The US nonfarm payrolls (NFP), a major market mover, will be released on Friday, Mar. 5, and covers the month of February.

The market consensus is that the US added 400K jobs to the economy last month. For comparison, the ADP Employment Change report (released Wednesday) reported that private businesses added 475K workers to their payrolls in February.

While a 50 basis points hike from the US Federal Reserve during its March 15/16 meeting is unlikely, a strong jobs report could pressure the Central Bank to consider it.

An increasing possibility for a 50 bps in the Federal Reserve’s subsequent April and May meeting will likely filter into the markets for US equities, gold, and USD pairs. As for the Federal Reserve’s March meeting, Jerome Powell, Chair of the Reserve, indicated on Wednesday that he favors a 25 basis point hike in March.

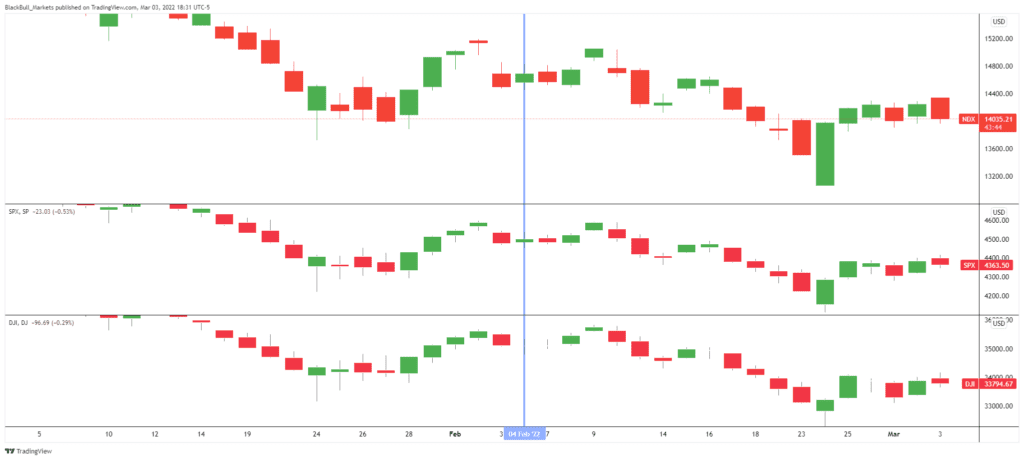

US Equities

In February, US equities were beaten down as investors priced in the impending Federal Reserve rate hike. Over the past month, the NASDAQ has fallen 4.5%, the S&P 500 has fallen 3%, and the Dow Jones Industrial Average has fallen 3.5%.

However, all three major US indices have been in positive territory over the past five trading days, with some analysts believing that the stock market has already bottomed out. Citi Group, for one, has upgraded their view on US stocks, thinking that they may get a bump from the Ukraine crisis, noting that US equities “have ended 10-20% higher after the previous geopolitical crisis”.

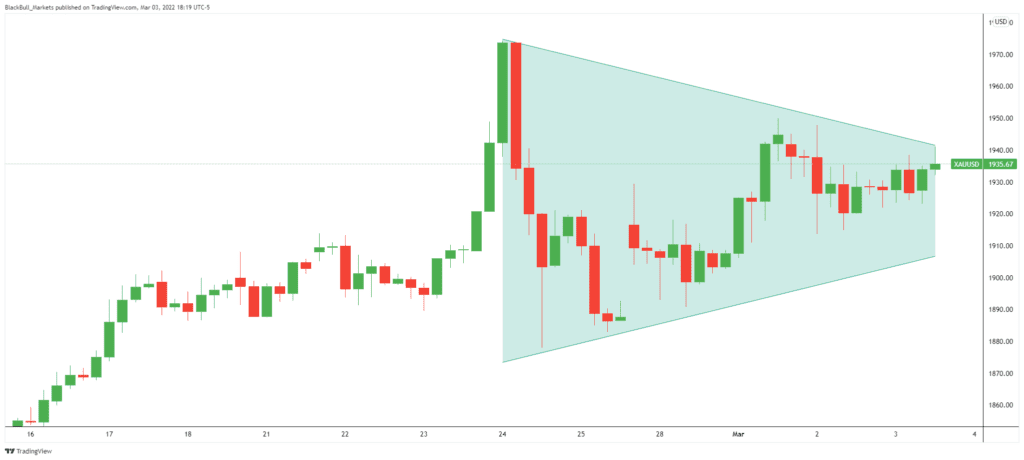

Gold

Over the past two weeks, the price of gold has been at the mercy of developments with the Ukraine crisis. XAU/USD quickly shot up to $1,970 after the crisis broke out before returning to $1,900, where it stagnated for a week.

Another major market event is entering the picture to help shake the gold price from its trenches. The March Non-Farm Payroll (NFP) is fast approaching, and with it, gold has found a new home close to $1,930.

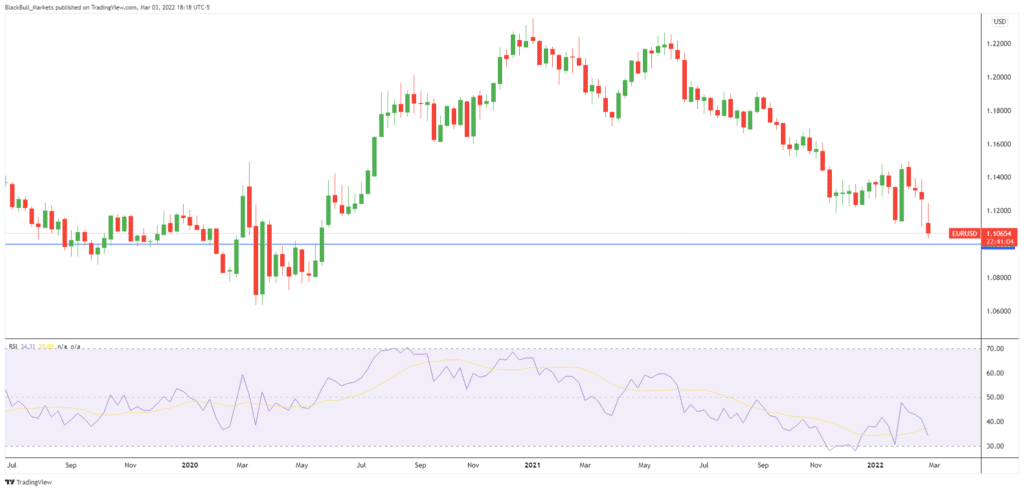

The USD

A risk-off market has supported the USD against several of its pairs in the lead up to the NFP. In particular, The EUR/USD is trading at a 22-month low and is trending to below 1.100. The RSI indicator on the EUR/USD may provide some comfort for EUR bulls in the face of a possible strong NFP report, as the pair appears over-sold.