Yen braces for turbulence

A difficult decision lies ahead for Bank of Japan officials. They will have to decide on Friday whether to take the next step in their tightening campaign, amid conflicting signals around the Japanese economy and the inflation outlook.

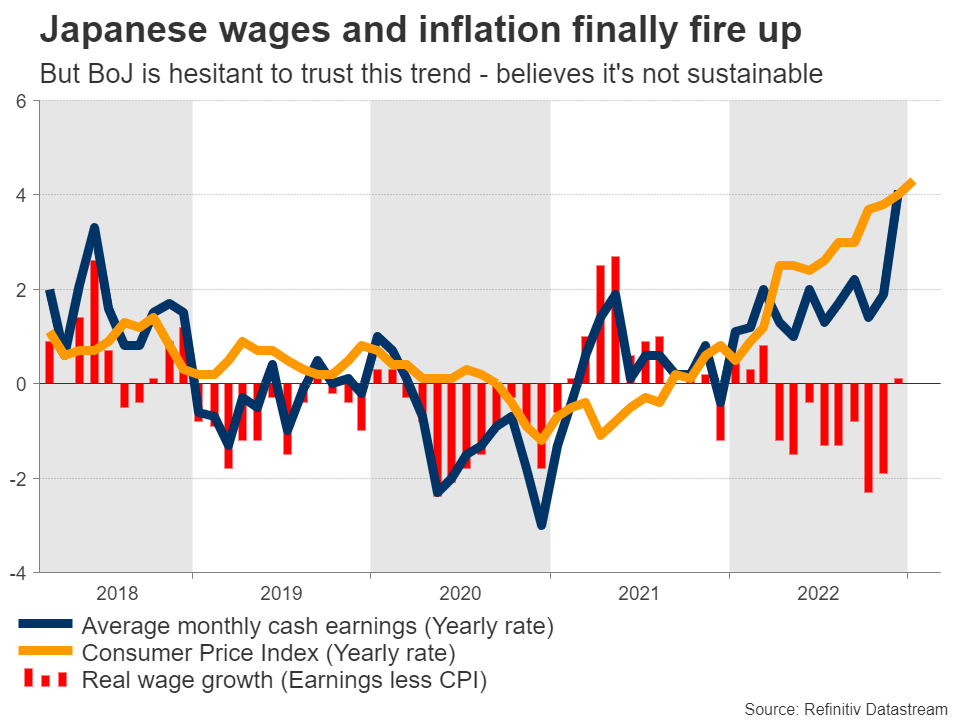

On the bright side, inflation and wage growth have fired up, both running above 4%. In fact, wages rose faster than inflation in January, which means real wage growth finally turned positive. That’s good news for Japanese consumers, and something the central bank has long waited for.

However, several BoJ members - including future Governor Ueda - believe this inflation spell is driven mostly by supply shocks and energy prices, so it won’t last. Energy subsidies from the government finally came into effect last month, driving electricity prices much lower.

Therefore, the logic is that inflation might be high today, but is destined to fall soon. Indeed, incoming data support this notion as the forward-looking Tokyo CPIs fell sharply in February. There are similar questions about wages, since the spring wage negotiations between unions and businesses have just started.

Another issue to consider is that this is the last meeting of outgoing BoJ Governor Kuroda, and he might prefer to leave any major decisions to his successor who will take over next month.

It’s a close call but weighing everything up, it seems more prudent for the BoJ to be patient. While economic data currently warrants further action, there’s heightened uncertainty around inflation and the ongoing wage negotiations. There’s always a chance the BoJ decides to pull the trigger now, but waiting until April would give the officials more clarity.

A decision to do nothing would spell bad news for the yen. That said, it’s probably only a matter of time until the BoJ does raise its yield ceiling again or abandons it completely, so it might not be a game changer for the yen’s trend.

US nonfarm payrolls, another solid print?

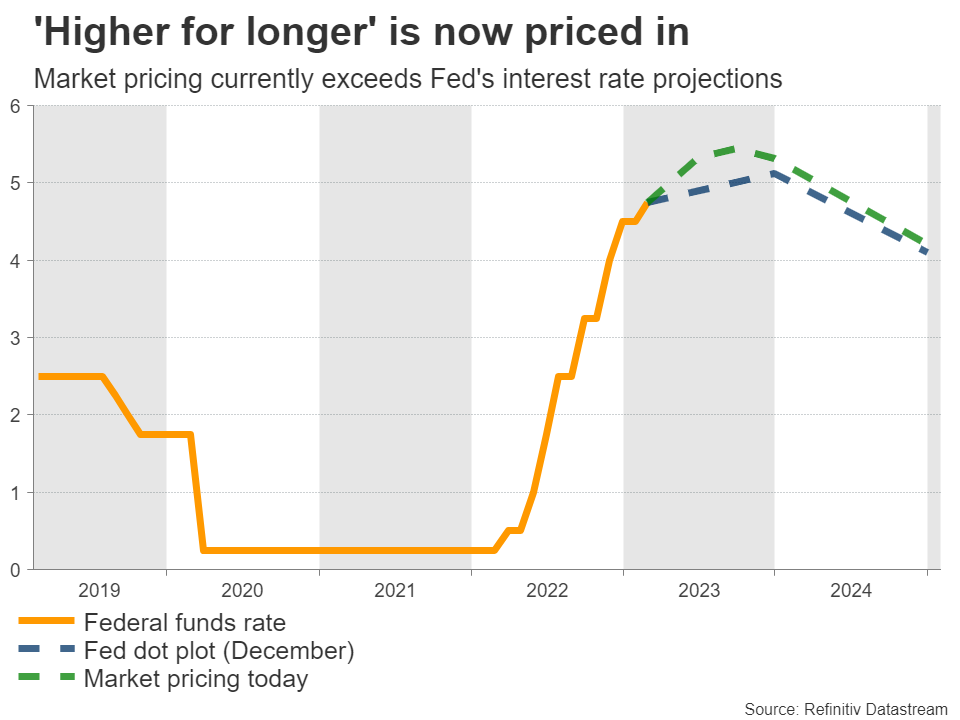

In the United States, the underlying theme lately has been how resilient the economy is. Consumer demand, inflationary pressures, and the labor market have not shown any real signs of damage yet despite the Fed’s relentless rate increases, fueling bets that interest rates will need to go higher and stay elevated for a longer period.

This coming week, the show will get started with Fed Chairman Powell, who will testify before Congress on Tuesday and Wednesday. Markets usually react to the Q&A session of his first testimony, and the risk is that he strikes a more hawkish tone following the recent barrage of strong data.

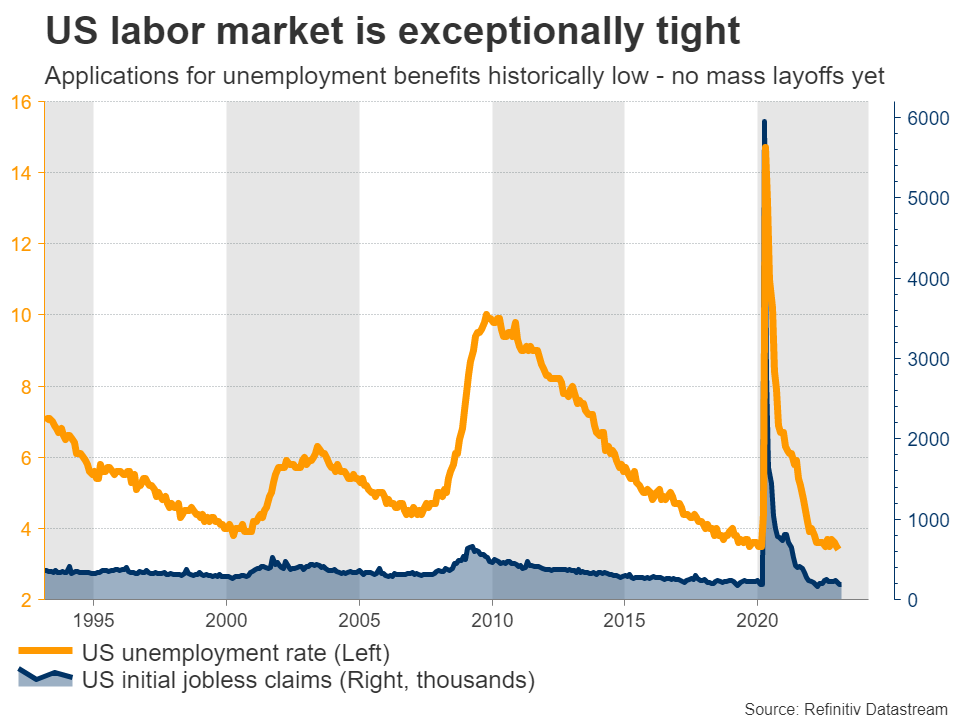

Beyond that, the spotlight will fall on the employment data out on Friday. Forecasts point to another solid report, with nonfarm payrolls seen at 200k in February after printing an astonishing 517k last month. The unemployment rate is expected to tick up to 3.5%, while wage growth is projected to accelerate.

Indeed, most early indicators suggest it was a strong month for the jobs market. Business surveys from S&P Global pointed to an acceleration in hiring, while applications for unemployment benefits remained historically low.

Still, there’s a risk that nonfarm payrolls disappoint. When an NFP report is as strong as it was last month, it is often followed by a weaker number - a correction back to the prevailing trend. Since warm weather played a huge role in boosting the last number, it wouldn’t be surprising to see some ‘payback’ this time.

As for the dollar, the outlook seems positive, even if there is a setback next week. With the Fed expected to stay restrictive for longer, US yields have started to race higher, reinforcing the dollar’s rate advantage. This dynamic has also weighed on stock markets, where any further losses could inflict collateral damage on currencies such as the euro or sterling, indirectly benefiting the greenback.

BoC and RBA rate decisions

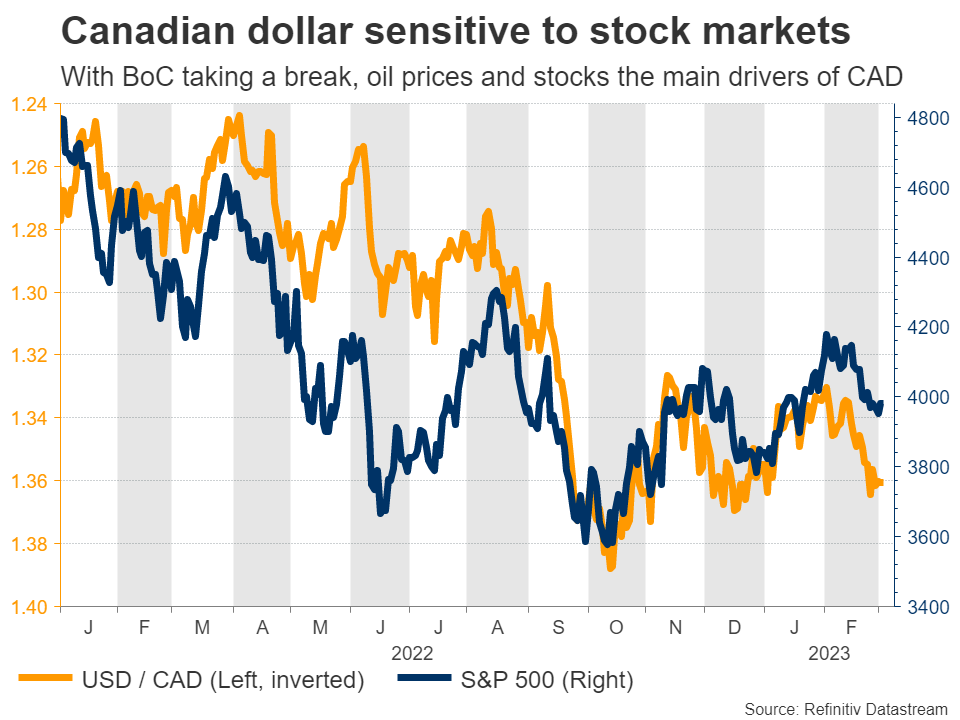

Crossing into Canada, the central bank is expected to take the sidelines when it meets on Wednesday following a series of disappointing data releases, most notably the latest GDP growth report.

With high interest rates restraining consumers and pressuring the nation’s housing market, the Canadian economy has stalled and inflationary pressures are cooling off. Investors have gotten the message, as market pricing implies almost no chance of a rate increase next week.

Now that monetary policy has taken a back seat, the primary drivers of the Canadian dollar moving forward might be the performance of oil prices and global risk sentiment, neither of which seems favorable at this stage. Beyond the Bank of Canada decision, the nation’s employment stats will also be in focus on Friday.

Over in Australia, the main event will be the Reserve Bank’s decision on Tuesday. Markets assign a 75% probability for a quarter-point rate increase, after the minutes of the previous meeting showed the Board envisioned “further increases”.

Since it is not fully priced in, a decision to raise rates could briefly boost the Australian dollar, although the currency’s overall trajectory will depend mostly on any signals around the terminal rate.

Developments in China will also be crucial for the Australian dollar, given the close trade links between the two economies. China will release its latest trade data on Tuesday and inflation stats on Thursday, which are likely to reflect the reopening boom seen in other indicators lately.