- PCE inflation to grab attention on Friday as Fed signals higher for longer

- But markets might be more worried about a government shutdown

- Eurozone flash CPIs will also be the in the spotlight on Friday

- Chinese PMIs to be watched for recovery signs

The latest spike in oil prices is causing some headaches for policymakers as energy costs are on the rise again just as they’ve started to see the result of their hard-fought battle to get inflation down. In the United States, higher gasoline prices have already started to push headline inflation back up. But as long as the oil surge turns out to be temporary, the trend in underlying price metrics should remain downwards.

That is what investors are hoping to see on Friday when the latest PCE inflation numbers are published. The core PCE price index is expected to have increased by 0.2% month-on-month in August, taking the annual figure down to 3.8% from 4.2% in July. For the Fed that’s mindful of overtightening, such a print would likely be low enough to give it second thoughts about hiking rates in November or December.

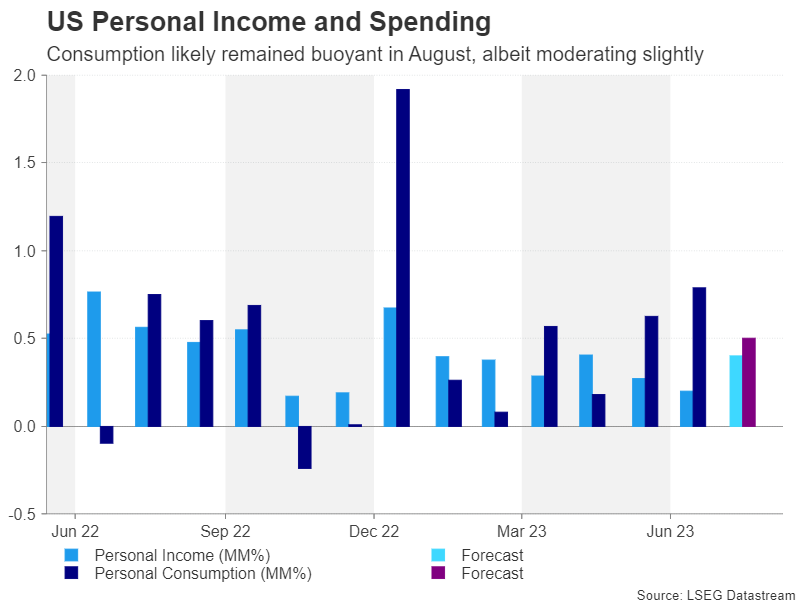

But resurgent energy prices aren’t the Fed’s only concern. Exceptionally strong consumption has been another incentive for policymakers to keep the door open to further hikes. Personal spending is forecast to have increased by 0.5% m/m, moderating slightly from 0.8% previously, while personal income is expected to have risen by 0.4% m/m.

Any upside surprise in either or both personal consumption and core PCE would boost the odds of one final hike, pushing up Treasury yields and the US dollar.

Looming government shutdown could rattle markets

However, a potentially bigger concern for investors is a possible government shutdown as time is running out for Congress before the midnight deadline on September 30 to agree to a stopgap spending bill. Republicans have already torpedoed three attempts by House Speaker Kevin McCarthy to bring to the floor a defence spending bill amid GOP opposition to further aid for Ukraine.

But even if McCarthy manages to get a funding bill through the House, it’s unlikely that the Democrat-controlled Senate would pass legislation that contains spending cuts proposed by hardline Republicans.

Falling inflation could be positive for the euro

In the euro area, higher energy prices also pose a problem for the European Central Bank and could determine whether rates stay on hold for the foreseeable future or rise further. Unlike the Fed, the ECB has to factor in a much weaker economy into its decision making, hence, the bar for a further hike is higher.

For the moment at least, Eurozone inflation is falling, removing any urgency for policymakers to respond pre-emptively to any new inflationary threat. The September flash estimates of the harmonised indices of consumer prices (HICP) are due on Friday and should they show a further decline in price pressures as expected, the outlook might brighten a little amid ongoing recession risks.

In this respect, a downside surprise in inflation might not necessarily be bad for the euro, as easing stagflation fears could offset diminishing expectations of further ECB rate hikes.

In other data, some business surveys might also capture the euro’s attention. Germany’s Ifo business climate index is due on Monday, and the Eurozone economic sentiment indicator will follow on Thursday.

Aussie likely to get caught between domestic CPI and Chinese PMIs

Another economy suffering a bit of a wobble lately is China’s. After the post-pandemic recovery unexpectedly faltered earlier this year, Chinese authorities have been busy devising various measures to boost growth. The problem is that a lot of the policy responses have been half measures, leaving investors exasperated by the lack of more substantive stimulus announcements.

However, the drip-feed stimulus has kept on coming and there are encouraging signs that they’ve started to have some effect. The PMI surveys for September will provide fresh clues if the economy is indeed stabilizing. The government will report its manufacturing and non-manufacturing PMI prints on Saturday, and the S&P Global/Caixin equivalent is due next Sunday.

The tepid improvement in the economic picture appears to have helped China-sensitive currencies such as the Australian dollar establish a floor under their recent slide. Whilst the aussie remains one of the worst performing currencies of the year, a Chinese economic revival could yet spur an end of year rally.

One major obstacle, though, for the aussie bulls is an increasingly neutral Reserve Bank of Australia. With inflation in Australia falling to just below 5% in July, RBA tightening has potentially reached the end of the road. However, despite the cautious rhetoric, the RBA did reveal in its meeting minutes that a rate increase was discussed in September. Therefore, Australian CPI figures for August released on Wednesday might pressure the RBA to hike again should the headline figure edge up as forecast.

Tokyo CPIs unlikely to provide much relief to the yen

The Tokyo CPI readings will be watched on Friday for any signs that inflation in Japan isn’t about to drop to 2% in a quick manner. The Tokyo stats are published in advance of the nationwide numbers so they are seen as a forward looking indicator.

The Bank of Japan has yet to be convinced that high inflation is here to stay and that the country isn’t about to fall back into deflation. A sustained rise in wages is a key criterion for policymakers, but even if this isn’t achieved anytime soon, the longer that CPI stays above the 2% target, the more difficult it will be for the Bank of Japan to justify maintaining ultra-loose monetary policy.

Thus, there could be some modest gains for the yen if the data is slightly stronger-than-expected. Also on the agenda in Japan are retail sales and preliminary industrial production figures for August, both on Friday.