Dollar awaits Fed update

It’s been a difficult few months for the US dollar. The world’s reserve currency lost a lot of ground as a persistent slowdown in inflation supported the notion that the Fed is about to end its tightening cycle. A winter ‘heat wave’ in Europe also played a role, by diminishing fears around the energy crisis and a harsh recession, boosting the euro.

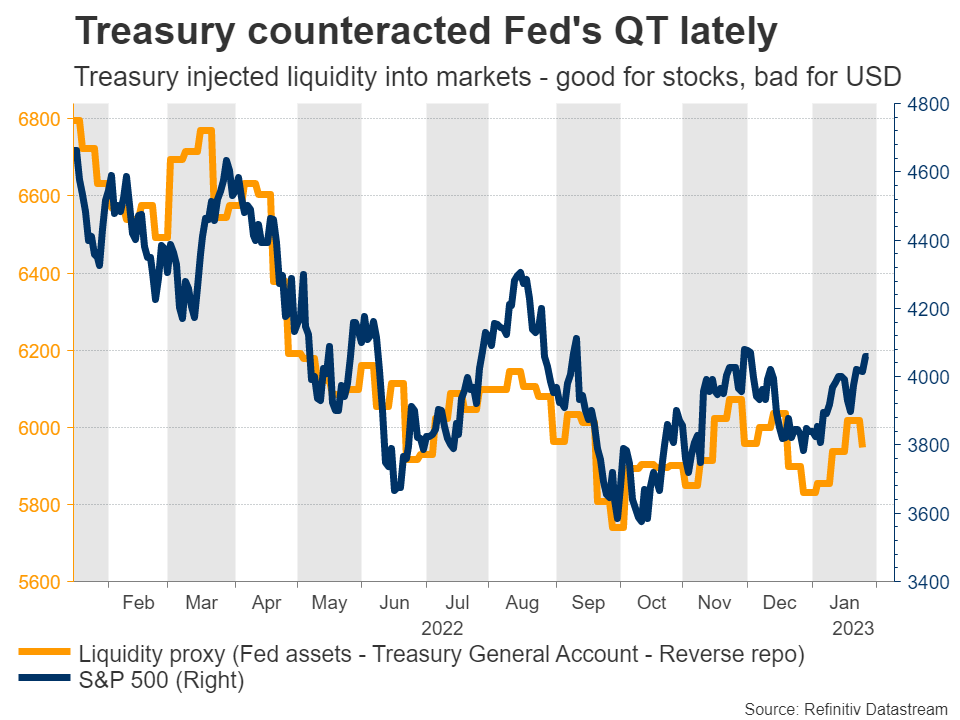

Another problem for the dollar is that the impact of the Fed’s quantitative tightening program has been negated by the US Treasury lately. Faced with another debt ceiling standoff, the Treasury has been using its cash buffer at the Fed, essentially injecting liquidity back into the markets. This dynamic enabled the rally in ‘meme stocks’ and other risky assets, but it is negative for the dollar.

Heading into the Fed decision on Wednesday, Chairman Powell and his colleagues will be faced with some mixed signals on the economy. Inflationary pressures finally seem to be moderating, but that’s happening mostly because demand is faltering and economic growth has started to lose steam.

Most importantly, the labor market remains extremely tight. The worry for policymakers is that even if inflation cools, it could come back swinging at any time if the jobs market stays extremely tight. Therefore, the Fed has to remain restrictive until it sees some real damage in employment numbers.

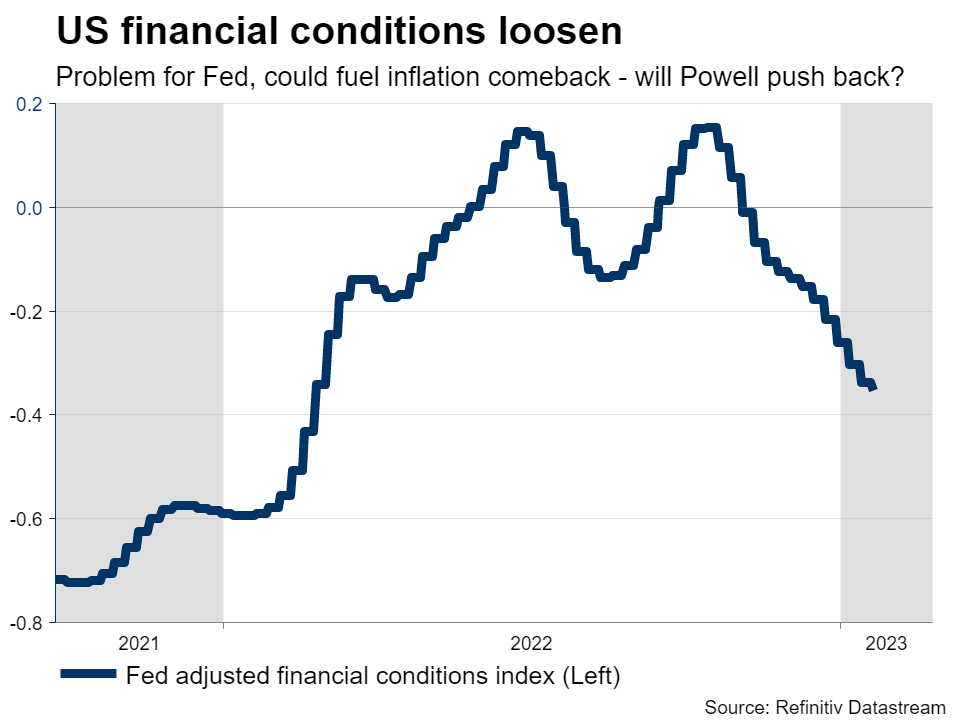

Markets have already fully priced in a 25 basis points rate hike for next week. Since that’s basically a done deal, the dollar’s reaction will depend mostly on what Chairman Powell says during his press conference. He probably won’t be too happy with the dramatic loosening in financial conditions, which have returned to where they were when the Fed started its tightening cycle.

This phenomenon blocks the effective transmission of monetary policy and generates the risk that inflation might come back for a second round, so Powell could push back against it. A firm tone by the Fed chief, reminding investors that the job is not done yet, would likely be beneficial for the dollar.

Still, the Fed makes decisions based on the data, so the employment report on Friday could be even more important. Economists expect another solid report, with nonfarm payrolls forecast at 175k in January. However, business surveys by S&P Global paint an uglier picture, warning that jobs growth almost came to a halt.

Despite these signs that the labor market is cooling, it’s probably too early for any real weakness to show up in this dataset, because applications for unemployment benefits remain exceptionally low. There are many anecdotes of mass layoffs, but it hasn’t shown up in the hard data yet.

The ISM non-manufacturing survey for January will also be released on Friday, after the jobs numbers, and could be just as important in shaping the economic narrative.

ECB and BoE to forge ahead

Over in Europe, the ball will get rolling on Monday with the first estimate of Germany’s GDP for last quarter. The nation’s latest inflation stats will follow on Tuesday, alongside the Eurozone-wide GDP print for Q4. Monthly inflation numbers for the Eurozone are out on Wednesday.

Of course, the main event will be the European Central Bank decision on Thursday. Markets have fully priced in a 50bps rate increase, following clear signals from President Lagarde about the need to move rapidly in half-point increments. Hence, similar to the Fed, traders will focus on the press conference.

Warmer than usual weather has been a real blessing for the Eurozone economy, and by extension for the euro itself, as it has alleviated some concerns about an energy-driven recession and helped cool inflationary pressures at the same time.

Despite all this, many ECB officials have been talking a big game, stressing the need for forceful action to make sure that high inflation does not become embedded. Accordingly, market pricing suggests the central bank will keep tightening well into the summer.

Turning to the United Kingdom, the economy seems to be in worse shape, complicating matters for the Bank of England that also meets on Thursday. Business surveys suggest recession risks are on the rise, as widespread worker strikes compound the economic damage from the cost of living crisis and higher interest rates.

Inflation is still raging though, essentially forcing the BoE to keep raising rates even as the economy deteriorates. Bearing that in mind, markets are split on how much the central bank will raise rates next week, pricing in a 70% probability for a half-point move and a 30% chance for a smaller, quarter-point increase.

The decision might ultimately depend on what the BoE’s updated economic forecasts show about inflation and growth moving forward. It will almost certainly be a split vote, as some officials place more weight on recession concerns and others on inflation risks.

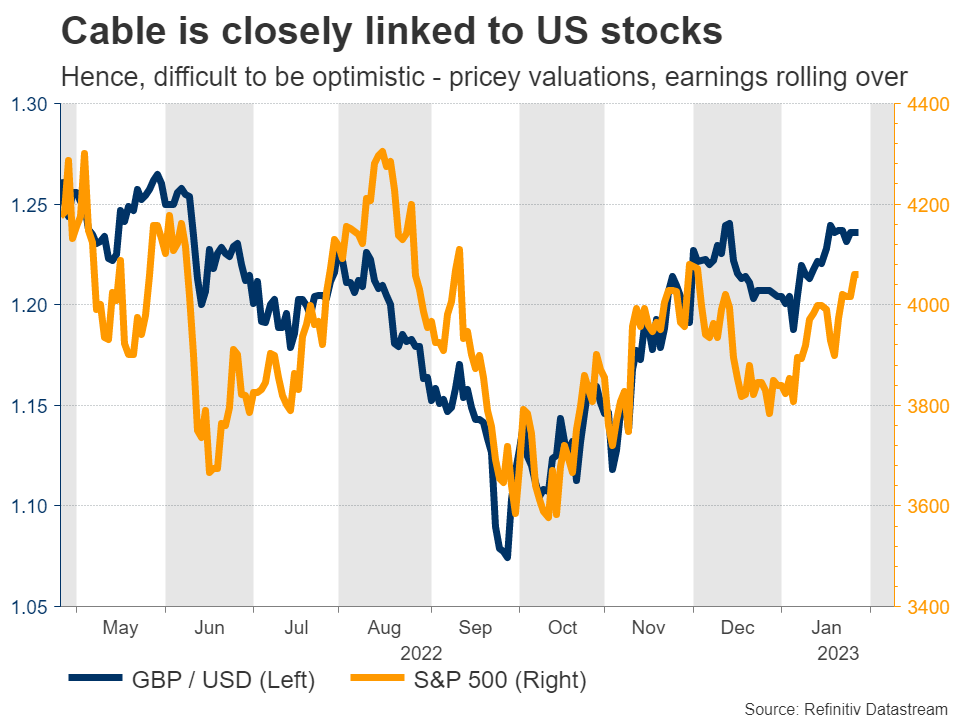

As for the pound, it’s difficult to be optimistic. The domestic UK economy is struggling and the British currency has a strong correlation with US stock markets, leaving it vulnerable to a selloff as equity valuations remain expensive and earnings growth has started to crumble.

Key data releases and earnings

On the data front, the show will start with the latest business surveys from China early on Tuesday, which will give investors an update into how the economic reopening is playing out.

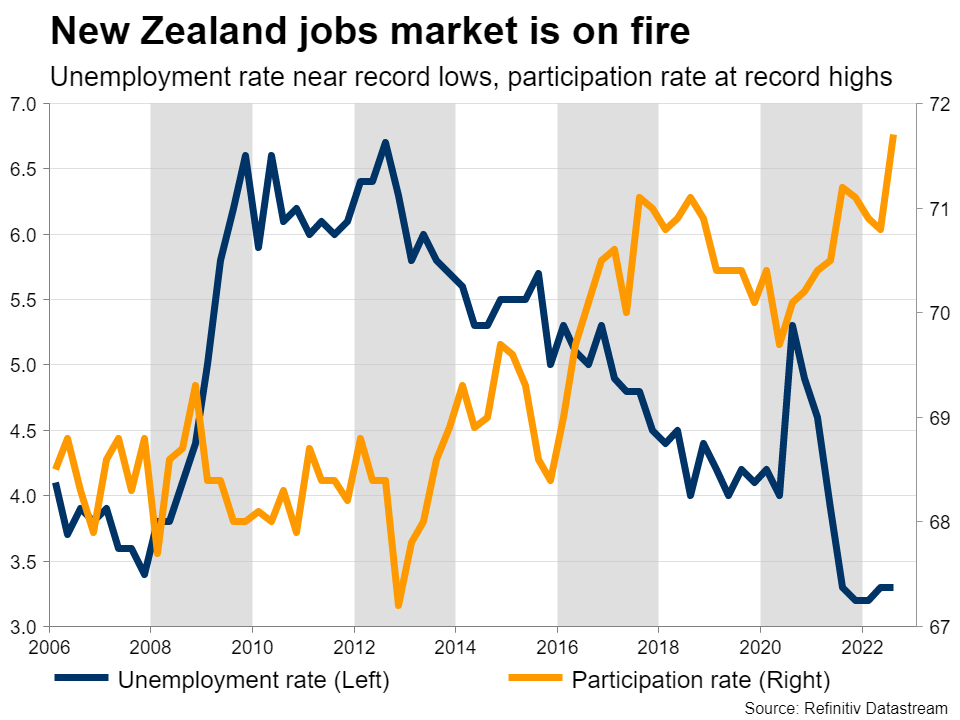

The New Zealand dollar has been a key beneficiary of China’s reopening, capitalizing also on speculation that the RBNZ will raise rates above the Fed this cycle, mostly because the nation’s jobs market is extremely hot. This elevates the importance of the employment numbers for Q4, which are out on Wednesday.

In Canada, the jobs report for January will be released on Friday, alongside the US data.

Finally, the corporate earnings season will kick into top gear next week with tech juggernauts like Apple (NASDAQ:AAPL), Google (NASDAQ:GOOGL), Amazon (NASDAQ:AMZN), Meta, and many other household names releasing their quarterly results.