- Fire at Ukrainian nuclear power plant gets extinguished

- Markets terrified initially but most assets retrace losses

- Euro is the exception - US nonfarm payrolls coming up next

Nuclear catastrophe averted

Russian forces attacked and captured Europe’s largest nuclear power plant. A nearby building was set ablaze from the intense shelling, sparking fears of a nuclear disaster similar to Chernobyl, until Ukrainian authorities reported the fire had been extinguished and the US Energy (NASDAQ:USEG) Secretary confirmed radiation levels remain normal.

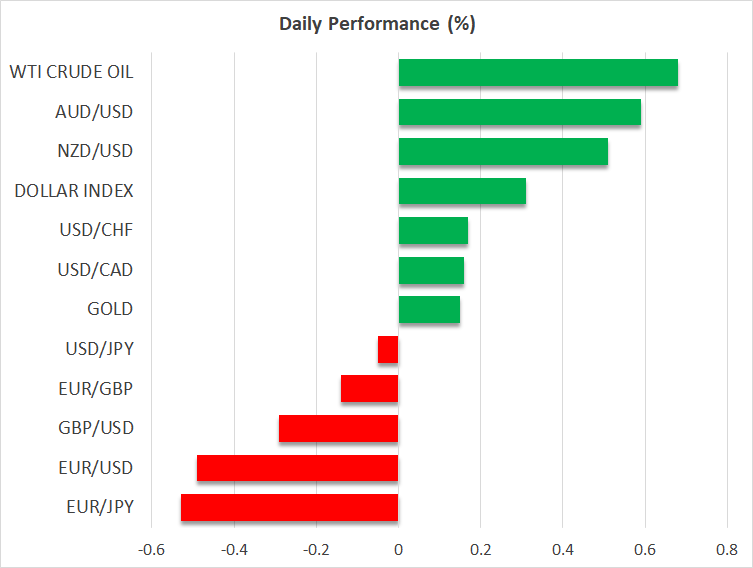

The initial reports of a potential mishap sent shivers through global markets, setting off a flight to safety with traders liquidating stocks and euro-denominated assets to load their portfolios with bonds, gold, and crude oil. This happened during the Asian trading session, which means market liquidity was very thin, exacerbating the reactions.

Naturally, all these moves were unwound once it became clear that catastrophe had been averted. Gold and oil prices retraced, while Asian equity markets and Wall Street futures recovered a decent chunk of their losses.

Euro can’t recover, antipodeans shine

The notable exception was Europe, where neither stock markets nor the single currency managed to get off the floor. This is a testament to the uncertainty surrounding the European economy, with the risk of a nuclear accident compounding concerns about a wave of stagflation as energy prices rocket higher but consumers get squeezed by falling real disposable incomes.

Euro/dollar dropped like a stone before stabilizing around the 1.10 region, which is an important psychological barometer for the pair. A weekly close below it could solidify the notion that the bears are in command as the fire sale in euro assets continues.

In the broader FX complex, what stands out are the powerful moves in the Australian and New Zealand dollars. These currencies typically trade in lockstep with risk appetite but this relationship has broken down lately, with the aussie and kiwi defying the gloom in equity markets to focus on the relentless rally in commodities instead. Their geographical distance from the conflict in Europe may be another variable.

US employment report next

As for today, market participants could finally turn their gaze back to economics with the release of the latest US jobs report. Nonfarm payrolls are expected to clock in at 400k in February, a touch lower than the previous month but a solid number considering that the labor market is close to full employment.

That’s expected to push the unemployment rate down by one tick to reach 3.9%. Of course, the metric that matters most for the Fed is wage growth, which is expected to have accelerated a little in yearly terms. Most labor market indicators were solid during the month, with the exception of the ISM services survey.

Bets for aggressive Fed rate increases have been unwound after the Ukraine crisis. Only five quarter-point hikes are currently priced into money markets for this year, from six and a half a few weeks ago. However, that might prove to be a miscalculation. Yes, Fed officials won’t be happy to tighten into a geopolitical crisis, but ultimately this is unlikely to be a serious setback for the US economy in particular, and it will probably be inflationary.

With an unemployment rate below 4%, rising participation, accelerating wage growth, and mounting signs that inflation is headed even higher, the Fed may not have much of a choice but to slam on the brakes. Another solid jobs report today could add credence to this view and by extension, keep the wind in the dollar’s sails.