Fed to begin front-loading rate hikes

As the US dollar scales multi-year highs against its rivals, traders will have their hands full next week with a barrage of data accompanying the crucial FOMC meeting. The ISM manufacturing PMI will kick things off on Monday but is unlikely to be a threat to USD bulls as it’s forecast to edge up from 57.1 to 58.0 in April. March factory orders will follow on Tuesday and on Wednesday, the JOLTS job openings and ADP employment reports are due, along with the ISM non-manufacturing PMI. Like the manufacturing sector, the services part of the US economy is not expected to display any signs of slowdown just yet as the non-manufacturing PMI is projected to improve to 59.0.

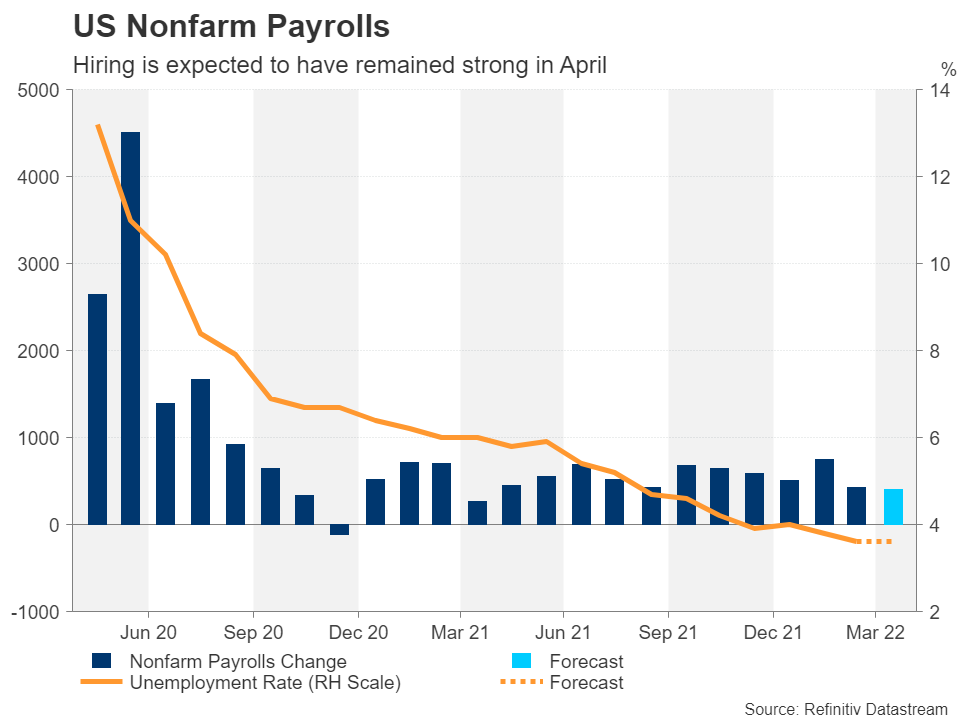

On Friday, the latest payrolls figures are not anticipated to cause any worries either. Nonfarm payrolls are expected to grow by a solid 400k in April, though the unemployment rate is predicted to hold steady at 3.6%. Average hourly earnings are forecast to rise by 0.4% month-on-month.

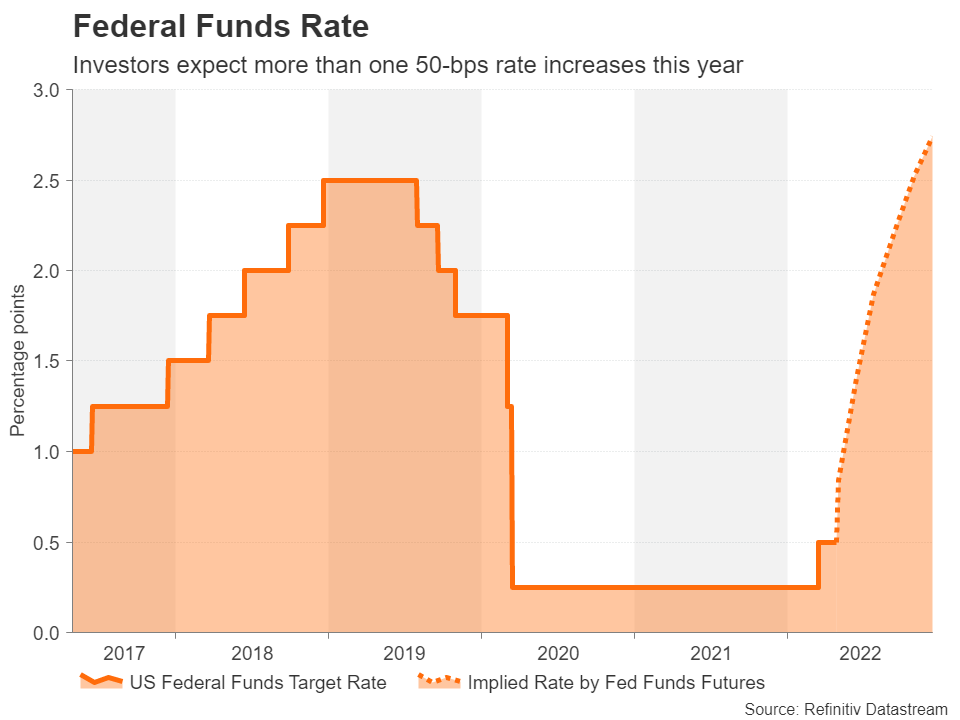

But the main spotlight will be on the Fed, which is almost certain to announce a 50-basis-point rate hike on Wednesday. The hefty move looks set to be the first of many in this cycle and Chair Powell has not been pushing back on the markets’ hawkish expectations.Powell will probably reinforce the view that the Fed needs to get to neutral rates “expeditiously”, but investors are also awaiting the decision on shrinking the balance sheet. The minutes of the last meeting flagged a $95 billion a month reduction plan and this will likely be confirmed on Wednesday.

If the Fed maintains its hawkish rhetoric and barring any shock weaknesses in the forthcoming data, the dollar is well placed to extend its bullish streak next week.

BoE to lift rates again, but will it accelerate QT?

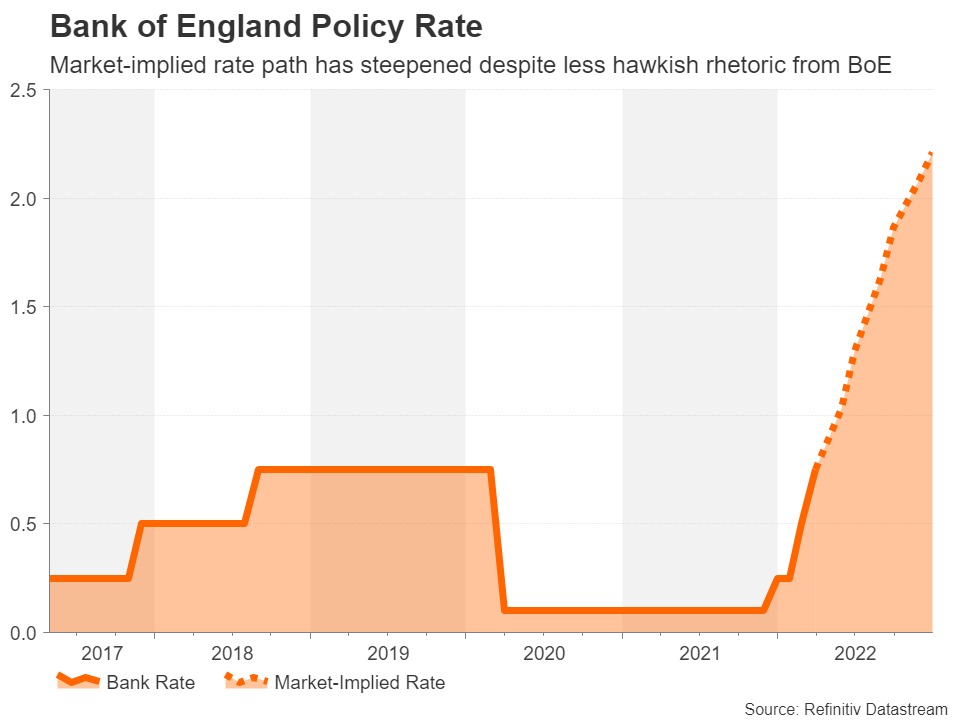

The Bank of England has become a lot less hawkish of late, as it frets about the impact of higher prices on consumer spending – the main driver of the British economy. The shift has been dramatic, with one MPC member even voting to keep rates on hold in March. Only in the previous meeting in February, the dissenting votes were by those opting to hike rates by a bigger 50 basis points.

Last meeting’s dissenter – Jon Cunliffe – is again expected to vote against a rate hike as the other eight members vote in favour for a 25-bps increase. This would push the Bank Rate up to 1% - the level set by the BoE for initiating the active sale of UK government bonds.

The BoE decided in February to stop reinvesting in maturing bonds but it’s unclear if policymakers are ready to speed things up by the outright sale of gilts. The recent deterioration in both the UK and global growth outlook has cast doubt on the need to tighten policy so aggressively. Moreover, Governor Andrew Bailey had previously signalled that the 1% threshold would not be an automatic trigger.

Thus, it’s possible the BoE will put off a decision to begin selling gilts for later in the year, potentially adding more pain to the beleaguered pound, which has slumped to near two-year lows against the dollar, as investors turn more pessimistic on the UK economy. However, sterling might find some support from potential upward revisions to the Bank’s inflation forecasts in its May Monetary Policy Report that will be published the same day.

Will the RBA take the plunge at May meeting?

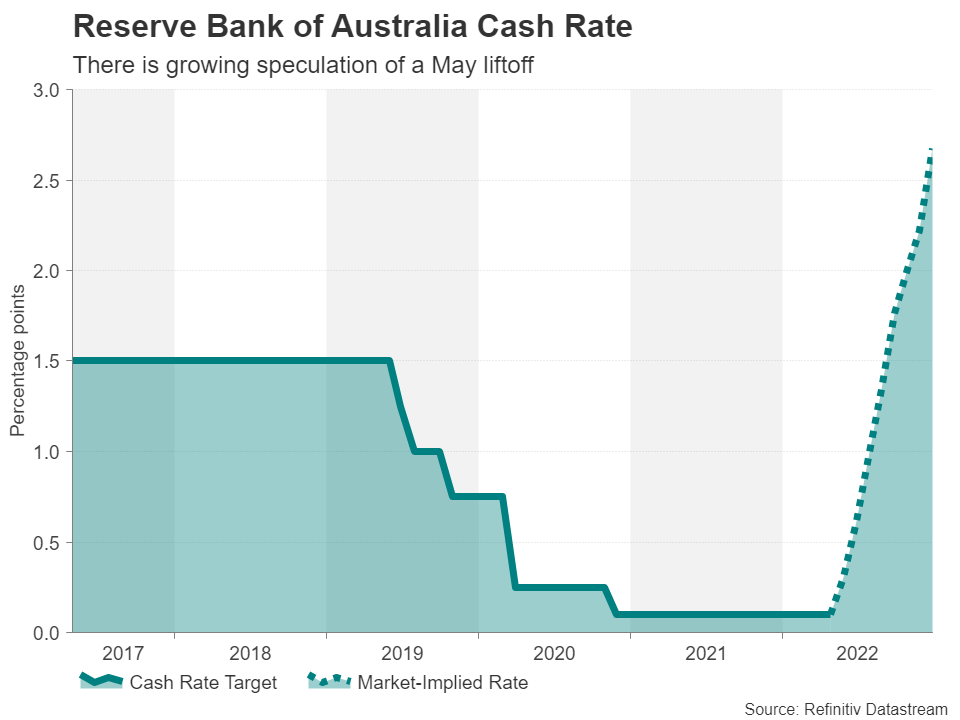

Inflation in Australia jumped to a hotter-than-expected 5.1% in the March quarter, sparking talk that the Reserve Bank of Australia will not delay a hike any further and raise the cash rate by 15 bps at the May meeting on Tuesday to contain price pressures.

The speculation has provided the Australian dollar with some support against the surging US currency, but the risks from the meeting are symmetric as a rate rise would surprise some, while no change would disappoint others. Australians go to the polls on May 21 to vote for a new government so lifting borrowing costs in May would be politically sensitive for the RBA.

In the bigger picture, however, the timing has only short-term implications for the aussie and the bigger question is whether the RBA will be able to hike as many times as futures markets have priced in for the whole of 2022. The quarterly Monetary Policy Statement on Friday might provide some clues on the pace of future tightening.

Up until recently, Australia’s growth outlook had not been severely dented by the Russia-Ukraine conflict. In fact, the broad-based rally in commodities had boosted its economic prospects. But things have changed after the latest lockdowns in China, as the longer they drag on, the more heavily they will weigh on demand for resources exports by Australia. This puts quite a bit of focus on China’s manufacturing PMIs for April that are due over the weekend.

Loonie and kiwi hoping for jobs boost

Both the Bank of Canada and Reserve Bank of New Zealand raised rates by 50 bps at their last meetings, but this was unable to put a floor under the local dollars versus their US counterpart. The US dollar’s reserve currency status as well as expectations that the American economy is better placed to withstand the economic turmoil generated by the Ukraine war has taken the shine off pretty much all the other majors.

Canada releases its employment report for April on Friday and another strong reading is probable as it’s too soon for any effect from either higher rates or the heightened geopolitical tensions to filter through.

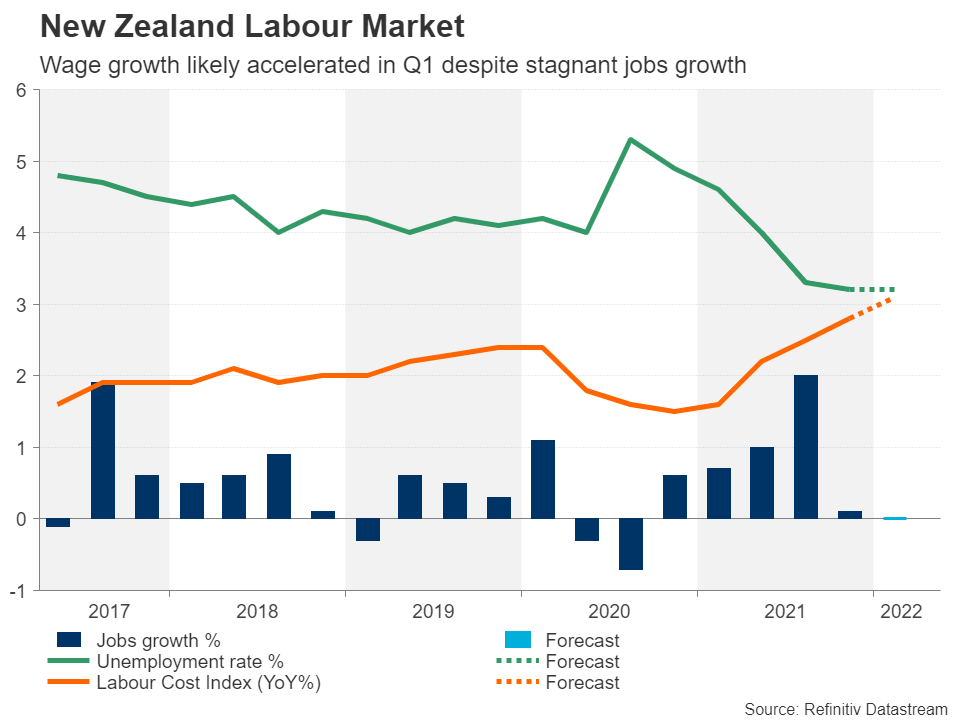

In New Zealand, the first quarter might have gotten off to a challenging start due to Omicron but the subsequent easing in virus restrictions means that the labour market overall likely remained tight during the period.

With both central banks flagging further hefty rate increases ahead on the back of soaring inflation, the jobs figures are not anticipated to materially alter the policy outlook, so unless there are any major surprises, such as stronger wage growth, the Canadian and New Zealand dollars’ best chance of a rebound is a pullback in the greenback.