- Central bank decisions in United States, United Kingdom, Japan, and Switzerland

- Fed almost certain to hit pause, markets will focus on updated rate projections

- More scope for surprises from Bank of England and Swiss National Bank instead

Fed - mind the dots

The central bank bonanza will kick off with the Fed on Wednesday. Markets are pricing in almost no chance of a rate increase, following several remarks from FOCM officials calling for patience and more time to examine incoming data before making their next move.

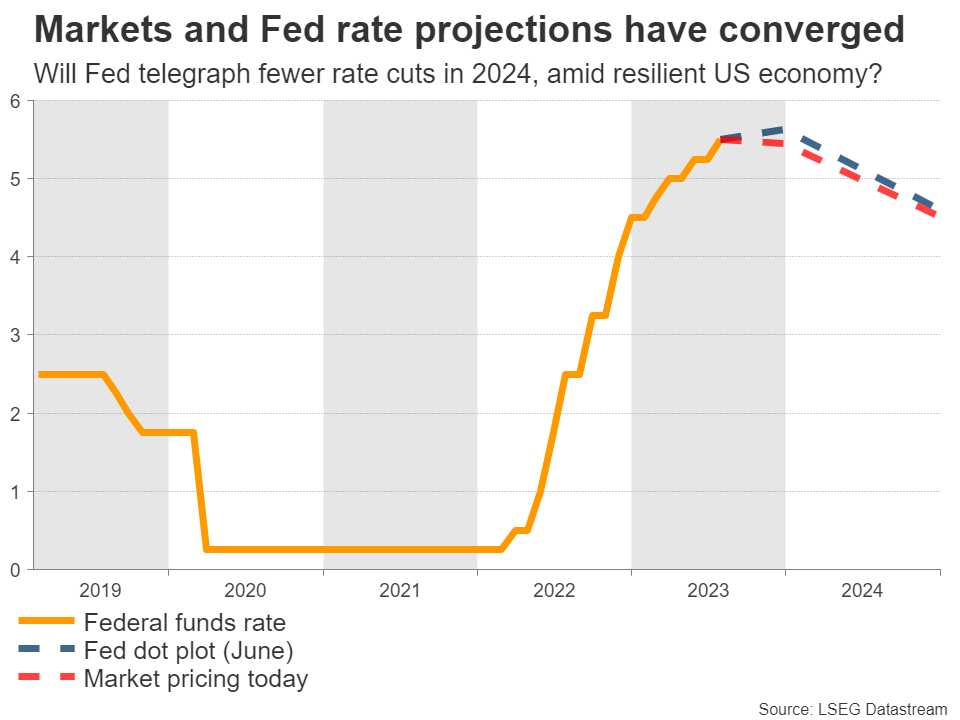

As such, the market action will most likely come from the updated economic forecasts and the interest rate projections in the new ‘dot plot’. Specifically, will the Fed continue to signal another rate increase this year and how many rate cuts will it telegraph for next year?

The latest projections showed interest rates closing next year at 4.6%, projecting roughly 100bps worth of rate cuts from the anticipated peak. But given the streak of robust economic data lately and signs the US economy is not cooling off, the risk is that policymakers signal fewer rate cuts this time.

Economic growth seems to have reaccelerated over the summer, with some help from resilient consumer spending and a labor market that’s beyond most estimates of full employment. With energy prices soaring as well, inflationary pressures are unlikely to die out. Therefore, this might be a meeting where the Fed cements the notion that rates will remain higher for a longer period of time, adding fuel to the rally in US yields and the dollar.

Overall, the outlook for the dollar seems bright as the reserve currency offers a unique combination of solid economic fundamentals, attractive interest rates, and safe haven qualities. That stands in contrast to the rest of the FX arena. Europe and China are plagued by a severe economic slowdown, the yen has been demolished by the Bank of Japan’s refusal to exit negative rates, and sterling is vulnerable to shifts in global risk sentiment.

BoE decision could be a close call

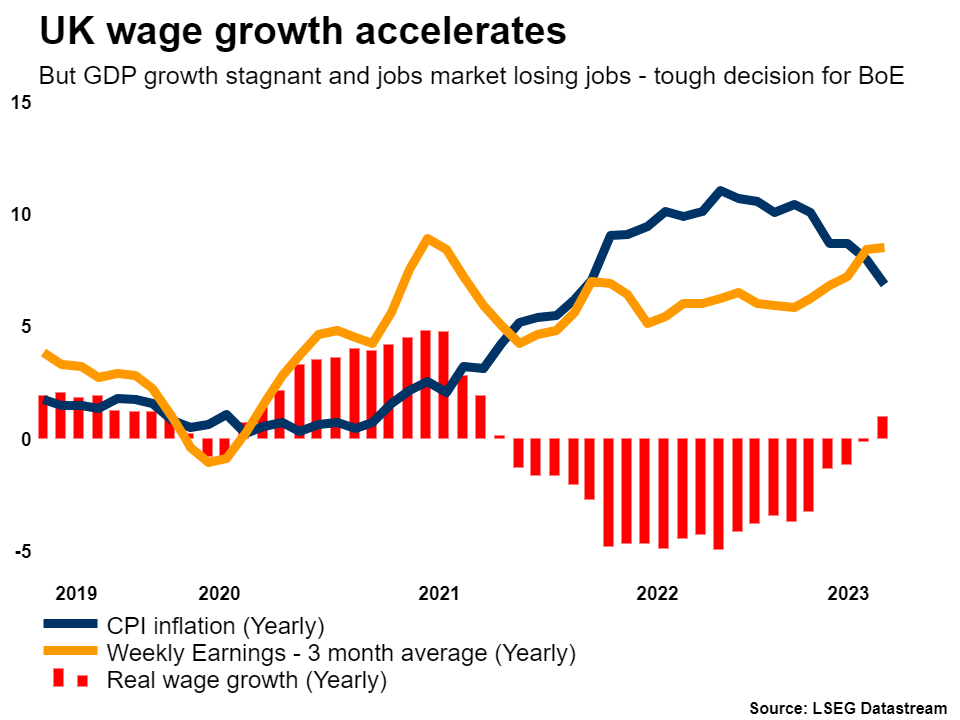

Over in the UK, the Bank of England will unveil its own decision on Thursday and traders assign a 70% probability to a rate increase. Recent data releases have been mixed, showcasing a sharp slowdown in growth and a weakening labor market. However, inflationary pressures remain hot, creating a dilemma for BoE officials.

Economic growth was stagnant in July from a year earlier, and business surveys point to a contraction ahead. Similarly, employment trends are moving in a negative direction. The labor market lost jobs in July, a phenomenon that will likely persist according to leading indicators.

And yet, wage growth accelerated in July, reaching 8.5% in annual terms. That’s a sign that inflation is unlikely to cool anytime soon, hence the dilemma for policymakers. Raising rates further would help bring inflation down, but it might also choke growth completely and push the economy into recession.

Therefore, the vote count for this decision will likely be split. Recent remarks from BoE officials suggest a rate increase is the more likely outcome, but it might be a closer call than markets expect.

As for sterling, the risks seem tilted to the downside. If the BoE raises rates the currency could initially spike higher, although any upside reaction might be minor as this is the market’s baseline scenario already, and reverse quickly if the vote is split and there’s no clear commitment to further hikes. And if the BoE doesn’t hike, that would be a huge surprise, pushing the pound lower instantly.

On the data front, the inflation stats for August will be released ahead of the BoE meeting on Wednesday, while the latest batch of business surveys is scheduled for Friday.

SNB and BoJ meetings

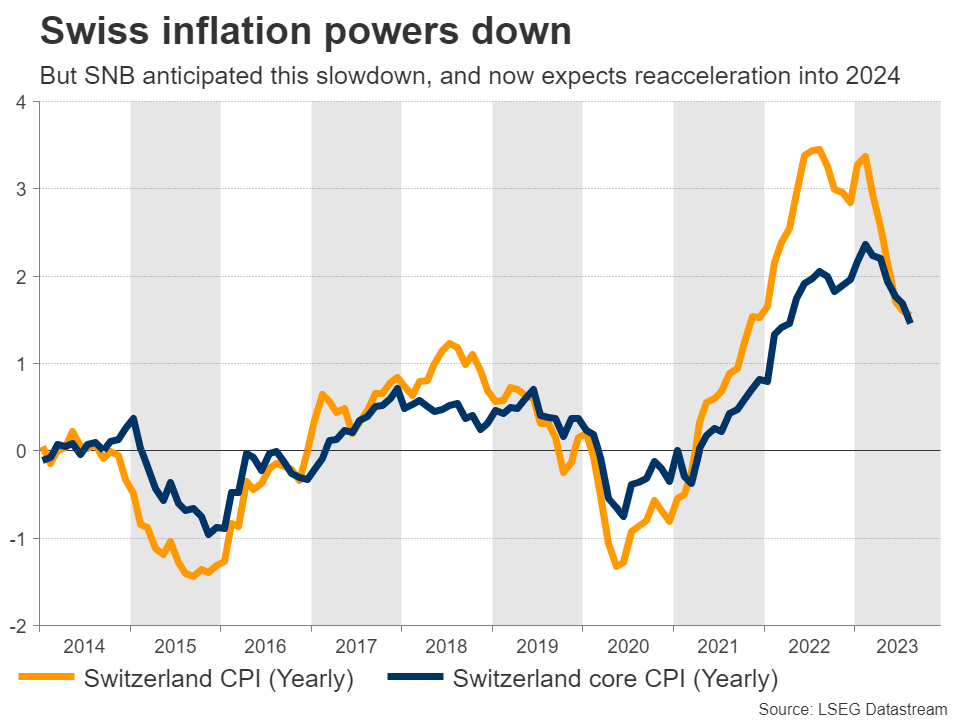

The Swiss franc is the best performing currency of 2023, with the British pound close behind. Driving this stellar performance was the Swiss National Bank’s exit from negative interest rates and FX interventions to strengthen the franc, alongside some quiet safety flows, courtesy of the darker growth outlook in the Eurozone.

SNB officials meet on Thursday and there’s a 60% probability they raise rates. Hence, there’s uncertainty on whether they will pull the trigger, as the Swiss economy has started to lose momentum and inflation was running at only 1.6% in August. Still, the central bank expects inflation to reaccelerate amid rising electricity and rent prices, and the recent spike in energy costs will likely reinforce their view.

Because of this inflation assessment, the SNB seems more likely to raise rates, potentially boosting the franc on the decision. That said, it might be the final rate increase of this cycle, as inflation is mostly under control.

Crossing into Japan, there isn’t much scope for any shifts when the central bank meets on Friday. The Bank of Japan already recalibrated policy back in July and will most likely take the sidelines this time while it monitors the effects of its previous actions.

But despite the BoJ’s tightening move, the yen has continued to lose ground, suffering at the hands of rising US yields and soaring energy prices. Dollar/yen is currently testing its highest levels of the year, and a combination of a slightly hawkish Fed alongside a BoJ that maintains its loose stance may be the catalyst for a break.

Finally, it’s a busy week in terms of data releases. The highlights will be the S&P Global PMIs for September, due on Friday. Markets will pay special attention to the Eurozone prints, amid signs the economy is slipping into recession. The latest batch of Canadian inflation stats on Tuesday and New Zealand’s GDP on Thursday will also be in focus.