- US CPI report and Fed minutes to take centre stage

- Will they fuel or dent the rally in yields and the dollar?

- Chinese inflation and UK growth data to also be eyed

- Otherwise, a quieter week awaits with Monday a holiday in the US

US headline CPI could rise again

As speculation about whether or not the Fed will hike one more time goes into overdrive, the latest report on the US consumer price index will be the big highlight of the week. With the next FOMC decision less than four weeks away, there is a sense of driving blindfolded for both policymakers and traders amid conflicting data on where the economy is headed.

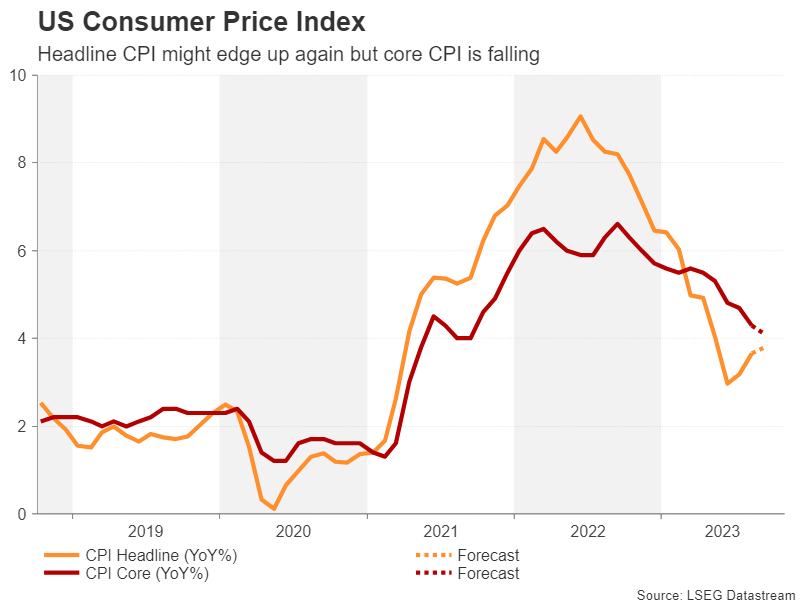

The September CPI report could clear some of the fog away on Thursday, or it may only add to the confusion. Headline CPI edged up in the previous two releases, rising to 3.7% y/y in August. The recent jump in gasoline prices was the main contributor to the increase and the month-on-month gain in CPI accelerated to 0.6% in August.

Forecasts point to a slight moderation in September to 0.3% m/m, but the annual figure is expected to have ticked up further to 3.8%.

Markets might well interpret this as a sign the effects from the energy price spike are beginning to level off, so unless the CPI numbers come in hotter than expected, they’re not likely to react negatively.

However, the core CPI print will also be important, if not more, as it strips out any distortions from food and energy prices. Core CPI has been steadily declining over the past 12 months and is forecast to have eased further to 4.1% y/y in September, potentially adding to the view that inflationary pressures are receding.

Will Fed minutes relay the hawkish tone?

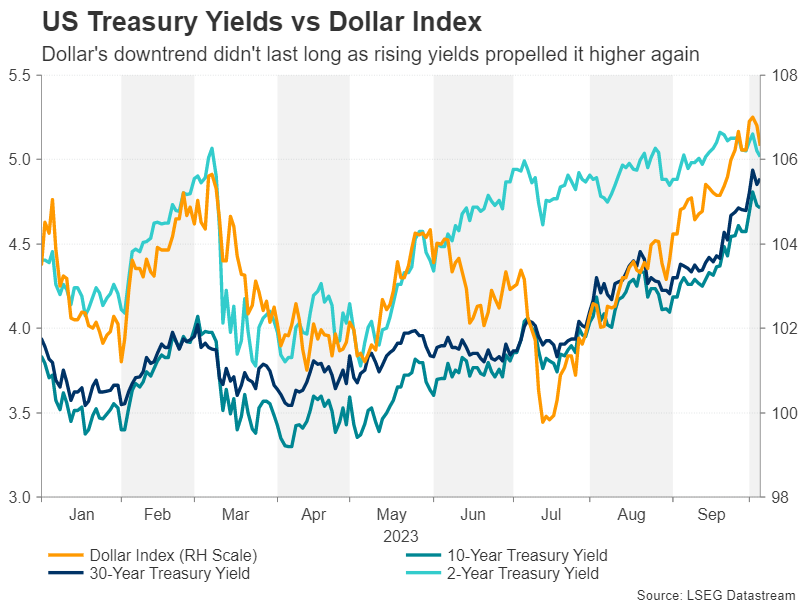

Heading into the CPI report, though, the mood will be determined by the producer price index as well as the minutes of the Fed’s September meeting that are due on Wednesday. The Fed may have kept rates unchanged at the last meeting, but a string of policymakers have since been beating the hawkish drum so loud that Treasury yields have skyrocketed to new cycle highs.

The 10-year yield briefly hit a 16-year peak of 4.88% last Tuesday, turbocharging the US dollar. Investors will likely weigh out concerns in the minutes about a slowing economy against fears of inflation firing up again. If Fed officials are less worried about a slowdown than sticky inflation, yields could climb to fresh highs. However, any boost to yields and the dollar will not be sustainable unless it’s followed up by a hot CPI report.

Finally, the University of Michigan’s preliminary consumer sentiment survey will be watched on Friday, particularly, the readings on inflation expectations.

UK economy: not as bad, but not strong enough

The pound has been hammered lately by a combination of a resurgent US dollar, the Bank of England’s unexpected dovish tilt and a bleaker outlook for the UK economy. In the process, sterling has lost its crown as the year’s best performer in the FX arena.

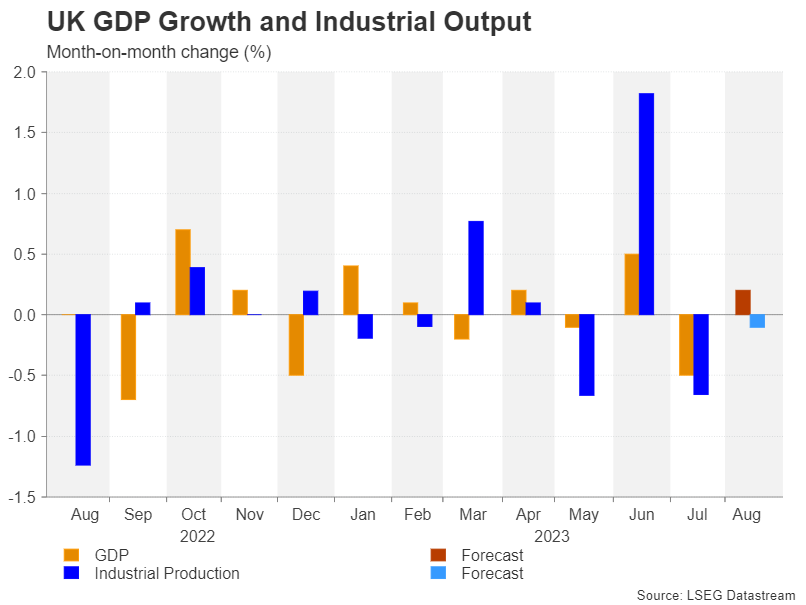

However, it hasn’t been all doom and gloom on the economy. The Office for National Statistics recently published revisions to its GDP calculations and it is now estimated that the British economy is 1.8% larger than it was before the pandemic compared to the previous estimate of being 0.2% smaller, putting the UK in no worse position than its major European counterparts. In addition, the September services PMI was revised up sharply in the final reading, easing fears about an imminent recession.

Yet, the pound hasn’t been able to stage much of a rebound. This suggests that investors remain downbeat about Britain’s growth potential and that sterling’s main advantage versus the greenback before the BoE’s shock decision to pause was that rates in the UK would peak above those in the US.

Thus, Thursday’s barrage of data on monthly GDP output and production as well as trade are unlikely to have a significant bearing on the pound’s near-term prospects other than a knee-jerk reaction. As long as a soft landing remains the base case scenario for the US economy, there will either have to be a series of upside surprises in UK growth indicators or downside surprises in inflation to shake off the stagflation risks pinning cable down.

Risk assets hoping for China boost

Another hope for those currencies that have been badly bruised by the US dollar is if there’s a turnaround in risk sentiment. In particular, risk-sensitive currencies such as the Australian dollar might be able to pare some of their recent losses if there’s some upbeat data out of China. However, the forecasts suggest otherwise.

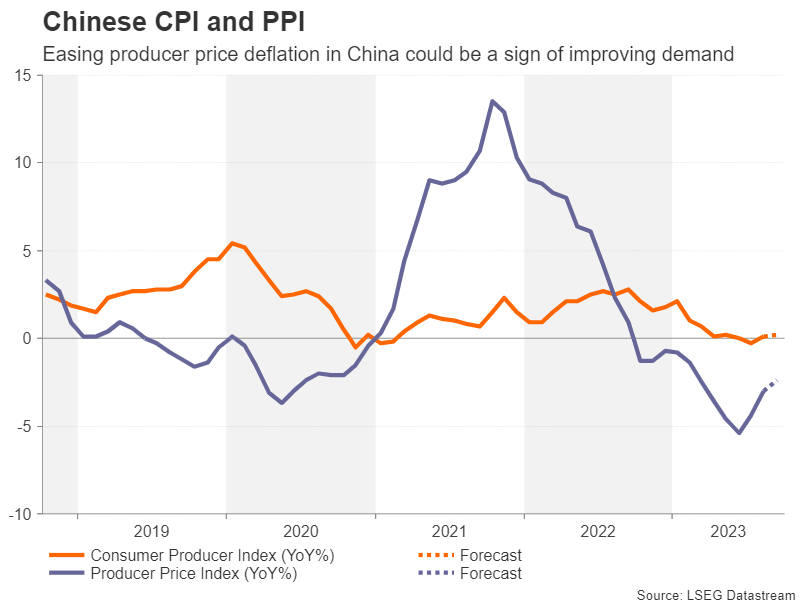

Producer prices in China are expected to have fallen by 2.4% y/y in September versus by 3.0% in August, pointing to a mild improvement in demand for goods churning out of Chinese factories. Meanwhile, the yearly CPI rate is projected to have quickened only marginally to 0.2%.

Friday’s releases will also include trade figures, with exports forecast to have dropped 8.3% y/y in September, making it the fifth straight month of decline.

Any promising signs of a rebound in China’s economy from better-than-expected numbers would also aid equities, as well as crude oil prices, which took a tumble in the past week.

Even the euro stands to gain from positive China-related headlines in the absence of any other developments. The European Central Bank is set to publish its account of the September policy meeting on Thursday but it’s doubtful whether it will have much of a market impact.

ECB policymakers have been very active post the meeting, providing plenty of commentary, and the doves appear to have become more vocal lately calling for a pause in rate hikes. It’s likely therefore that even if the minutes maintain a tightening bias, investors will consider them as outdated.