoJ wants to signal an exit from decades of easy money policies, it is difficult to do so with inflationary dynamics still muted. The next step in the normalization process would be to widen the range in which Japanese yields are allowed to trade, essentially raising the ceiling for yields.

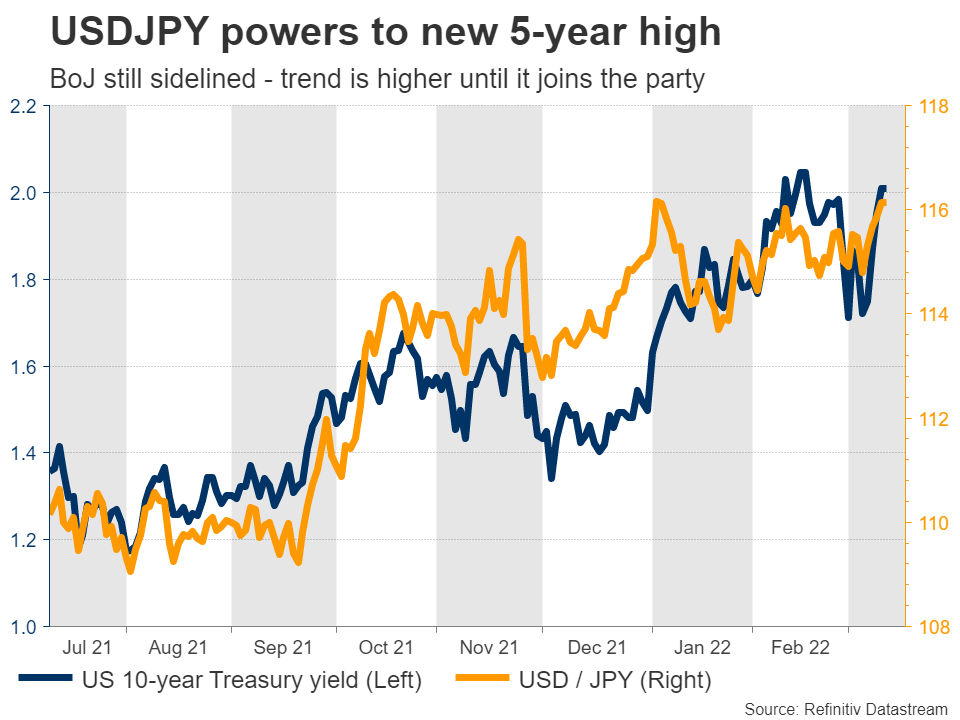

As for the yen, with the BoJ still sidelined, its fate is linked to risk sentiment. However, the dollar - which also benefits from haven flows - may be an exception. Dollar/yen has skyrocketed as yield differentials widened lately and it’s difficult to see this trend turning around until the BoJ executes its own U-turn.

Commodity currencies in focus

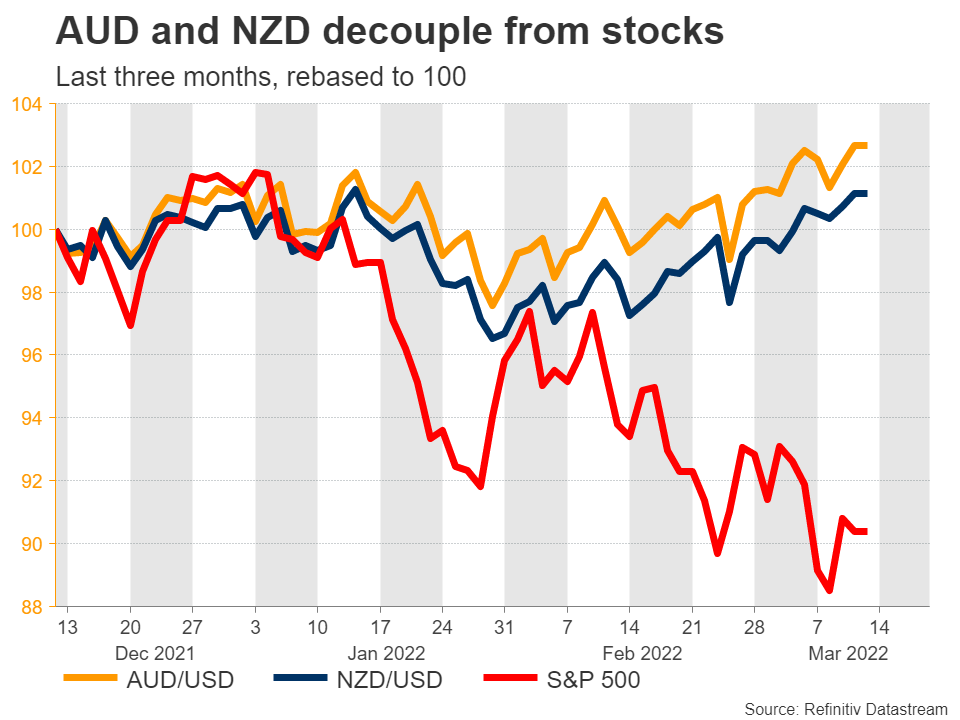

The Australian and New Zealand dollars typically trade in lockstep with risk appetite but this relationship has broken down lately, with both currencies defying the gloom in equity markets to focus on the relentless rally in commodity prices instead.

Next week will bring crucial releases from both economies. Australia’s latest jobs numbers are out early on Thursday, ahead of New Zealand’s GDP stats for Q4 later that day. There is also the monthly data barrage from China on Tuesday.

Finally in Canada, the latest inflation report will hit the markets on Wednesday ahead of retail sales on Friday. In contrast to its commodity currency cousins, the loonie has not managed to capitalize on the boom in commodities, which is a bad sign.

The stars have aligned lately with soaring oil prices, a strong domestic economy, and markets pricing in aggressive rate increases by the Bank of Canada. If the loonie couldn’t rally under these conditions, will it rally at all?