The US Federal Reserve kicked off its Federal Open Market Committee (FOMC) meeting on Tuesday, with the markets widely anticipating a 25 basis-point hike in what would be the first interest rate increase since 2018.

Fed Chair Jerome Powell had earlier raised the prospect of a 25 bps hike, telling a House financial services committee hearing two weeks ago that he is "inclined to propose and support” the increase as inflation has sat above 2% and as the United States’ labor market continued to recover.

High Inflation Underscores the Need for Tightening

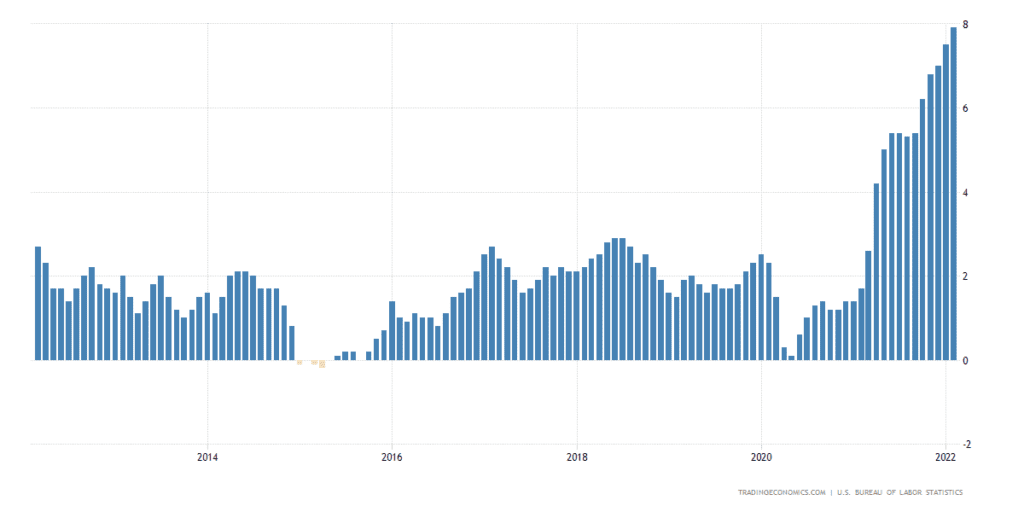

With the US consumer inflation soaring to a 40-year high of 7.9% in February, a rate hike this week is highly anticipated, although uncertainty lies in how much the Fed will have to tighten to tame inflation. Markets are also pricing in up to six or seven hikes this year, one for each of the upcoming FOMC meetings.

Higher inflation expectations among US consumers, according to surveys by the New York Fed and Cleveland Fed, also ramp up the likelihood of a more hawkish Fed.

50 Bps Hike Also on the Table

Although many market watchers anticipate a 25bp hike when the Fed caps off its meeting on Thursday, some economists say a 50 bps is also likely. Last month, St. Louis Fed President James Bullard called for a full percentage-point hike by July 1.

ING Bank’s Chief International Economist James Knightley wrote in a note last week,

"it wouldn’t be surprising to see maybe two FOMC members vote for 50 bps.”

Knightley and other economists from the Dutch bank most recently said markets are back to pricing 160 bps hikes in six meetings in total for 2022, although the Fed may have five rate hikes planned for the year.

Russia-Ukraine War Places Fed in a Precarious Spot

However, the worsening conflict between Russia and Ukraine, which has reached its third week, puts the Fed on alert due to expectations that the war could worsen inflation and result in a potential global economic recession that could derail the United States’ recovery momentum.

Still, the Fed appeared to be undeterred by the crisis, with Powell saying in a recent speech to Congress that the near-term effects of the war and Western sanctions on Russia remain highly uncertain.

Powell said,

"Making appropriate monetary policy in this environment requires a recognition that the economy evolves in unexpected ways. We will need to be nimble in responding to incoming data and the evolving outlook."

Squeezing Household Income

A rate hike in the US — the first since the COVID-19 pandemic emerged — could further squeeze household income at a time when gas prices hover around record highs. Gasoline prices in the US surged to an all-time high of $4.33 on Friday, before retreating over the weekend, according to data from the American Automobile Association.

Higher interest rates will raise borrowing costs in banks, lifting variable rates on credit card debt and affecting interests on auto loans and mortgages. This could further weigh on consumer’s spending habits.