FORT COLLINS, Colo., Feb 6 (Reuters) - Speculatorsâ energy for soybeans was critically lacking following the U.S. harvest, but dwindling supplies in South America have rapidly restored their enthusiasm to the impressive year-ago levels.

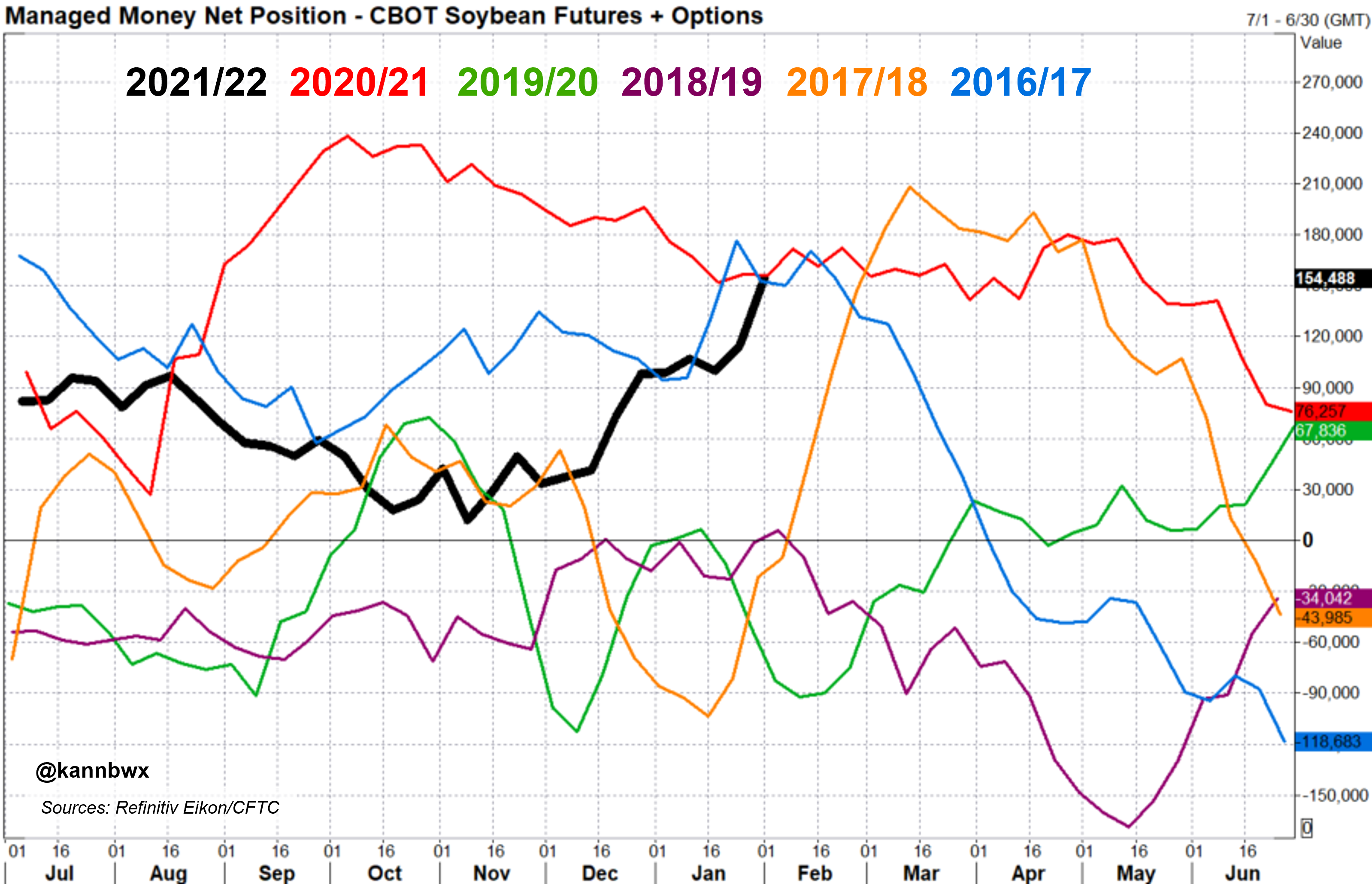

In the week ended Feb. 1, money managers added nearly 40,000 CBOT soybean futures and options contracts to their net long, which reached 154,488 contracts according to data from the U.S. Commodity Futures Trading Commission.

That is fundsâ most optimistic soybean view since May and identical to the same weeks in both 2021 and 2017. They added almost 30,000 gross soybean longs through Feb. 1, the most for any week since Sept. 1, 2020, and their net long is about as large as it has ever been for the date.

Money managersâ net long hit its recent peak near 238,000 contracts in early October 2020, but one year later, that position sat just below 50,000. Most-active CBOT soybean futures have risen 24% since then versus a 30% gain in the same period last year.

Soy futures had risen nearly 9% in the week ended Feb. 1, and they tacked on another 1.6% in the last three days. Brazilâs shrinking crop, uncertainty in Argentina and an increase in U.S. export demand kept the bulls in control last week.

As of Friday afternoon, weather models were mixed as to when rains might arrive in Argentina beyond the upcoming week, which was expected to be dry. The forecast also showed dry weather on tap for southern Brazil.

Brazilian corn harvest outlooks are beginning to slide as well despite the season just beginning for the exported crop, but corn faced headwinds late last week on shaky U.S. export demand and burgeoning corn-based ethanol supplies.

Most-active corn futures slid about 2% between Wednesday and Friday but had notched equivalent gains in the week ended Feb. 1. Money managers extended their net long that week by about 7,000 to 372,551 corn futures and options contracts, similar to their end-2021 stance.

Corn open interest as of Feb. 1 was down 25% on the year and soybeans are down 23%. But soybean open interest surged 14% in the latest week, a seasonal but unusually strong move, pushing past 1,000,000 contracts for the first time since June.

SOY PRODUCTS AND WHEAT

CBOT soybean meal futures exploded more than 11% in the week ended Feb. 1, and money managersâ net long jumped more than 12,000 to 76,743 futures and options contracts, a one-year high.

Soybean oil futures added 5% that week as rival vegoil and crude oil prices continued the upward march, and iffy weather lingered for top soy product exporter Argentina.

Money managers increased their net long in soybean oil futures and options to 80,476 contracts through Feb. 1 from 68,773 in the prior week, and that compares with a stance of about 106,000 contracts a year earlier.

Most-active soybean meal settled on Friday at $443.90 per short ton, its highest level since May 12 and up more than 11% since the start of 2022. Soybean oil slipped fractionally in the last three sessions after reaching 66.92 cents per pound on Wednesday, its highest since June 15.

Wheat futures struggled late last month as fears over tension in the Black Sea faded just as quickly as they arrived. The brief rally could not sustain without new developments in the Russia/Ukraine conflict or export disruptions, the primary concern for wheat traders.

Chicago futures sank 6% in the week ended Feb. 1 after jumping 6% in the previous week. Money managers added about 13,000 contracts to their net short, which reached 26,452 futures and options contracts. Selling was expected to be more than double those levels.

Kansas City wheat futures suffered similar losses in that week, and money managers reduced their net long by about 3,000 futures and options contracts to 37,799. Traders continue monitoring poor conditions and expansion of drought for the U.S. hard red winter wheat crop.

Minneapolis wheat futures lost only 3% through Feb. 1, but funds snapped their six-week selling streak and added 620 contracts to their net long, which reached 3,960. Spring wheat futures are down about 7% so far in 2022.

Karen Braun is a market analyst for Reuters. Views expressed above are her own.

Register now for FREE unlimited access to Reuters.com

Our Standards: The Thomson Reuters Trust Principles.