- Quiet week ahead as FX markets enter holiday season

- Spotlight will fall mostly on some Japanese releases

- Most importantly, liquidity will be in short supply

Yen awaits Bank of Japan signals

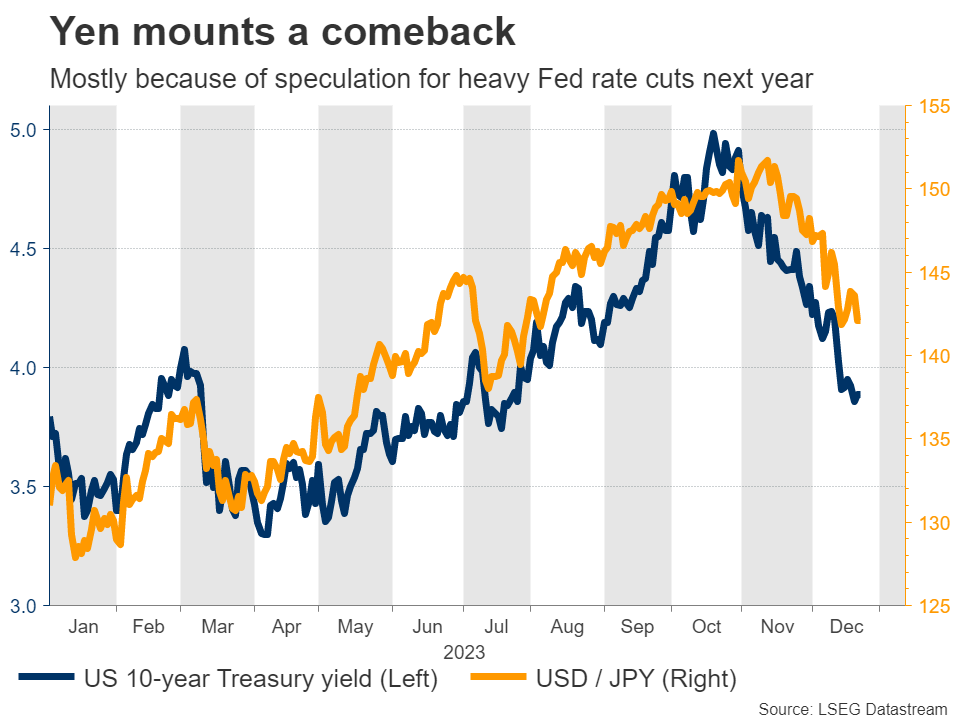

Another devastating year for the Japanese currency is coming to an end. Despite mounting a comeback in recent months, the yen is still on track to close the year with losses of around 8% against the US dollar, mostly because of the Bank of Japan’s refusal to raise interest rates.

Indeed, the latest recovery in the yen has been driven mostly by speculation that foreign central banks in the United States and Europe will slash interest rates aggressively next year. Hence, currencies like the dollar and the euro have lost some of their interest rate advantage over the yen.

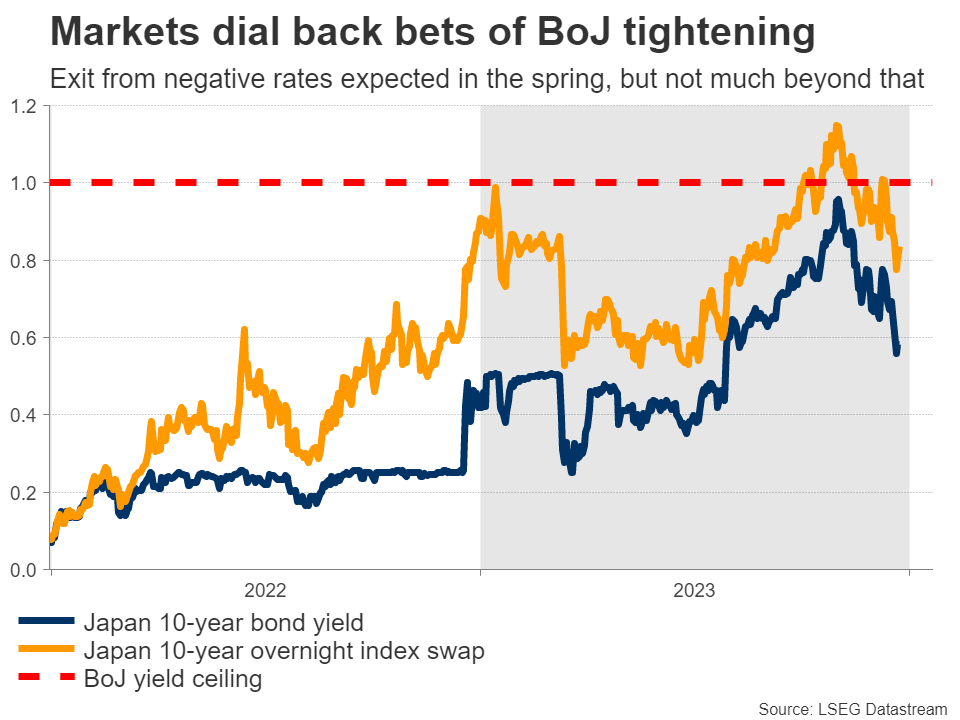

Despite a streak of high inflation readings, the Bank of Japan is still reluctant to raise rates because it is not yet confident that this inflation impulse will be sustained. For that to happen, BoJ officials need to see an acceleration in wage growth. This puts extra emphasis on the spring wage negotiations between big businesses and big labor unions.

Markets currently assign an 80% probability for the BoJ to exit negative interest rates in April, which is when the wage negotiations will conclude. Next week’s events will help shape this pricing, and drive the yen accordingly.

The show will get started on Monday with a speech by BoJ Governor Ueda. Then on Tuesday, the nation’s employment data for November will hit the markets. But the main event will probably be on Wednesday, when the summary of opinions from the latest BoJ meeting is released.

This was the meeting when the BoJ kept policy unchanged and pushed back against the notion that it will begin tightening soon. Governor Ueda stressed that they won’t rush into anything and will take a measured approach overall, crushing the hopes of yen bulls.

Investors will be hoping to get some more clarity from the summary of opinions. Specifically, was this view shared by all BoJ officials, or are some of them leaning in the direction of tightening policy next year?

Speaking of next year, the stage appears set for the yen to perform better. The world economy is losing momentum and markets anticipate a global rate-cutting cycle to begin in the spring, right as the Bank of Japan might finally raise its own rates. Hence, interest rate differentials are set to compress in the yen’s favor, which could provide some relief to the bruised currency.

Mind the liquidity risk

Beyond any movements in the yen, the main story next week might be a shortage of liquidity. With many traders away from their desks and several investment managers having closed their books for the year, liquidity will be in short supply.

When liquidity is low, financial markets can move sharply without any real news. And if there are news headlines, their market impact could be greater than usual. In other words, low liquidity conditions can amplify volatility, especially if there is a news catalyst.

Monday will be a public holiday in much of the world, so most stock and bond markets will remain closed. As always though, the FX market will be open for business.

On the data front, there are some second-tier releases in the United States, including regional Fed surveys from Dallas and Richmond on Tuesday and Wednesday, respectively.

For a complete guide into how the major currencies could perform in 2024, please check out our FX Year Ahead report here. Happy holidays!